Daily Energy Report

China’s Saudi crude oil imports, IEA’s Oil Market Report, the race to secure critical minerals, Rwanda’s plans for nuclear energy, India’s EV sales, demand for older tankers, and more

CHART OF THE DAY:

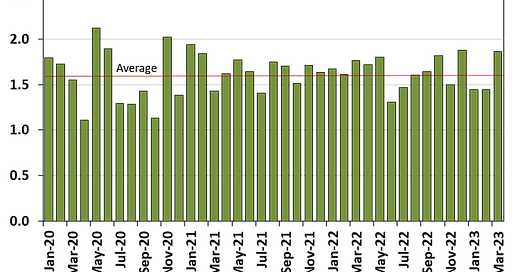

Saudi Share in China’s Oil Market Not Affected by Increased Crude Flows from Russia

Summary:

Figure (1) above shows that despite the increase in China’s dependence on crude oil imports from Russia, imports from Saudi Arabia have been steady, unlike what some media reports have claimed regarding a shrinking Saudi share in China’s oil market.

Commentary:

Saudi Arabia does not want to lose its market share in China and the latter does not want tensions with Saudi Arabia. The result is what we see in the chart: exports have remained steady, fluctuating around an average of about 1.65 million barrels per day (mb/d).

It is also worth noting that China significantly increased its imports from Saudi Arabia and Iran in March after Beijing brokered an agreement between Riyadh and Tehran. We do not know if these flows were a coincidence or preplanned, but at the same time, we cannot ignore the politics of the deal because the percentage increase is almost the same for both countries.

Meanwhile, as China’s oil demand rises while OPEC+ cuts production and Aramco keeps its OSPs high, one result is clear: China may not raise its crude oil imports from Saudi Arabia. Saudi market share as a percentage of total Chinese crude oil imports will decrease as a result, but the actual amount will remain the same. What Saudi Arabia cares about is the amount and has no problem if the increase in Chinese oil demand is met by boosting Russian oil imports. Media reports claiming that Saudi Arabia is losing its market share to Russia in China miss the big picture. Saudi Arabia will maintain its exports within the range indicated in the chart above.

STORY OF THE DAY

IEA: Surprise OPEC+ supply cuts risk aggravating an expected oil supply deficit

TRADEWINDS: Russia’s crude exports breach G7 oil price cap for first time, says IEA