Daily Energy Report

EU natural gas sources, US crude/product inventories, World’s gas deficit, Iran exports, Brazil’s “green” package, EIA global oil forecast, Bloomberg clickbait, EV charging issues, EV mandate backlash

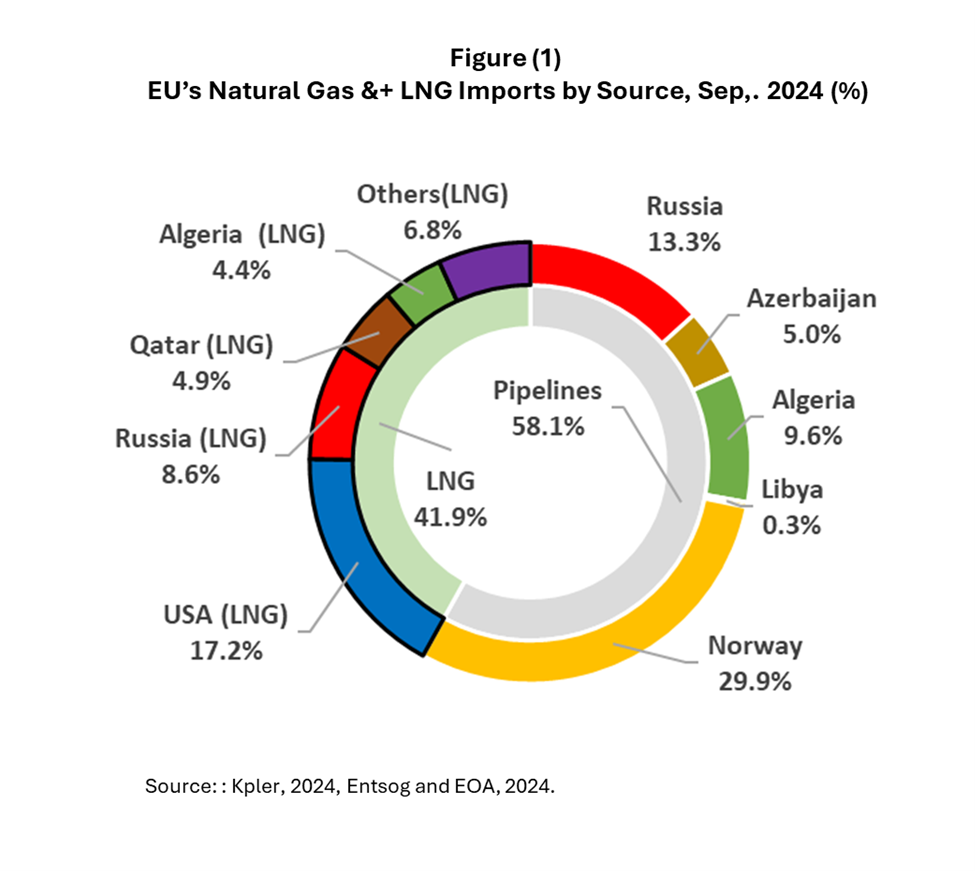

Chart of the Day: EU Sources of Natural Gas

Summary

Figure (1) shows EU gas imports by source. LNG accounted for 41.9% of EU’s total gas (and LNG) imports, while pipeline gas accounted for the remaining share of 58.1%. In September, Norway supplied 29.9% of the EU’s total gas imports. Russia’s share (including its LNG) in EU gas imports reached 21.9%, followed by Algeria (14%), the US (LNG only) which supplied 17.2% of EU’s total imports.

EU LNG imports remained low in September, reaching the lowest monthly figure in over two years of 5.63 million tons (equivalent to 7.7 bcm of re-gasified LNG). Low economic growth and mild weather reduced the demand for gas in general and LNG in particular. France was the top LNG importer among EU countries with 1.64 bcm, followed by Spain with 1.38 bcm, and the Netherlands with 1.26 bcm.

The US remained the EU’s top LNG supplier with a 41% of total LNG imports, followed by Russia (20%), Qatar (12%) and Algeria (11%).

EOA’s Main Takeaway

Two issues here:

The decline in EU gas demand.

The possibility of the end of the 5-year contract between Russia and Ukraine to supply Europe via pipeline.