DAILY ENERGY REPORT

Correlation between recessions and decline in energy consumption, Russian Recession, IEA’s mid-term report, IEA’s monthly market report, US coal exports, NextDacade LNG

CHART OF THE DAY: Recession in Russia Could Spell Trouble for OPEC+, Oil Markets

Summary:

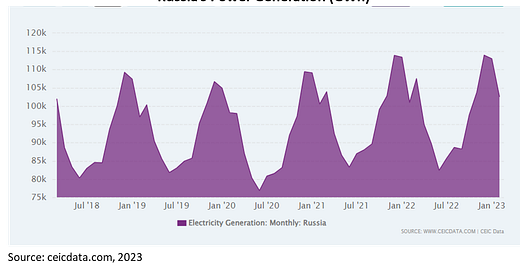

Figure (1) above from the data provider CEIC Data, shows Russia’s power generation from January 2018 until March 2023. It shows seasonality in power consumption, just like any other country, as well as overall growth in electricity generation/consumption.

EOA’s Main Takeaway:

The relationship between a recession and a decline in energy consumption, including electricity, is well-established in the existing literature and applies to all countries, including Russia. Figure (1) shows the decline during the COVID-related lockdowns in 2020.

Moving to the current period, is Russia in a recession, or is it entering one? Based on the electricity consumption indicator, the slowdown in growth is clear in the months following Moscow’s invasion of Ukraine. Although additional data for the last two months of 2022 is needed to determine if Russia is in a recession, the slowdown is clear.

A recession in Russia will have a significant impact on global energy markets. If this scenario happens, Moscow will have more oil, gas, and coal to export to the rest of the world without spending anything on additional investments. A recession will also wreak havoc on OPEC+ since it will raise Russia’s crude oil exports. The OPEC+ agreement is about production, not exports. Russia MIGHT comply with its output quota, but its exports will be higher because of the recession as it diverts oil from domestic consumption to exports. Any way you look at it, it is an additional supply that will be sold at a discount.

STORY OF THE DAY

IEA: ‘A Peak in Global Oil Demand in Sight before the End of this Decade’

Summary:

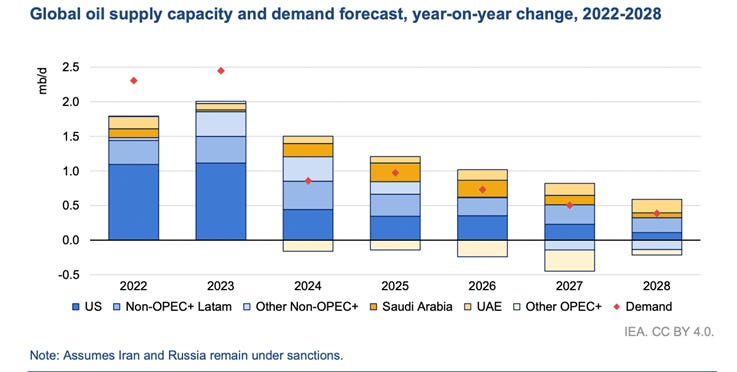

The International Energy Agency (IEA) said today that growth in global oil demand is expected to slow “almost to a halt” later this decade due to the energy transition. In its medium-term report, the IEA forecasts that global oil demand will increase by 6% between 2022 and 2028 to 105.7 mb/d, driven by strong demand from the petrochemical and aviation sectors, but annual demand growth is expected to fall from 2.4 mb/d this year to only 0.4 mb/d in 2028. With respect to China, specifically, the IEA said that demand growth is forecast to slow significantly starting in 2024.

“The shift to a clean energy economy is picking up pace, with a peak in global oil demand in sight before the end of this decade as electric vehicles, energy efficiency, and other technologies advance,” the IEA Executive Director Fatih Birol said according to a press release. “Oil producers need to pay careful attention to the gathering pace of change and calibrate their investment decisions to ensure an orderly transition,” he added.

Source: IEA, Oil 2023 medium-term market report

On supply, the IEA said that the total global supply capacity is expected to post a net increase of 5.9 mb/d to 111 mb/d by 2028. However, a significant slowdown in additions from the US “sees overall global capacity growth easing annually from an average 1.9 mb/d in 2022-23 to just 300 kb/d by the end of the forecast.”

Source: IEA, Oil 2023 medium-term market report

Medium-term capacity expansion plans, according to the report, will be led by producers outside the OPEC+ alliance, accounting for 86% of the total increase. This will primarily be driven by the US, while Brazil and Guyana are expected to have an additional 1.9 mb/d in Latin America.

Within OPEC+, Saudi Arabia and the UAE are expected to lead capacity-building efforts. “These Middle East heavyweights are boosting capacity now in anticipation of higher long-term demand for their barrels. Overall capacity from the 23 members in the OPEC+ alliance rises by 800 kb/d, which leaves a spare capacity cushion of at least 3.8 mb/d,” the report said.

As for Russia, the situation remains opaque given the current geopolitical developments, the report said while expecting capacity to decline due to sanctions.

EOA’s Main Takeaway:

Our long-term outlook differs from that of the IEA. We believe that the IEA and other organizations are exaggerating the impact of fuel economy and electric vehicles on global oil demand while underestimating oil demand growth in developing countries. Some European countries, and even the US and Canada, may experience peak demand, but that does not mean peak demand for the whole world. Some nations will experience peak demand as their populations age and decline, such as Japan and smaller countries in Europe.

It’s worth remembering that gasoline demand increased in many European countries so far in 2023, even in Norway, despite the heavy penetration of electric vehicles. For more on this, we encourage readers to check our Weekly Newsletter published on May 8.

