Daily Energy Report

US gasoline exports to Mexico, IEA’s World Energy Investment 2023 report, Europe’s imports of Russian diesel, Iraq’s Akkas gas field, US sale of oil and gas drilling rights, and more

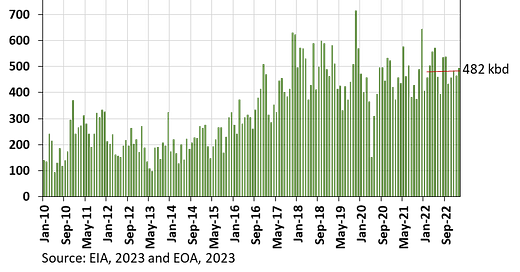

CHART OF THE DAY: Future of US Gasoline Exports to Mexico

Summary:

Figure (1) above shows that between January and September 2022, Mexico’s gasoline imports from the US averaged 482,000 barrels per day (b/d). Since the start of the US shale revolution in 2010, US gasoline exports to Mexico increased by more than fourfold, fueled by growing domestic demand in the Latin American country.

EOA’s Main Takeaway:

The Mexican government plans to stop gasoline imports by 2024 by building new refineries and increasing utilization at existing facilities. This is part of a plan to achieve self-sufficiency in all types of fuels by producing 1.36 mb/d by next year, according to S&P Global. This would end Mexico’s crude exports.

The plan has significant ramifications for Mexico and the rest of the world. With respect to the US, specifically, this would mean that almost half a million barrels of gasoline will need to find new markets. But this may not turn out to be a major problem. US gasoline inventories are at their lowest levels since 2014 (see Figure 2 below). Lower exports to Mexico could redirect gasoline flows to the US domestic market simply because shipping gasoline to other countries changes gasoline economics.

For now, Mexico’s plans for its refining sector are facing various constraints.

Fire incidents were reported this month at different refineries operated by Mexican state oil company Pemex. Last week, two refineries caught fire, the Salina Cruz refinery, which has the capacity to process 330,000 b/d, and the Madero refinery with a capacity to process around 190,000 b/d. Yesterday, meanwhile, reports emerged of another blaze at the Lazaro Cardenas refinery (capacity around 283,000 b/d).

These fires have been ongoing since at least 2021. Last year, a fire erupted at a gasoline storage tank at the Salina Cruz refinery.

Amid these problems, Mexico's long-awaited and newest Olmeca refinery will once again miss its launch date to kick off production, Reuters reported yesterday. Check our analysis here.

For these reasons, we believe that US gasoline exports to Mexico will continue, but they will probably decline over time.

Finally, if Mexico stops its crude exports, this will have a limited impact on global balances: Mexican crude exports will be replaced with Mexican oil product imports, so they cancel each other out. But an end to crude exports will force Mexico to leave OPEC+.

STORY OF THE DAY

IEA: Annual clean energy development has increased much faster than investment in fossil fuels

Summary:

In its latest World Energy Investment 2023 (WEI 2023) report, the International Energy Agency (IEA) said the recovery from the 2020 COVID pandemic, as well as the response to the global energy crisis, have boosted investment in clean energy. The IEA wrote that comparing estimates for this year with 2021 data shows that annual clean energy development has increased “much faster than investment in fossil fuels over this period (24% vs 15%)”.

“For every dollar invested in fossil fuels, about 1.7 dollars are now going into clean energy. Five years ago, this ratio was one-to-one. One shining example is an investment in solar, which is set to overtake the amount of investment going into oil production for the first time,” the IEA Executive Director Fatih Birol said according to a press statement.

Although the boost in clean energy spending in recent years has been notable, the IEA said that it has been "heavily concentrated in a handful of countries" or distributed unevenly across countries and regions. The top three countries that have seen an impressive increase in clean energy spending are China, the EU, and the US.

Regarding costs for some key clean energy technologies, they increased in 2021 and 2022 mainly due to higher input prices for critical minerals, semiconductors, and other materials. According to the IEA, solar PV modules "were around 20% more expensive in early 2022 than one year earlier, although these price pressures have eased since." The costs of wind turbines, meanwhile, and particularly for European manufacturers, were still high early this year, "at 35% above the low levels of early 2020," the IEA said.

Figure (4)

IEA, World Energy Investment 2023 (WEI 2023) report

"Permitting has been a key concern for investors and financiers, especially for wind and grid infrastructure," the report said.

In a report published in March 2023, JP Morgan noted that Western countries have "set a high bar" for achieving their energy transition goals, adding that capacity additions could be constrained by issues related to critical minerals, grid connection, and project siting. The situation is different in China where solar and wind targets, according to the report, “are within reach compared to the pace of recent capacity additions." China is also building coal since it cannot rely only on new solar and wind. According to JP Morgan, China, last year gave the green light to 106 GW of new coal capacity, which is considered the "highest figure in 7 years and which is equal to the last 5 years of decommissioned coal capacity in the US and Europe combined."

EOA’s Main Takeaway:

We find the IEA report to be more logical and practical than other reports and statements on energy investment. OPEC has even been more practical, seeing the decline in E&P in oil and gas investment as a cause for great concern.

Our view is that the increase in spending on renewables is great, but as renewables expand, they will need more backup energy sources. If the backup is not there or is extremely expensive, then the act of expanding renewables will lead to outages and energy crises.

Some climate change enthusiasts, activists, politicians, and companies need to get a grip on reality. Renewable energy, such as solar and wind are weather-dependent, and energy storage is still years behind, while the cost of transition is increasing—which is in conflict with some governments’ promises to bring costs down. They also need to consider national security. If countries do not want to depend on China, then they need to start working on projects to mine for critical minerals, which are essential for some energy transition technologies, within their own borders. Mining, however, goes against their commitment to fighting climate change.

NEWS OF THE DAY

1- BLOOMBERG: Europe Is Successfully Replacing Its Lost Russian Diesel Supply

Summary:

Bloomberg today wrote that the EU has been able to replace Russian diesel imports with supplies from other places.

Deliveries from the Middle East and the US, Bloomberg said, have been “booming”. Imports from Saudi Arabia are estimated to hit a new high of around 324,000 barrels a day, while US supplies are expected to climb to their highest since August 2020.

EOA’s Main Takeaway:

It is all a game of musical chairs. The story is about “direct” and not “indirect” imports.

Russian petroleum products are reaching Europe and will continue to do so. We have discussed this issue in various reports on Turkey’s imports and reexports of Russian oil products to Europe. Check our latest in-depth analysis here.

Countries like India, China, and others are importing Russian crude, refining it, and exporting the refined products to Europe. The sad part is that Europe has not learned the lessons from the latest energy crisis. European countries are shifting energy dependence from one country to another but with higher costs! The good news is that suppliers that lost market shares in Europe in the past, such as Saudi Arabia, are now regaining their shares.

2- REUTERS: Chevron launches sale of Congo oil assets - sources

Summary:

Reuters today cited industry sources as saying that the US energy giant, Chevron, is in the process of selling its oil and gas assets in Congo, attributing this to the company's focus on newer and more profitable output.

Last year, Chevron’s production in Congo dropped by about 40% from 2019 to 31,000 barrels of oil equivalent per day (boed), according to the report.

Sources told Reuters that the assets "could fetch up to $1.5 billion."

EOA’s Main Takeaway: