Daily Energy Report

Russia’s Petroleum Products Exports to OPEC+ Members, Price Cap & the US Treasury Department, Saudi-Iran Relations, India, China, the EU, and more

CHART OF THE DAY

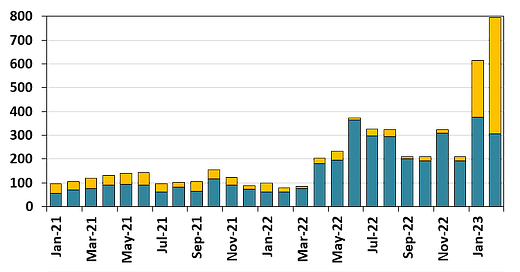

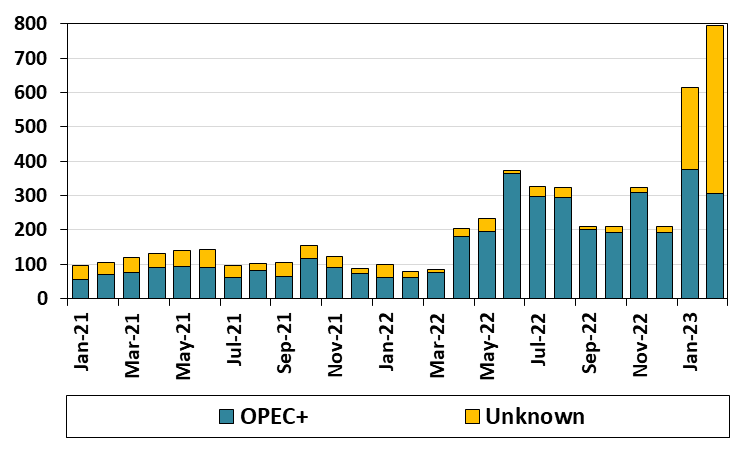

Figure (1)

Russia’s Petroleum Products Exports to OPEC+ Members and Unknown Destinations (kbd)

Source: Kpler, 2023 and EOA, 2023

Commentary

Figure (1) above shows Russia’s exports of petroleum products to OPEC+ members (only six members imported oil products from Russia: UAE, Saudi Arabia, Algeria, Nigeria, Libya, and Oman). Based on recent data from Kpler, Russian product exports dropped from 2.974 million barrels per day (mb/d) in January to 2.701 mb/d last month. However, exports remain within the historical range and are significantly higher than the levels in the third quarter of 2022. Last May, exports of Russian petroleum products declined to 2.33 mb/d.

EOA’s Main Takeaway

Russia has managed to find markets for its petroleum products that were diverted from Europe. China, India, Turkey, and Singapore are the main countries that have increased their imports of Russian products.

The trends in Figure (1) are more about economics than politics. Some OPEC+ members imported cheap Russian oil products either because they’re needed in the domestic market or to refine (mostly desulphurization) and resell them in the global market at international prices.

The increase in the cargoes with “unknown” destinations matches what we discussed in our previous reports about the fact that they’re growing and may end up anywhere.

The bottom line here is that Russian exports of petroleum products are finding markets, just like Russian crude shipments. Meanwhile, the rise in “unknown” destinations does not mean unsold oil. It implies that some buyers do not want to anger the US and the EU or be subject to their regulations.

STORY OF THE DAY

FINANCIAL TIMES: US taps big trading houses to help move price-capped Russian oil

Summary:

“The US has privately urged some of the world’s largest commodity traders to shed concerns over shipping price-capped Russian oil, in a bid to keep supplies stable and regain some oversight of Moscow’s exports,” The Financial Times wrote on Thursday. According to the newspaper, these have included executives and traders at Trafigura and Gunvor.

EOA’s Main Takeaway:

In our previous reports, we underlined the fact that the US and Europe want Russia to continue exporting crude and petroleum products to prevent prices from skyrocketing – so no surprise there. We also told our readers that western claims that price caps are working amount to propaganda. Price caps work when they are well-enforced and below the market price. That’s not the case with the G7-led price caps on Russian oil.

NEWS OF THE DAY

1- WALL STREET JOURNAL: Saudi Arabia, Iran Restore Relations in Deal Brokered by China

Iran and Saudi Arabia have agreed to re-establish diplomatic relations in a deal brokered by China.

EOA’s Main Takeaway:

This is the result of a two-year diplomacy that involved several countries. While we remain cautious given the outcome of previous agreements, a solid deal will have significant implications for the energy markets and not only oil. We will publish soon an interview with a top expert on the topic, and a detailed report in our weekly newsletter.

2- REUTERS: India jostles with China for April ESPO crude from Russia, prices jump

Reuters cited industry sources as saying that private Indian refiners have been competing with independent Chinese refiners over loadings of Russian EPSO blend for April. This has put upward pressure on prices especially after Russia reduced exports of Urals crude, according to Reuters.

EOA’s Main Takeaway: