Daily Energy Report

Russia’s oil exports, Shale maturity & rising costs, China & Saudis eye deal, Saudi production cut unwinding, Solar & hail damage, Subsea cable failures, EV factory in Saudi Arabia, and more.

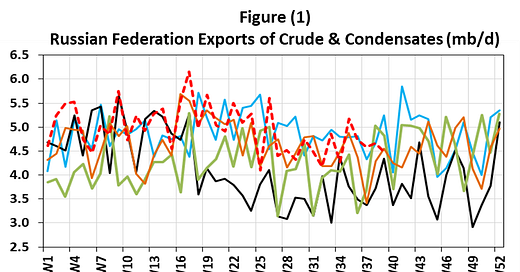

Chart of the Day: Russia did well exporting oil under sanctions.

Summary

Figure (1) above shows Russian oil exports since 2019. It shows that Russia’s exports of crude and condensates in 2023 were high relative to last year. They declined after an agreement with Saudi Arabia last March to voluntarily cut production.

EOA’s Main Takeaway

We decided to post this chart today because of the Story of the Day below. We have emphasized since last year that sanctions and price caps do not work. As Figure (1) shows, Russian exports of crude and condensates in the first quarter of 2023 were higher than exports in previous years, despite sanctions. The decline since April was related to an agreement with Saudi Arabia to cut production voluntarily, not the sanctions.

Story of the Day

Bloomberg: Russian Oil Is Trading Closer to $100 Than the G-7 Price Cap

Summary

Russia’s Urals traded at $85.35 a barrel from the Baltic port of Primorsk and $86 from the Black Sea port of Novorossiysk. The G7/EU price cap is $60 and the group has no intention of raising it.

Reuters: Russian Oil Sold to India at 30% above Western Price Cap

Summary

Russia is selling oil to India at nearly $80 per barrel, which is $20 higher than the Western price cap. Since mid-July, Russia's primary export grade, Urals, has been trading at over $60 per barrel. India, now the largest buyer of Russian seaborne oil, primarily Urals, has turned to Moscow after Western sanctions. The price surge is attributed to Russia's low oil inventory and reduced production.

EOA’s Main Takeaway

This is just one more story that proves the point that the price cap does not work, never worked, and will never work. Everything we have heard from the US Treasury Department and certain media outlets was a lie. Regardless of the first headline, “closer to $100” is clickbait. The price was $86 and it is true it is closer to $100 than $60, but that has no meaning. Instead, it gives those who do not know the oil market landscape the impression that Russian oil is sold closer to $100.

News of the Day

Wall Street Journal: Saudi Arabia & Russia Win Big in Gamble on Oil Cuts

Summary

Energy Aspects' data suggests that Saudi Arabia's oil revenues have likely increased by about $2.6 billion this quarter, while Russia has seen a rise of around $2.8 billion. Recent actions by OPEC+, including significant production cuts and plans to extend these reductions, have resulted in a 25% increase in Brent crude prices this quarter. However, reducing output comes with risks, including potential loss of market share and the possibility of reduced revenues if prices don't increase as anticipated.

EOA’s Main Takeaway

Saudi Arabia has been making these cuts for decades. The Saudis have been working with the Russians since 2016. To label the cut as “a gamble” does not square with historical facts and the statements by the Saudi Energy Minister. It also does not fit with what oil market experts have been saying about the impact of the voluntary cuts.

At issue here is market management. The oil market needs to be managed because of the nature of the industry where most of the expenses are fixed, sunk costs. While the article talks about the loss of market share, it ignores the fact that natural resource economics is different from regular economics. If you cut production by 1 mb/d, you conserve 1 mb/d of your resource. You save it for the future. You also reduce emissions.

Enverus: Shale Maturity Driving Increase in Cost of Supply

Summary

Enverus Intelligence Research (EIR) has published a report assessing the drilling inventory in major North American shale areas. The report states that as the industry shifts from Tier 1 to Tier 2-4 locations, supply costs for North American shale producers are expected to rise in the next five years. Nevertheless, the available Tier 2-4 inventory should dispel concerns about a long-term decline in North American production for the upcoming 15 years.

EOA’s Main Takeaway