NEWS OF THE DAY

1- IEA: ‘World oil demand will grow by 2.4 mb/d in 2023 to 102.3 mb/d, a new record’

IEA building entrance in Paris. Source: Nigel Bruce

Summary:

In its monthly Oil Market Report, the IEA said that world oil demand will grow by 2.4 mb/d in 2023 reaching 102.3 mb/d, calling this increase “a new record”. However, the IEA added that an “adverse macroeconomic climate” will partly contribute in 2024 to a slowdown in oil demand growth which is expected to slow to 860,000 b/d. China’s oil demand in April hit an all-time high at 16.3 mb/d, according to the report.

On supply, the IEA said that global supply growth will be driven by non-OPEC+ through next year, adding 1.9 mb/d this year and 1.2 mb/d in 2024. Turning to OPEC+, total oil output in 2024 is expected to drop by 200,000 b/d due to the alliance’s output reductions.

With respect to Russia, the IEA said that Russian oil exports dropped by 260,000 b/d last month to 7.8 mb/d, “largely unchanged from a year ago”. In detail, crude exports increased by 90,000 b/d to 5.2 mb/d while petroleum product exports plunged by 350,000 b/d to 2.6 mb/d. The report estimated that Russia’s oil revenues declined by $1.4 bn to $13.3 bn, “with average crude prices easing from $60/bbl in April to $55/bbl in May.”

EOA’s Main Takeaway:

The IEA’s estimates of global demand growth now match those of OPEC. But OPEC was ahead of the curve on this one. As we discussed in our two commentaries earlier this month on the June 4 OPEC+ meeting, OPEC has no choice but to increase production considering these demand estimates and despite the alliance’s commitment to maintaining the output cuts agreement until the end of 2024.

Our estimate of global oil demand growth is significantly lower than those of the IEA and OPEC. However, even with such lower levels, the oil will be significantly withdrawn from global inventories, and OPEC will have to raise its production unless China floods the market with oil from its Strategic Petroleum Reserve (SPR).

Just to be clear, China will use its SPR if OPEC’s and the IEA’s estimates on global demand growth materialize. Regardless of the outcome, OPEC will have to increase production either way. Meanwhile, and if our estimates on global demand growth are accurate, then the need for additional OPEC oil will be reduced as destocking in China will be enough, in this case, to put a lid on oil prices.

Regarding the IEA’s forecast of a slowdown in oil demand growth in 2024, it is worth noting that 2021, 2022, and 2023 are considered years of recovery from COVID-related lockdowns. Therefore, slower growth in 2024 is only a natural and logical result.

2- REUTERS: TotalEnergies buys $219 million stake in LNG developer NextDecade

Source: NextDacade, 2022 (From a presentation in August 2022)

Summary:

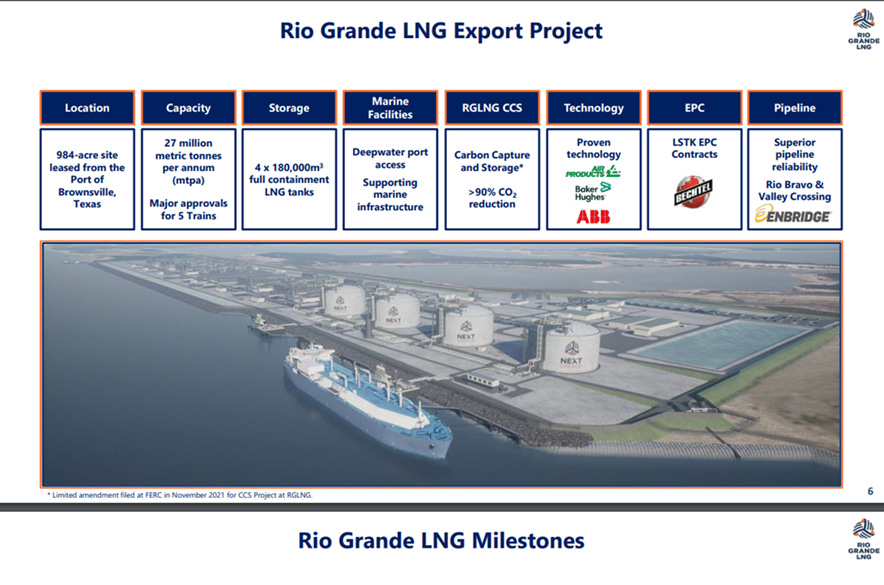

TotalEnergies announced today that it had signed a framework agreement with US NextDecade to participate in the development of the Rio Grande LNG (RGLNG) project in South Texas.

The French company said in a press release that “the first phase of RGLNG, whose final investment decision is expected in the coming weeks for start-up in 2027, will be developed, besides TotalEnergies, by NextDecade as shareholder and operator and Global Infrastructure Partners (GIP) as majority shareholder. The project has already received all the necessary authorizations from FERC, the US Federal Energy Regulatory Commission.”

EOA’s Main Takeaway:

NextDecade is different from other LNG companies, and it might set the stage for a new approach whereby carbon capture technologies and various measures to mitigate GHG emissions are all integrated into one project.

Such investment from an energy major illustrates the significant future roles of LNG and carbon capture technologies. It also shows that abandoning fossil fuels, especially natural gas, is impractical.

The Stock of NextDecade went up by about 51% today.

3- BLOOMBERG: US Plans to Buy 12 Million Barrels of Oil for Reserve This Year

Summary:

Bloomberg cited sources as saying that the US plans to buy around 12 million barrels of oil this year as it begins to refill its emergency reserve.

“The figure includes 3 million barrels already scheduled for delivery in August and an additional 3 million barrels from a solicitation the Biden administration issued on Friday,” Bloomberg said.

EOA’s Main Takeaway: