Daily Energy Report

Oil on water in perspective, offshore drillers, G20 avoid fossil fuel phaseouts, Chevron earnings, China all-in on green tech, Biden Admin focuses on methane leaks, CO2 Credit Plan unrealistic, Russia

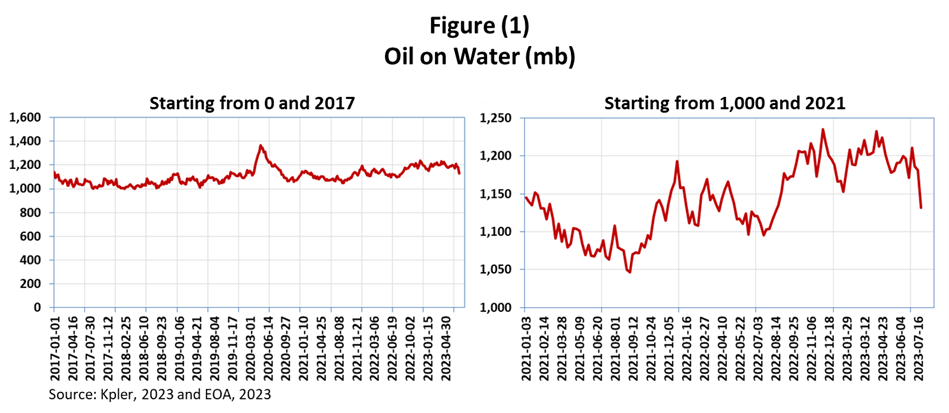

Chart of the Day: Oil on water does not tell us much.

Summary

The two panels in Figure (1) above show oil on water, which is oil in transit in oil tankers. It does not include oil in floating storage. The left panel shows oil on water since early 2017. It shows that oil on water declined in recent weeks. In general, excluding the period of COVID-19 lockdowns, oil on water is relatively stable and it increased after the Russian invasion of Ukraine as oil is diverted from short-haul to long-haul and as some oil is searching for ports to be unloaded

The panel on the right shows oil on water since early 2021 but it started the quantity from 1,000 instead of zero.

EOA’s Main Takeaway

Several factors affect the amount of Oil on Water. However, the left panel in Figure (1) above shows that the amount is range bound except in extreme circumstances such as the COVID-19 lockdown and sanctions on Russia. The sanctions shifted short haul to long haul, leading to more oil on water. Please note that oil on water might become “floating storage” under specific circumstances.

Oil on water can be used as an indicator of bullishness or bearishness only when used with other data sets to complete a story, and only at inflection points, but on their own, they do not tell much. The recent decline is the result of export cuts by Saudi Arabia and its allies on one hand, the increased ability of Russian oil companies to market their oil, and probably an increased efficiency in shipping as the world was disorientated because of the ramifications of the Russian invasion of Ukraine. In other words, a shift from long haul to short haul could reduce oil on water. This might sound more bearish than bullish!

However, Oil on Water remains higher than the historical average under normal circumstances.

The Panel on the right is just to contrast recent changes, but if the objective is for it to be used to indicate price direction, it becomes an example of a chart crime.

Story of the Day

MSN/WSJ: Global Hunt for Crude Sends Offshore Oil Stocks Soaring

ULTRA-DEEPWATER DUAL-ACTIVITY APOLLO. Source: Transocean

Summary

Offshore oil stocks have surged around 35% this year as investors anticipate a future where energy production is increasingly reliant on deep water. Companies like Noble, Transocean, TechnipFMC, and Oceaneering International, which provide various services to the offshore drilling industry, have seen significant stock gains. This rise is driven by increased demand for petroleum and a growing expectation that more fossil fuels will be sourced from undersea reserves. The demand for ocean rigs is high, with drillers receiving sizeable contracts for their services, with some producers securing rigs up to a decade in advance. Rystad Energy predicts that annual investment in offshore exploration and production could exceed $200 billion in the coming years, its highest since 2016.

EOA’s Main Takeaway

As our readers know, we have been bullish on offshore activities since the fourth quarter of last year. We expect offshore activities to remain strong.

News of the Day

S&P Global: G20 Energy Ministers Avoid Fossil Fuel Phaseout Goals

Source: Ministry Of Power, India,

Summary

During the G20 energy ministers' meeting in Goa, India, five voluntary principles regarding carbon and renewable hydrogen were introduced, but no targets were set for phasing out fossil fuels, including coal-fired power generation. The voluntary principles involve encouraging collaboration on the development of national standards, global certification of low carbon and renewable hydrogen, promoting clean hydrogen trade, accelerating tech innovation, mobilizing finance, and sharing information. While some G20 members support the phasing down of fossil fuels, others believe carbon capture, storage, and abatement could be alternative solutions. On climate finance, the document urges G20 nations to meet their commitment of delivering $100 billion per year until 2025 to developing countries and calls for improved access to low-cost financing, particularly for low-carbon and renewable hydrogen.

EOA’s Main Takeaway