Daily Energy Report

China oil imports up, OPEC & IEA divided over demand growth, Aramco dividend & spending, US key to Philippines oil/gas, Big midstream deal, Republican climate caucus, Japan offshore wind, and more.

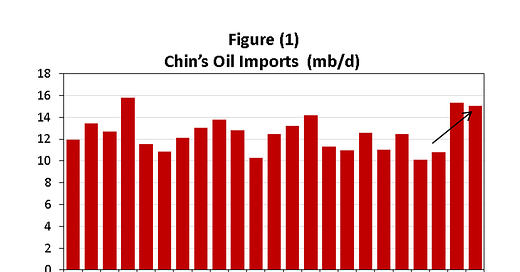

Chart of the Day: China’s Oil Imports Are Increasing

Summary

Figure (1) above shows that China’s oil imports are increasing and this is supported by a statement by Aramco’s CEO: China demand growing. While weekly data involves a lot of noise and is subject to revision, the upward trend and size of the increase are significant. Even a downward revision cannot reverse this trend. Year-over-year, the recent increase in imports amounts to about 1.5 mb/d.

EOA’s Main Takeaway

Oil imports are increasing in other countries, too: India, South Korea, the EU and some countries in Latin America. We posted a NOTE over the weekend entitled: Oil Market Green Shoots? In this article we discussed the details of these increases and global oil demand in 2024. When talking about China, we must be careful associating strong growth in imports with strong economic growth, hence and increase in oil consumption. Some of the oil imports are simply China replenishing inventories. China’s oil inventories have declined by about 90 mb since August. In addition, some of the imports are Russian crude being refined and exported to other countries.

Despite the increase in imports in the countries mentioned above, we saw a decline in imports of other countries, mainly Japan, where imports declined year-over-year by about 400 kb/d.

Story of the Day

Reuters: OPEC, IEA at Most Divided on Oil Demand Since at Least 2008

Summary

OPEC and the IEA have the largest discrepancy in 16 years in their oil demand forecasts for 2024, with a gap of around 1 mb/d. The difference in perspective also extends to the medium term; the IEA anticipates a demand peak by 2030, whereas OPEC's projections show no peak until at least 2045. This divergence reflects their differing roles. The IEA has moved from focusing on oil supply security to promoting renewables while OPEC nations remain focused on oil & gas.