DAILY ENERGY REPORT

OPEC production cut, OPEC monthly oil market report, Iran-Venezuela energy cooperation, Pakistan’s LNG imports, renewables investment in Germany, China’s electricity challenges, and more

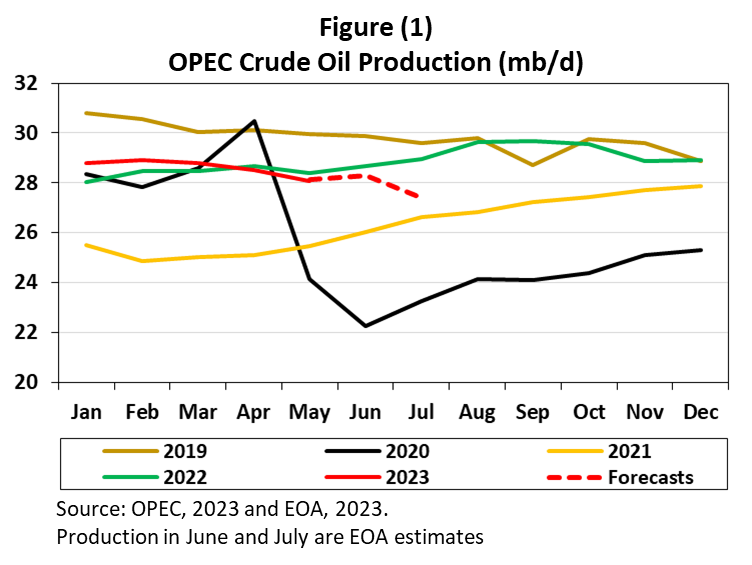

CHART OF THE DAY: Will OPEC Maintain Production Cuts in 2023?

Summary:

Figure (1) above shows OPEC’s monthly crude oil production year over year. We are reposting the OPEC chart we shared on June 5 since our estimate for May was spot on. The figure also shows our estimates for June and July.

EOA’s Main Takeaway:

In its Monthly Oil Market Report released today (details in the next section), OPEC maintained its estimates for global demand growth for 2023 at 2.34 mb/d and expected global oil demand to reach an average of 103.25 mb in the fourth quarter.

Such estimates do not fit with OPEC’s plan to keep its output reductions in place until the end of 2024. If the oil group maintains the cuts until the end of the year, then, in this case, global crude oil inventories have to decline by about 300 mb in the next six months, which would be unprecedented. Considering OPEC and the International Energy Agency’s forecasts for demand, OPEC has to increase production in the fourth quarter, or even earlier.

STORY OF THE DAY

MOMR: OPEC keeps forecast for 2023 world demand growth at 2.3 mb/d

ENERGY INTELLIGENCE: Opec-Plus Output Sinks to 19-Month Low in May

REUTERS: Iraq produced well below its OPEC+ quota in May, source says

In its Monthly Oil Market Report, OPEC kept its forecast for world demand growth in 2023 the same at 2.3 mb/d. “China, Latin America, and the Middle East were revised up slightly, while OECD Europe, Other Asia, and Africa have been adjusted slightly lower. The OECD is expected to grow by about 50 tb/d and the non-OECD by about 2.3 mb/d in 2023,” the report said.

With respect to world oil supply, OPEC said that non-OPEC liquids output growth for 2023 remained the same as last month’s forecast at 1.4 mb/d year-on-year. Liquid supply growth is expected to primarily be driven by the US, Brazil, Norway, Canada, Kazakhstan, and Guyana. OPEC also expected declines mainly from Russia.

As for OPEC production, the oil group said in its report that OPEC-13 crude oil

output in May dropped by 464,000 b/d month over month to an average 28.06 mb/d, based on available secondary sources.

Energy Intelligence wrote yesterday that OPEC+ crude output plunged to 430,000 b/d last month to 36.9 mb/d, which is the lowest level since October 2021 “when the alliance's production was still limited by pandemic-era quotas.”

In another report, a source at Iraq's state-owned marketer SOMO told Reuters that the country pumped 3.955 mb/d of crude in May, up 17,000 b/d from April. Reuters also cited SOMO as saying that the May production was 265,000 bpd below Iraq's OPEC+ quota when including pledged additional voluntary reductions.