Daily Energy Report

China inventory declined, OPEC cut speculation, Israeli ship capture, Carbon tax debated, Europe petrochemical decline, China builds power plants overseas, Germany electricity prices to climb, and mor

Dear Readers,

We wish our readers who celebrate Thanksgiving Holiday a happy and blessed time with family and friends. We will not publish the Daily Energy Report on Wednesday, Thursday, or Friday so members of our team may spend the holidays with their families. However, since this is a US holiday and world markets will remain open, we will send short notes in case of breaking or significant news.

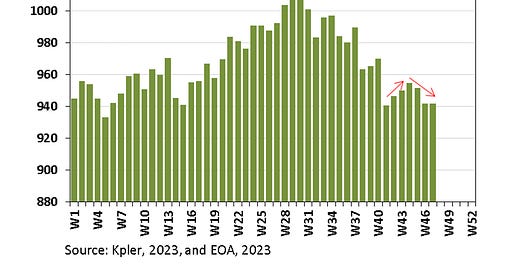

Chart of the Day: As expected, China’s oil inventories are declining again!

Summary

After a surprise increase in China’s oil inventories, they started declining again as shown in Figure (1) above.

EOA’s Main Takeaway

We still expect a draw of an additional 30+ mb by year’s end. When we covered the increase in inventories a few weeks ago, we predicted that inventories would decline again even in the case of slower economic growth because prices remain high and there is no need for additional inventories.

Story of the Day

Reuters: Brent, US crude futures climb over 2% as OPEC cuts expected

Summary

Brent crude futures rose to $82.80 a barrel, and U.S. West Texas Intermediate crude increased to $77.87, with the January futures also up. The price hike follows a nearly 20% drop in oil prices since late September and comes ahead of an OPEC+ meeting scheduled for November 26, where additional supply cuts will be considered. Market dynamics show a contango situation, indicating sufficient supply.

EOA’s Main Takeaway

The whole idea that OPEC will cut production is nonsense. A more plausible scenario is an extension of the current voluntary cuts to January or even through the first quarter. A less plausible scenario is deepening the voluntary cuts. The story above ignores the decline in inventories in China and Japan. It ignores that exports of OPEC+ and Norway have been declining (see Figure 2 below). It also ignores the fact that the IEA is expecting a decline in US production. Political risks have also come to the forefront as Houthi rebels captured an Israeli owned vessel. (see story below)

We will publish a full report on possible OPEC actions soon.