Daily Energy Report

Europe’s gas imports, Venezuela’s oil output, middle eastern crude in China’s market, OPEC+ June meeting, lithium refineries, Druzhba pipeline, divisions ahead of COP28, EIA inventories and more

CHART OF THE DAY: Will Europe Face Natural Gas Shortages Next Winter?

Commentary:

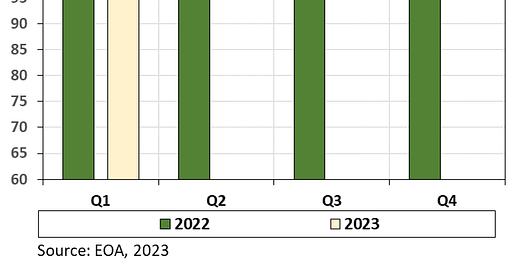

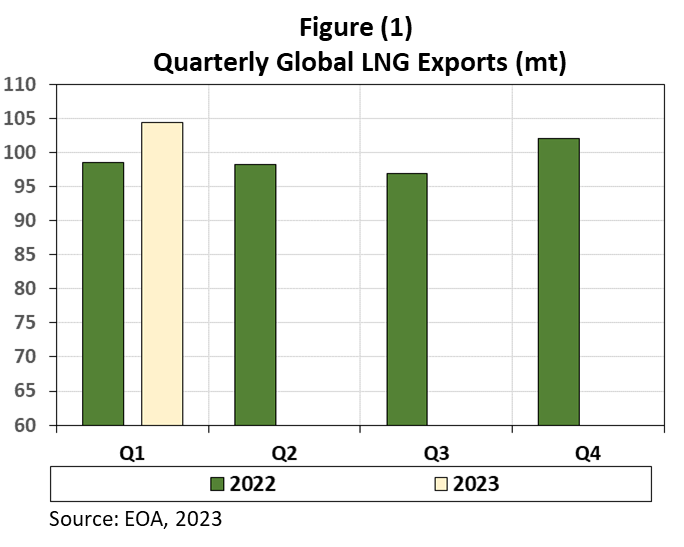

Figure (1) above shows a major increase in global LNG exports in the first quarter of 2023 relative to that of 2022, while Figure (2) below reveals that most volumes went to Europe, with a slight increase in exports to Asia, mainly China.

EOA’s Main Takeaway:

We have discussed on different occasions in our Daily Energy Report and Weekly Newsletter how Europe’s energy policies have been ineffective so far, and since Russia’s invasion of Ukraine. European governments have mainly succeeded in shifting their dependence on gas imports from Russia to Norway and the US. With respect to LNG imports from the US specifically, we highlighted how this will pose high risks for Europe due to several reasons, chief among them hurricanes in the Gulf of Mexico that can interrupt LNG exports.

In the short-term, several LNG plants in different countries are expected to go offline for a few weeks due to planned and unplanned maintenance activities, and we will be monitoring how this could affect Europe.

Norway’s Hammerfest LNG plant suffered from a compressor failure on May 5 and will remain offline for two weeks. Remember, Europe depends on Norway’s LNG!

Oman’s Qalhat LNG Terminal started turnaround activities on train-3 in early May to sustain the plant’s productivity and reliability, but Oman LNG did not provide the timeframe to accomplish the planned maintenance activities. This means some Asian countries will compete with European countries for alternatives!

The most significant and longest maintenance activity that could affect global supply will be conducted at Russia’s 10.8 million tonnes per annum (mtpa) Sakhalin-2 LNG plant in summer, and it is expected to last for about 40 days. The temporary shutdown of the facility could add risks to global supply and increase the competition for spot LNG between European and Asian buyers. This would put upward pressure on gas prices as a result.

Our long-standing view has been that the world needs Russian LNG. Even without piped gas flows to Europe, Russia can still squeeze the continent, at least by having European customers pay a hefty price for LNG.

To assess the success of European efforts in shifting away from Russian gas, the EOA issues in its Weekly Newsletter a monthly tracker for the EU external gas supplies through pipelines from Russia, Azerbaijan, Norway, and North Africa (Algeria and Libya), as well as LNG cargoes from the global market. This tracker aims to highlight EU gas supply changes and the extent to which the bloc has managed to reduce its reliance on Moscow. We encourage readers to subscribe to our Weekly Newsletter here.

STORY OF THE DAY

REUTERS: Russia's Transneft says Druzhba pipeline 'attacked' near Ukraine border - TASS

Summary:

Transneft, Russia's oil pipeline operator, claimed today that there "was an attempt to commit a terrorist act against the Druzhba oil pipeline system at the Bryansk filling station" Reuters reported citing a report by Russian news agency TASS.

Other reports out of Russia said there were no injuries or leaks as a result of the incident.