Daily Energy Report

China LNG imports, Cushing inventories, IEA oil forecast, Russia/India oil deal, Saudi crude to China, Rooftop solar hacking, Exxon/Chevron visions, Germany’s power price spike, and more.

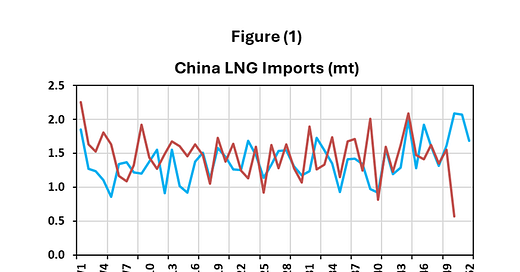

Chart of the Day: China’s LNG Imports Declined, Why?

Summary

Figure (1) shows trends in China’s LNG imports in 2023 and 2024. Although imports were high in 2024 for most of the year, they have declined markedly in recent weeks. As the story from Bloomberg below shows, China is also reselling cargos, indicating lower demand for LNG. Notice that we said lower demand for LNG, not natural gas. Explanation below.

Related News

Bloomberg: China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Summary

High LNG prices have led China, the top global buyer, to cut imports and resell cargoes, with imports now 12% below average. LNG costs $14.50/MMBtu, making spot imports unprofitable. With ample inventories and weak demand in China, companies like CNOOC and PetroChina are selling abroad. This could alleviate supply pressures elsewhere as Europe seeks more LNG.