Daily Energy Report

Rising US Crud inventories, OPEC+ Quota Rift, Aramco Oil Prices, COP28 oil & gas deal accusations, Wind/solar fail, China refiners and energy transition, Soft EV sales, Energy intensity slows, and mor

Chart of the Day: US Crude Oil Inventories Continue to Rise

Summary

Figure (1) above shows trends in US crude oil inventories in the last 6 years, including last week’s inventory numbers that the EIA released earlier today. The EIA showed a continuous build in oil invitatories with 1.6 mb/d added last week. Inventory levels stand at a comfortable 449.7 mb.

EOA’s Main Takeaway

Although the rise in oil inventories in recent weeks matches the historical trend, the amount of the increase is spectacular, indicating some serious issues with US oil demand. So far this year, US oil demand is lower than demand in 2022 for the same period by 700 kbd.

The EIA also showed a large build in petroleum products. Gasoline inventories increased by 1.8 mb to 218.2 mb. Distillate inventories increase by a whopping 5.2 mb to 110.8 mb.

Today’s numbers will cast their shadow on the OPEC+ meeting tomorrow and support the idea of additional cuts.

Story of the Day

Bloomberg: OPEC+ Quota Rift Exposes Long-Running Divisions

Summary

OPEC+ is facing difficulties in agreeing on oil output quotas for 2024, due to a dispute over lowering targets for Angola and Nigeria. The disagreement risks a supply surplus that could collapse crude prices. Few OPEC+ members have the capacity or financial ability to cut production. If further cutbacks are announced, only a handful of countries are expected to participate, most notably Angola and Nigeria.

EOA’s Main Takeaway

The issue is simple: some countries feel that the current “quotas” do not reflect the reality on the ground in 2024. In other words, they do not want to cut, they want others to cut. This has been the story of OPEC in the last 4 decades. This is nothing new. Historical data show that OPEC members have worked it out most of the time, especially when the differences are relatively small. Our view is that there will be a cut, one way or the other. There will either be an OPEC + agreement to cut, or if they do not agree to a cut, the voluntary cuts of Saudi Arabia and its allies with OPEC+ will extend their existing voluntary cuts. We believe that the Saudis have mastered the carrot and stick approach and it will be used directly or indirectly.

For detailed analysis, see our report: What to Expect from the OPEC+ Meeting? Will the Oil Futures Curve Shift into Backwardation?

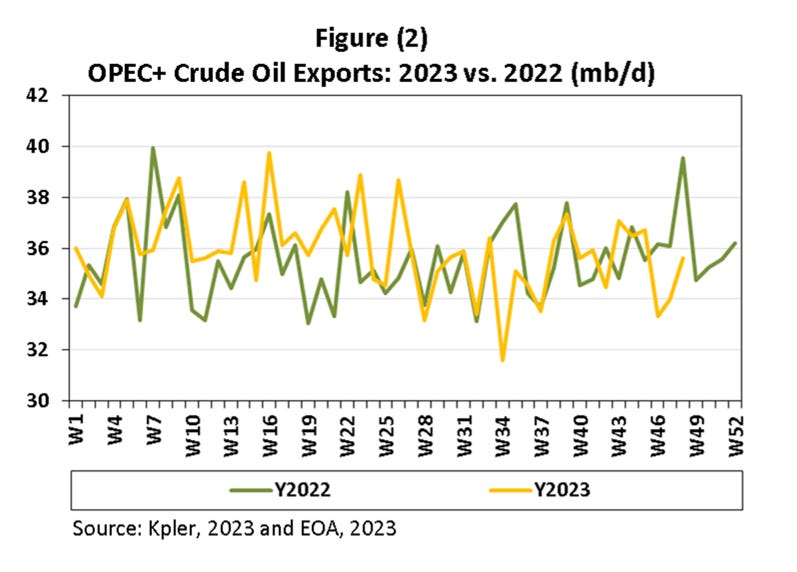

It remains to be seen how new cuts will affect the total exports of OPEC+. (see Figure 2)

News of the Day

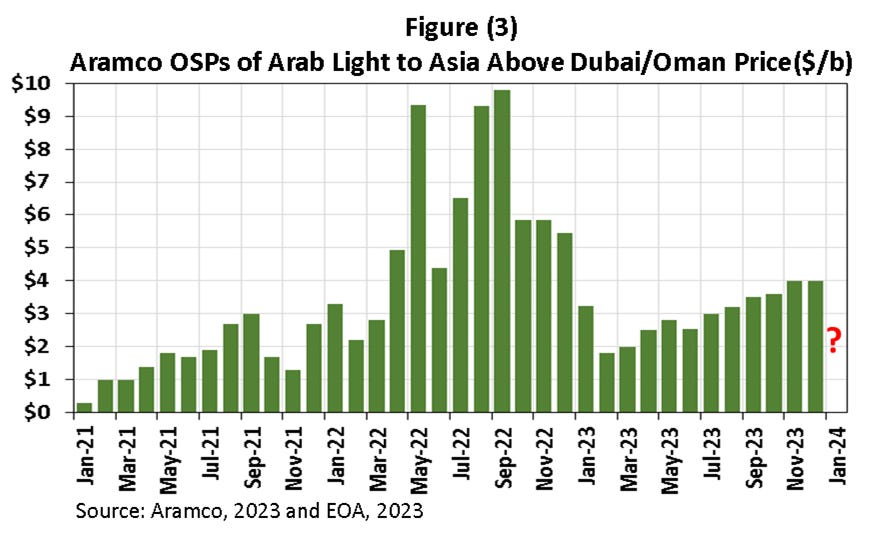

Bloomberg: Saudis Forecast to Cut Oil Price to Asia

Summary

Saudi Aramco is expected to lower the selling price of its main oil grade, Arab Light, to Asia in January by $1.05 a barrel. This anticipated reduction is due to increased competition from cheaper oil supplies from the US, Guyana, and the North Sea entering Asia, the largest oil-importing region. Price cut estimates vary but hinge on the expectation that Saudi Arabia will continue its additional 1mb/d production cut into the next year.

EOA’s Main Takeaway

We believe the opposite is true. If OPEC+ ends up with an additional cut and an extension of voluntary cuts through the first quarter (or just extension of voluntary cuts), Aramco will RAISE its OSP.

Reuters: UAE’s Jaber Rejects Report on Seeking Hydrocarbon Deals at COP28

CNBC: COP28 Host UAE Lashes Out at ‘Fake News’ on Eve of the Major UN Climate Summit

Summary

Sultan Al Jaber, the incoming president of the COP28 climate summit hosted by the UAE, has denied allegations that the host country intends to negotiate natural gas and other fossil fuel deals during the U.N. talks. The denial comes in response to a BBC and Centre for Climate Reporting claim stating that leaked documents suggested such discussions with 15 countries. A COP28 spokesperson also labeled the documents as "inaccurate" and "unverified."

EOA’s Main Takeaway