Daily Energy Report

Russia crude to India drops, US SPR refill misguided, NetZero meets economic reality, China electricity pricing, Asia gasoil spread, Australia “Green Steel,” Japan & US LNG, and more.

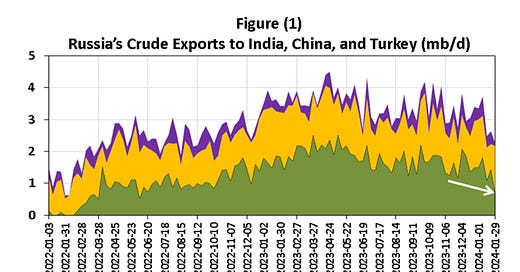

Chart of the Day: Russia’s Crude Exports to India Declined Markedly

Summary

Figure (1) above shows Russia’s crude exports to India, China, and Turkey, three main destinations for Russian crude. Although exports to China declined, exports to India declined markedly. Note that India barely imported any oil from Russia before the Russian invasion of Ukraine.

EOA’s Main Takeaways

Russian crude production increased last month. It was even higher than the exports in January, 2023. The decline in refining utilization because of drone attacks and maintenance could be one of the reasons.

However, the decline in shipments to India has been in the news for weeks. They declined from about 2 mb/d last April to only about 700 kb/d last month. While sanctions and disagreement about payments and currencies used are widely cited, we believe there are deeper political issues than that. It is a fallout with Putin. As we discussed in previous reports, not all the decline in India’s imports is related to Russia. India’s oil imports in general declined.

Story of the Day

Bloomberg: Insisting on US Crude for the SPR is Misguided

Summary

Refilling the US SPR exclusively with domestic crude is problematic. The composition of the reserve is critical. The cancellation of a contract for light crude from Texas's Eagle Ford shale due to incompatibility with existing stocks underlines the issue. US shale oil is less likely to experience disruptions compared to Gulf or foreign sources, which are more vulnerable to natural and geopolitical risks and produce the heavier crudes US refiners might need in an emergency. Therefore, the SPR should prioritize storing crudes that are at a greater risk of supply interruption rather than adhering to domestic political pressures.

EOA’s Main Takeaways

Our followers heard this from us in November of 2022. It was clear for years, especially after 2014, that the the US should reduce the size of the SPR. The production of light-sweet oil increased due to domestic shale production. The SPR needs more medium-sour and heavy-sour crude.

Here is a link to a 30-minute Video from November 2022 discussing all these points

https://x.com/Attaqa2/status/1588258950985547777?s=20

Figure (2) below shows the trends in US SPR and the amounts of sour and sweet. All the recent increases are sour crude.

News of the Day

Reuters: Barclays to Adopt Fresh Curbs on Oil & Gas Financing

Summary

Barclays is halting direct financing for new oil and gas fields. This move is part of its broader Transition Finance Framework, which includes reducing lending to companies heavily investing in fossil fuel production from 2025. The bank has set a goal of $1 trillion for renewable energy financing by 2030. Barclays' policy represents a significant shift, as it has been a major funder of fossil fuels in Europe. The bank's lending-related emissions have already decreased by 32% from 2020 to 2022.