Daily Energy Report

LNG share in Europe’s market, Aramco’s oil volumes to Asian refiners, Shell and future of natural gas, Alberta wildfires and energy infrastructure, Iraq’s 2023 budget, and more

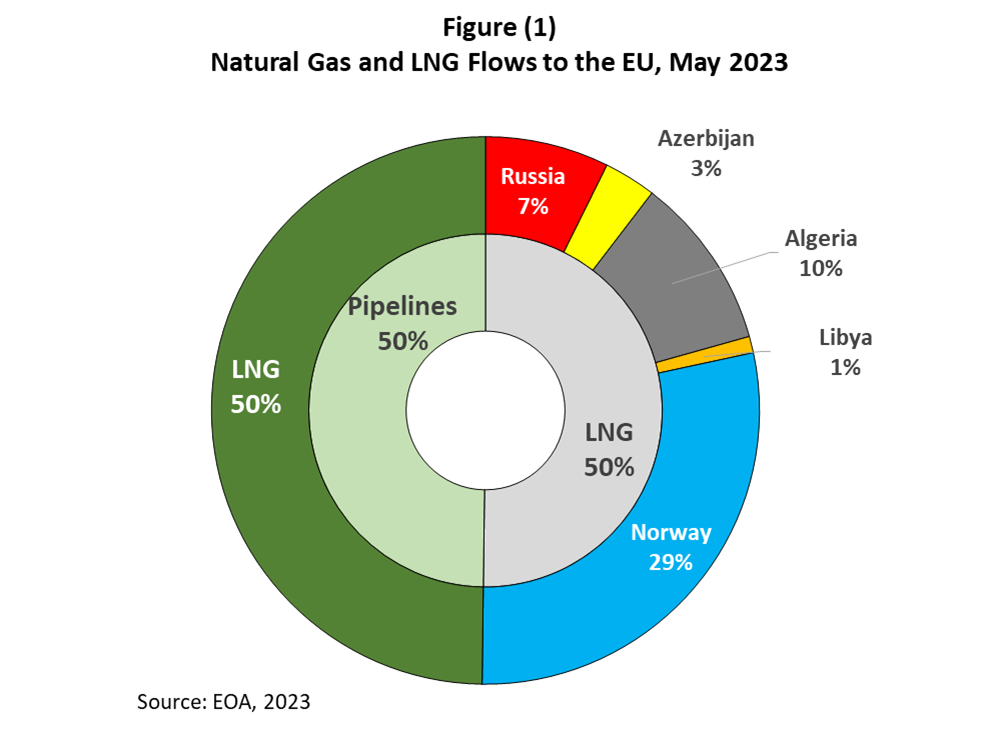

CHART OF THE DAY: LNG Share in Europe’s Gas Market Increased

Summary:

Last month, the EU’s LNG imports fell to 9 million tons (equivalent to 12.3 bcm), based on shipping data compiled by the EOA. The bloc received less LNG cargoes from the US as shipments were directed to Asia amid declining prices in Europe. Spain, for instance, received one cargo in May, down from 8 cargoes in April. Nevertheless, Europe remains the main destination for US LNG. So far this year, the US has exported 60.5% of its outgoing LNG to Europe.

Looking at the full picture, the LNG segment accounted for 50% of the EU’s total gas imports, followed by Norway’s mostly piped gas flows at 29%, while Russia (excluding its LNG cargoes) has retained a share of 7% of total EU gas imports. Regarding Russian gas, German Economy Minister Robert Habeck has said that if Ukraine's gas transit deal with Russia is not extended by the end of 2024, Germany could be forced to gradually reduce or even turn off industrial capacity, Bloomberg reported today.

EOA’s Main Takeaway:

In response to lower gas supplies, the European benchmark for gas prices, TTF, surged 20% to 33 Euros per megawatt hour on June 9. The prices could see more gains if some of the ongoing maintenance work takes longer than scheduled, and Asian LNG demand shows strong growth to attract cargoes from the European market.

With respect to the statement by Habeck, we have been telling our readers that Europe still needs Russia’s gas despite its efforts to cut energy trade with Moscow.

STORY OF THE DAY

BLOOMBERG: Shell CEO’s New Strategy Sees a Long-Term Future for Natural Gas

Summary:

As part of its new strategy, Shell Plc now sees a long-term role for natural gas in the global energy mix, and for this reason, it plans to expand in top growth markets, namely India and China, Bloomberg reported.

“We have always known that gas is crucial for the energy transition, but our new strategy is built around a new belief — that gas will continue to play a key role in the energy mix,” Cederic Cremers, an executive vice president for LNG at Shell, was quoted as saying based on an internal memo, according to Bloomberg.

EOA’s Main Takeaway:

This fits with our long-term oil and gas outlook. As we stated in previous reports, natural gas is NOT a bridge to the future, it is the future. Below are key facts to keep in mind:

1- As solar and wind expand, natural gas is expected to become the backup fuel.

2- As some green policies fail, natural gas will turn into the default fuel.

NEWS OF THE DAY

1- REUTERS: Saudi Aramco to supply full oil volumes to some Asian refiners in July – sources

Summary:

Reuters cited several sources as saying that Saudi Aramco has informed at least five clients in North Asia that they will receive full nominated volumes of crude next month.

"Some Chinese state-owned refiners have requested lower supply in July, according to three trading sources, estimating the combined volume could be about 10 million barrels less than they took for June," Reuters wrote. Meanwhile, some other Chinese refiners have requested extra supply for July from a low base in June, the report added.

EOA’s Main Takeaway:

This news story was misunderstood by many traders and analysts. Supplying “full volume” as stated in the headline does not contradict the Saudi additional voluntary cuts announced earlier this month for two reasons: