Daily Energy Report

US oil imports from Venezuela, Mideast conflict impact, Aramco’s deal with China, Germany winter, India/Russia Yuan dispute, China teapot refiners, Green grid fantasy, Turbine troubles, and more.

Chart of the Day: Venezuela Crude Exports to the US

The News

Reuters: Top oilfield service firm SLB moving to resume work in Venezuela, CEO says

Fox News: Biden admin suspends select sanctions on Venezuela for its move toward fair elections

Bloomberg: US Suspends Some Sanctions on Venezuelan Oil, Gas, Gold Sectors

Bloomberg: Venezuela Oil Production Seen Rising 25% as US Eases Sanctions

GRS: Venezuela: Overview of U.S. Sanctions

Summary

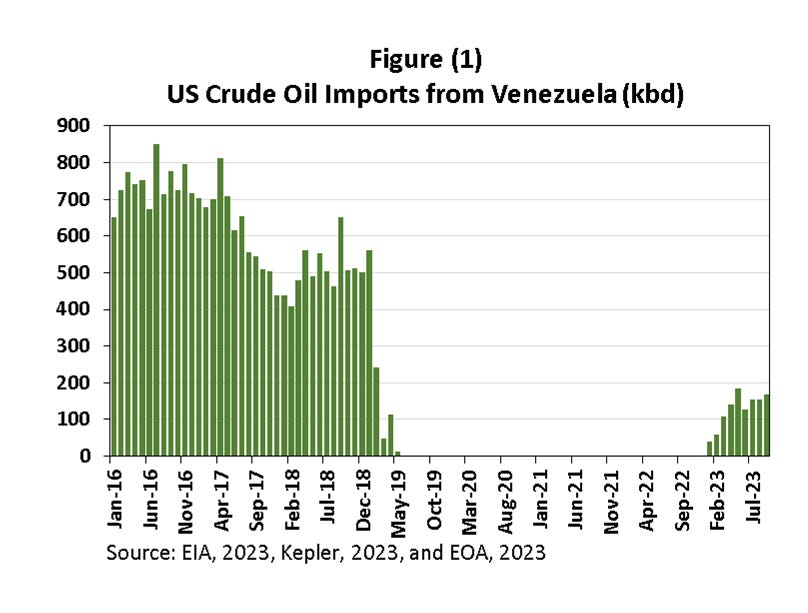

Figure (1) above shows how Venezuela’s crude exports increased after the Biden Administration gave Chevron an exception from sanctions to develop Venezuelan fields in its joint ventures with the intent of exporting crude to the US.

The Administration suspended some of the sanctions for six months, probably in preparation for lifting them completely. Lifting sanctions on the oil sector, though only for six months, allows international companies, including oil service companies to move in to repair and develop Venezuelan oil fields. It also allows additional oil imports from Venezuela.

Currently, the US is importing about 170,000 b/d from Venezuela. If diluent from US shale is valuable on a steady basis, we expect US imports to increase above 300,000 b/d by next April.

EOA’s Main Takeaway

We are surprised by the widespread attention that suspending some of the sanctions on Venezuela has received. We would like to reiterate our view that the impact in the short run is very limited and the maximum amount that can added is 100,000 b/d to 200,000 b/d. Any meaningful addition will take much longer.

A fair question was asked by one of our readers: What is the increase in Venezuela’s production by next summer, just before the presidential elections in the US?

Aside from what can be added in the short run, the availability of service companies and diluents can increase Venezuela’s production by a sustainable 400,000 b/d to 500,000 b/d. While not all of that will go to the US, it remains to be seen if a major increase in Venezuelan crude exports to the US will affect Canadian oil prices. At that time, the Canadian Trans Mountain pipeline became more important than ever. Those who oppose the pipeline and question its viability ignore this point: The comparison should be between prices of WCS when Venezuela is back in full force, vs WCS with the Trans Mountain pipeline exporting at full capacity.

Story of the day

Baker Hughes: Total Rig Count Increased by 2 to 624