Daily Energy Report

On the “demise” of the US dollar, Republican moves against President Biden’s climate change policies, Freeport LNG, Russian oil shipments, Qatar LNG carriers, energy security in UK, and more

CHART OF THE DAY: The “Demise” of the US Dollar? Really?

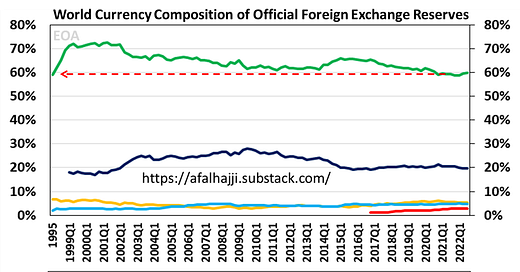

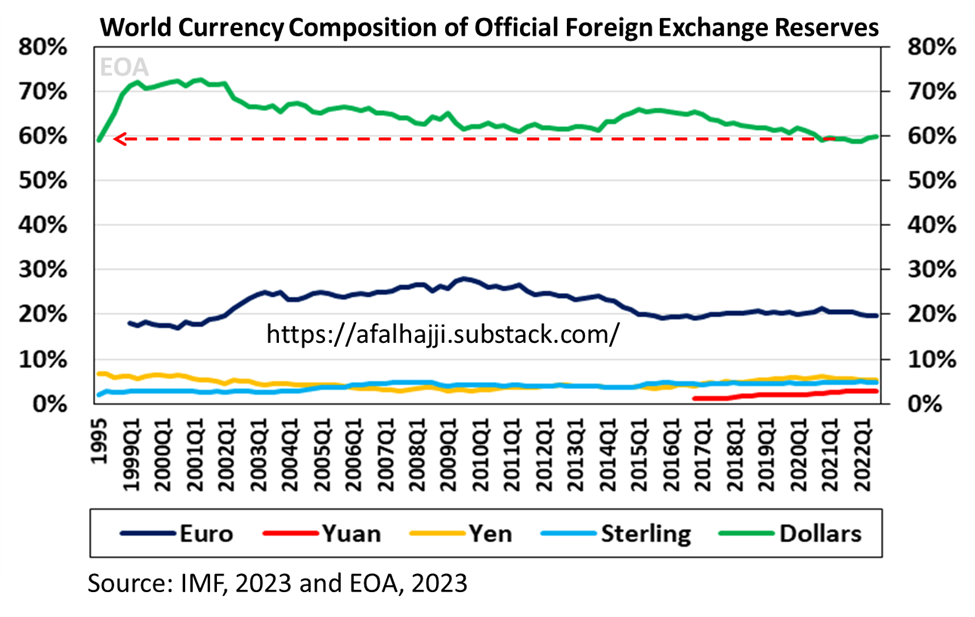

Figure (1)

Commentary:

Various reports about the “demise” of the US dollar have been published in recent years, although this is a decades-old topic.

OPEC countries spent a great deal of time and effort in the early 1970s trying to find an alternative to the US dollar. Readers who are interested in learning more about this can check this recorded Twitter Space: OPEC & Oil Pricing Dollar, Bitcoin, Ruble & Russia.

In the last two days, arguments about the “demise” of the US dollar became more intense after China made two moves. First, it completed the first yuan-settled LNG trade through the Shanghai Petroleum and Natural Gas Exchange. The deal was between the Chinese national oil company CNOOC and France's TotalEnergies for 65,000 tons of LNG imported from the UAE.

Second, China and Brazil signed an agreement to trade in local currencies.

So, is this the beginning of the US dollar collapse as some pundits have claimed? The short answer is: NO.

The dollar is losing ground, mostly because of the sanctions the US imposed on some countries, including Russia and Iran, and due to the trade war between the US and China, but it is NOT losing dominance.

Figure (1) above shows the world currency composition of official foreign exchange reserves. Yes, with the rise of the euro, Japan’s yen, and China’s yuan, the US dollar lost some ground, but here is the shocker: based on the most recent data from the International Monetary Fund (IMF), the US dollar’s share is where it was in 1995.

Figure (1) also reveals a very important fact: the US dollar share is at 60%. China’s yuan is at 2.76%! Here is another fact: percentage-wise, and because of the low base, any growth in yuan holdings by central banks will look large, but the absolute number is actually small.

Going back to the report about China completing its first yuan-settled LNG trade, Reuters said that the LNG contract was settled between CNOOC and TotalEnergies in yuan through the Shanghai Petroleum and Natural Gas Exchange, but the LNG is imported from the UAE! The question here is how is the UAE paid for its LNG? Of course, in the US dollar! So, the act of settling the contract in yuan was “symbolic” at best.

As for the China-Brazil story, the headline that got some pundits excited about the “imminent demise” of the US dollar was: Brazil and China Agreed to Trade in Local Currencies. However, the same headline was published on June 30, 2009! (See below)

Brazil-China bilateral trade in Real and Yuan instead of US dollar

And the headline below is from March 28, 2013!

China and Brazil sign agreement to trade in their local currencies

If the previous deals did not work, why would this latest agreement be any different? Better yet, if they are already trading in local currencies, then the impact of the new deal is pretty limited!

China is Brazil’s largest trade partner. About 27% of Brazil's total exports go to China, while around 11% flows to the US, its second-largest trade partner. Meanwhile, about 23% of Brazil's total imports come from China, while 19% are sourced from the US.

Brazil runs a trade surplus with China because of the exports of raw materials. If we assume ALL trade with China will be in yuan, what would Brazil then do with the accumulated yuan, whose value is controlled by the government, and especially if a new conservative president wins a future election in Brazil?

Moreover, the value of Brazil’s exports to China is about $90 billion and the value of imports is about $68 billion. What is the impact on the US dollar when the size of the global trade is $29 trillion and the value of US trade alone is about $6 trillion?

EOA’s Main Takeaway:

The two stories about China’s first yuan-settled LNG trade, and Brazil and China agreeing to trade in local currencies are greatly exaggerated. The US dollar is losing ground, but it is not losing dominance.

STORY OF THE DAY

REUTERS: US House Republicans face unity test with major energy bill

REUTERS: Manchin threatens to sue US Treasury over EV tax credit rules

Summary:

The Republican-controlled US House of Representatives is expected to vote today on the so-called “Lower Energy Costs Act, which represents a top 2022 Republican campaign pledge to lower Americans' energy costs by scaling back Democratic President Joe Biden's climate policies and increasing oil and gas production through deregulation,” Reuters wrote.

Meanwhile, Reuters reported that Senate Energy Committee Chair Joe Manchin has threatened to resort to court over concerns “about how Treasury will classify processing and manufacturing in determining eligibility for $7,500 EV tax credits.” The US Treasury is expected to release later this week battery sourcing guidance for electric vehicle tax credits, according to Reuters.

EOA’s Main Takeaway:

We do not expect the Republican proposal to pass, but Senator Joe Manchin’s threat is not only serious, but it would also slow down the US administration’s efforts significantly.

Our view is that once Republicans become in control, they will reverse most of what the Biden administration has done. For better or worse, we could see similar developments in some European countries. We remain bullish on oil and gas in the medium and long term for several reasons, including these latest developments in the US.

NEWS OF THE DAY (8 news items)

1- REUTERS: UPDATE 2-Freeport LNG's Texas export plant back at full power, data shows

Summary:

Freeport LNG’s export plant in Texas “was on track to pull in as much natural gas from pipelines as the facility can process into LNG, a sure sign that it was back at full power,” Reuters reported citing data provider Refinitiv.

EOA’s Main Takeaway: