Daily Energy Report

US crude & Canada, Global oil Demand, Trump & OPEC+, EU gas storage, Panama concessions to US, India energy consumption, EU power dispute, Saudis to add 10 VLCCs, Mid-East Trump summit, and more.

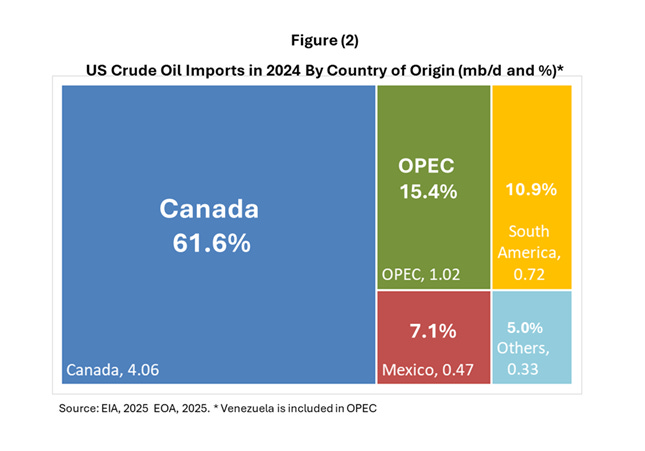

Chart of the Day: US Crude Imports by Origin and the Role of Canada

Related News

Bloomberg: Trump Bets Oil Suppliers’ Tariff Pain Will Mean Long-Term US Gains

Summary

President Trump's tariffs are pressuring Mexico and Canada into negotiations by hiking import costs for US producers of fuel and plastics. This has domestic drawbacks, with Midwest refineries facing higher feedstock costs from Canadian oil dependency, and coastal refineries seeking new suppliers. Canada faces logistical issues in redirecting oil, potentially lowering their prices, while Mexico incurs higher shipping costs to new Asian markets.

Bloomberg: US Oil Refiners Look to Latin America, Iraq After Trump Tariffs

Summary

Following President Trump's imposition of tariffs on oil from Canada and Mexico, US refiners are looking to source heavier crude from Brazil, Guyana, and possibly Iraq. The tariffs impose a 10% levy on Canadian oil and a 25% duty on Mexican oil, potentially disrupting 4.5 mb/d of imports. This shift will increase transport costs and travel times, with Mexican oil likely heading to Asia and Canadian oil expected to be discounted for US markets. Logistical issues like limited pipeline capacity and shipping risks might moderate these changes.

Additional News

Bloomberg: Canadian Oil Dodges ‘Cataclysm’ With Lower Tariffs, Gulf Outlet

Bloomberg: Sheinbaum to Announce Measures Against Tariffs on Monday

Argus: Pemex Can Partially Bypass US Tariffs with Asia Sales

WSJ (Opinion): Mexico and Canada Fire Back

EOA’s Main Takeaway

- More than 60% of US crude oil imports come from Canada, as shown in figure (2) below. Canada imports about 500 kb/d of petroleum products, as shown in Figure (3). Most imports go to Eastern Canada.

- A 10% tariff on oil imports from Canada, starting Tuesday, would increase diesel prices by about 1-11 cents. This is a problem for the US trucking industry, the backbone of the US economy. We have already seen higher oil, gasoline, and diesel prices today.

- Some of the President's supporters spread rumors that the US can increase production to replace Canadian crude, import oil from elsewhere, and that the impact is limited. This is all nonsense, as explained below. The market reaction today tells the whole story. President Trump wanted: 1. A weaker dollar (it went up), 2. Lower oil prices (they rose), 3. A healthy stock market (it declined), and 4. Strong crypto markets (they fell). Detailed explanations follow.

- US Shale produces light sweet crude, which is good for gasoline, naphtha, and NGLs. The US produces close to 9 mb/d, exports about 4 mb/d because US refiners do not want it. Expansion will produce more of the same. The US cannot replace Canadian crude.

- The US imports about 6-7 mb/d of mostly medium-heavy sour crude due to demand for diesel and heavier products. The US imports about 4 mb/d of Canadian medium/heavy sour. The US needs the Canadian crude.

- The US cannot replace these amounts by increasing production, now or in the coming years. Crude quality matters.

- President Trump wants to increase US crude production significantly, but he CANNOT. Here is why:

- Venezuela might add 200-300 kb/d in 2025 with lifted sanctions and investment. South America is maxed out. Again, there is no replacement for Canadian crude.

- Only Saudi Arabia, Kuwait, and Iraq can replace SOME Canadian crude. But the US aimed for decades to reduce dependence on Middle Eastern oil.

- The claim that the impact on diesel prices is lower than what is stated in the tweet below because it's 4 mb/d out of 21 mb/d of consumption misses the following points:

Crude quality matters. Most US diesel and heating oil comes from Canadian crude.

Geographic location matters. Canadian crude is refined in the Midwest, distributed in the region and the Northeast, causing concentrated impact. But the problem is much larger: Higher prices will attract supplies from other states that have nothing to do with Canadian oil. This ripple effect will impact several other states. The irony is, the US might end up with a flood of petroleum products in the Midwest while other states suffer!

- Tariffs are affecting the entire energy complex, including natural gas and fertilizers. Many regions are in the planting season for several crops. Farmers' costs will increase. If the dollar remains strong, farmers will suffer again because they cannot export their products.

To conclude, crude quality matters. Increased US oil production will be light sweet, while replacing Canadian crude requires more medium/heavy sour crude. Countries with this quality are those the US avoids dependence on. They can replace about 1.5-1.7 mb after 3-4 months, not the 4 mb/d from Canada. However, the cost of Middle Eastern oil, even with a 25% tariff on Canadian crude, is higher than Canadian crude. Even then, there is no way to get that oil to the Midwest.