Daily Energy Report

Oil inventories, prices & OPEC, Goldman oil prediction, US Treasury sanctions, EU tanker ban, Japan offshore wind, US EV market, False green jobs, Oil Majors & Kashagan, and more

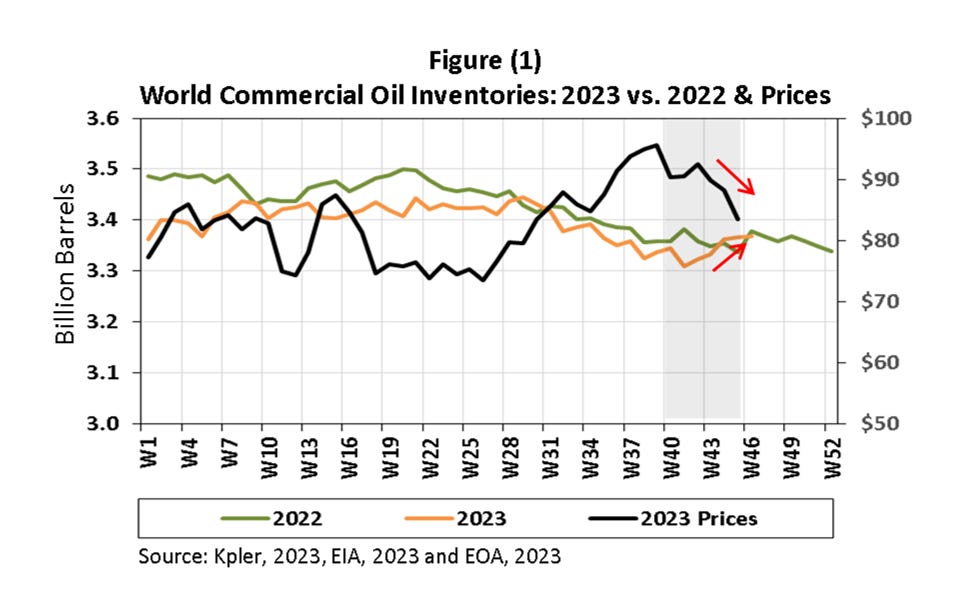

Chart of the Day: Oil prices decreased as world oil inventories increased.

Summary

Figure (1) above compares world oil inventories in 2023 to that of 2022. It also shows the inverse relationship between world oil inventories and oil prices in recent weeks. As inventories increased; prices decreased.

EOA’s Main Takeaway

The recent decline in oil prices was fueled by fundamentals as we have argued in recent reports, especially that this change in fundamentals was a surprise to most of us. Options, algos, and speculation accentuated the trend.

Warning: The chart above is used for illustration only and does not reflect the true relationship between inventories and prices. The chart is not scaled accurately. The chart reveals a stronger relationship between inventories and prices than the actual relationship. Inventories are one factor that influences prices.

Story of the Day

Reuters: OPEC+ to consider whether more oil cuts needed - sources

Summary

OPEC+ ministers will meet on November 26. “OPEC+ is set to consider whether to make additional oil supply cuts when the group meets later this month, three OPEC+ sources told Reuters”