Daily Energy Report

EU gas imports, Brent below $80, Exxon climate push back, Dark money oil attacks, Russia dodges sanctions, UK offshore auction #2, Norway investment, Canadian carbon tax, and more.

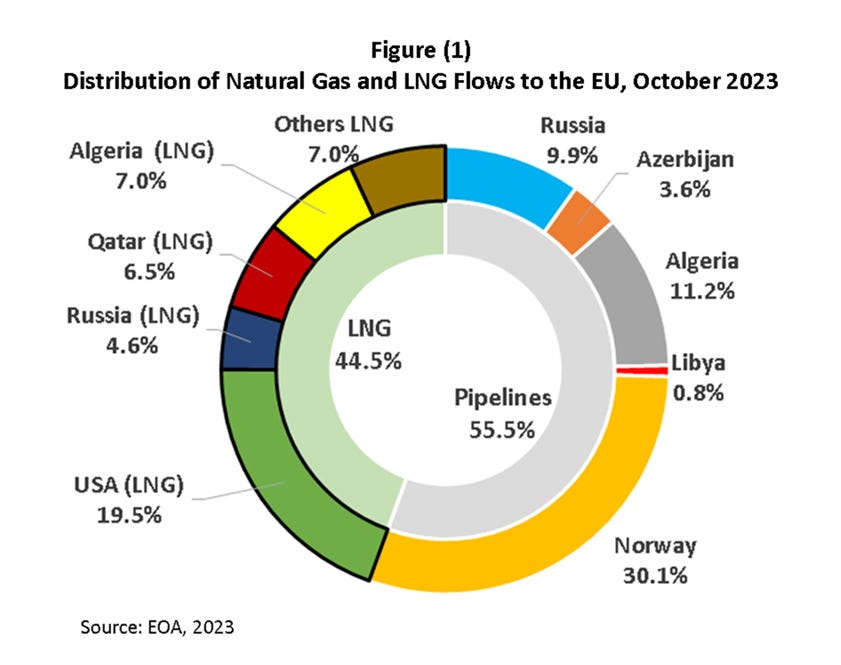

Chart of the Day: EU Gas Imports by Source

Summary

Figure (1) above shows EU gas imports by source in October. About 55.5 of total gas imported were piped and 44.5% were LNG. About 30% EU gas imports come from Norway, 20% from the US, 15% from Russia, and 11% from Algeria.

After hitting a 21-month low in September, EU’s LNG imports recovered in October, reaching 8 million tons (equivalent to 10.9 bcm of gas), based on shipping data compiled by the EOA. This is the highest monthly level of LNG imports since June. Spain was the top importer in October with 1.6 million tons, followed by France with just under 1.6 million tons, and the Netherlands with 1.4 million tons.

EOA’s Main Takeaway

Europe currently has sufficient gas in storage to withstand peak demand on natural gas during the heating season as long as supplies keep flowing. Europe shifted its dependence from Russia to Norway and the US but was not able to eliminate threats to its energy security. While European gas prices could spike at the end of the winter season due to an expected depletion of gas stockpiles, they could spike earlier if the EU decides to ban imports of Russian LNG or if supplies from Norway or Algeria decline or are disrupted.

Story of the Day

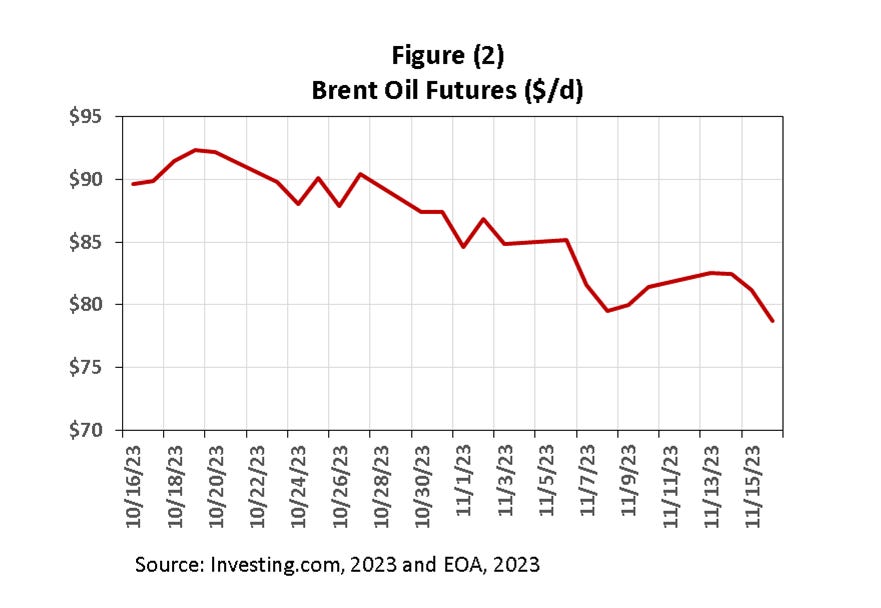

Reuters: Brent declines below $80/b

Summary

Oil prices declined today to be $80/b. In less than 3 weeks, Brent futures declined by about $12/b.