Daily Energy Report

OPEC+ compliance/exports, China naphtha imports down, ND fires lower production, Oil investment needed, EU car carbon rules, Japan LNG, Refining shakeout, UN climate push, and more.

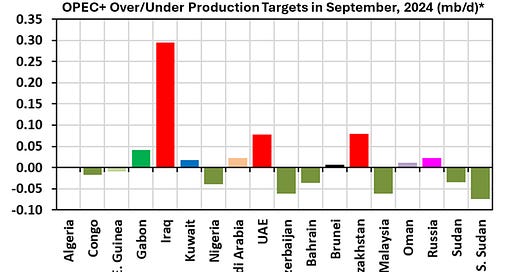

Chart of the Day: OPEC+ Production Compliance vs. Exports

Summary

S&P Global published a report highlighting OPEC+ production in September. It provided data on production changes in September relative to that of August and to production targets. Figure (1) shows S&P Global’s estimates of over/under production targets. It shows that three countries stand out in their over-production: Iraq, Kazakhstan, and the UAE. However, we must be careful making any conclusions about the impact on the oil market of over-production for the reasons mentioned below.

According to SP Global, OPEC+ oil production fell by 500 kb/d in September, mainly due to Libya's shutdowns and Iraq’s export cuts, easing pressure on overproducers. OPEC's output dropped by 520 kb/d, while non-OPEC+ members like Russia saw small increases. Despite efforts to stabilize prices, weak demand from China and high non-OPEC+ output continue to impact the market, though Middle East tensions have recently pushed prices up.