Daily Energy Report

US crude to China, Oil prices steady, Russian crude exports, Europe storing gas offshore, America leads LNG, Saudis invest in metals, solar PV emissions, Japan/China LNG transport, and more

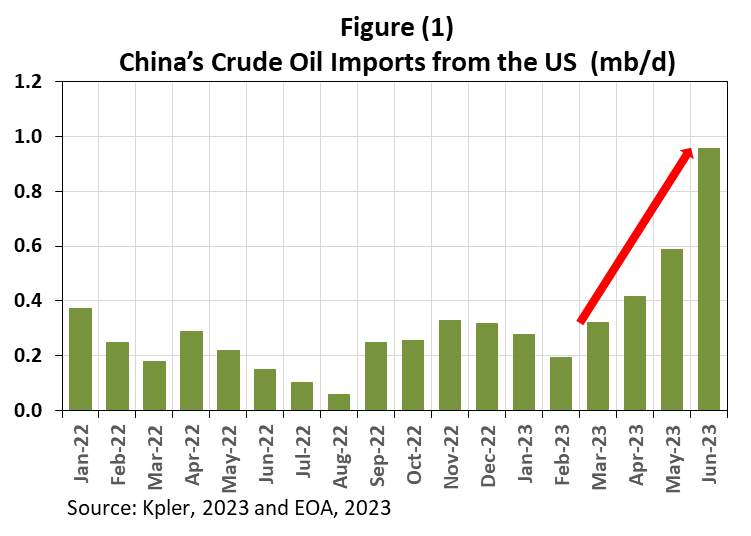

Chart of the Day: US Crude Oil Exports to China are second-highest on record

Summary

Figure (1) above shows US crude exports to China, which were virtually nonexistent before the US shale revolution and increased since President Obama lifted the ban on US crude exports at the end of 2015. The chart shows a large increase in US exports to China in recent months. Kpler data shows that China’s crude imports from the US increased in June to the second highest on record. The highest was in May 2020, after the price collapse in March and April following COVID-19 lockdowns.

EOA’s Main Takeaway

At a time when the US Senate overwhelmingly backed a measure to ban US crude exports to China from the US Strategic Petroleum Reserves (SPR), China’s crude oil imports reached the second-highest level on record. Chinese companies do not care if the oil comes from wells in Texas or Oklahoma or from the US SPR.

It is also interesting that when China wanted to build its SPR cheaply, it did so by importing a record amount of crude in May 2020.

The Senate ban is merely symbolic and has no impact on the market nor on China. It was simply a reaction to the fact that a small part of the crude that the Biden administration released in 2022 was exported to China. For more illumination on this matter see the Anas Alhajji Tweet from November 7, 2021.

Worth noting that what is counted in Chinese imports was US exports a few weeks earlier.

Story of the Day

Reuters: Oil Prices Steady Near 3-Month Highs

Summary

Oil prices remained steady on Tuesday, with Brent futures at $82.74 a barrel and U.S. West Texas Intermediate (WTI) crude slightly up at $78.75, due to signs of tighter supplies and China's commitment to bolster its economy. This stability comes despite weaker economic data from Western countries. The supply is expected to tighten due to output cuts from OPEC and allies, a situation that has caused four consecutive weekly gains in crude benchmarks. Additionally, there are growing concerns about a potential supply disruption due to Russia's escalating activities in Ukraine.

EOA’s Main Takeaway

We refer our readers to two podcasts related to this topic:

Oil Market Views: Dr. Alhajji’s interview with Macro Voices:

https://www.macrovoices.com/1220-macrovoices-385-dr-anas-alhajji-2024-energy-markets-outlook-more

Or on YouTube:

OPEC, OPEC+, and the Oil Market: Dr. Alhajji’s Interview with Energy Oracles Podcast

News of the Day

Bloomberg: Russian Crude Flows from Western Ports at 7-Month Low

Summary

Russia's seaborne crude flows from its Baltic and Black Sea ports have fallen to the lowest level in seven months, indicating the country is fulfilling its pledge to reduce supply in line with the OPEC+ producer coalition. Shipments from the ports of Primorsk, Ust-Luga, and Novorossiysk dropped to 1.17 million barrels a day in the week to July 23, a fall of 625,000 barrels a day from the previous week. However, increased flows from the Pacific port of Kozmino partially offset this decline. The reduced availability of Russian crude and lesser supplies from the Middle East have impacted global pricing and made Russian crude less attractive to buyers such as Indian refiners.

EOA’s Main Takeaway

We told our readers in past reports that: