Daily Energy Report

Alberta’s wildfires and Canadian oil output, Middle Eastern producers hiking prices for Europe-bound cargoes, Brazil-China trade, methane emissions rules in Europe, OPEC+ cuts, and more

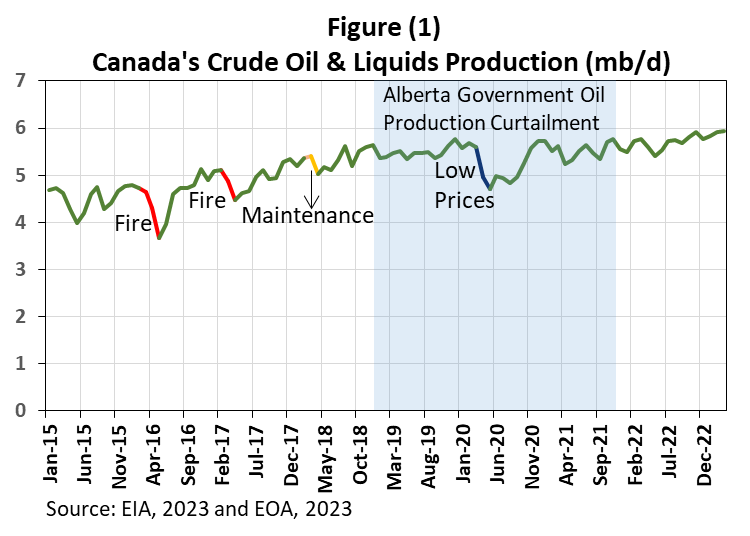

CHART OF THE DAY: Alberta Fires and Canadian Oil Production

Commentary:

The wildfires in Alberta, the richest oil province in Canada, have forced some oil producers to shut down and evoked horrific memories of the fires in 2016.

Figure (1) above shows Canada’s crude and liquid production since 2015. It reveals the impact of the wildfires in 2016 and 2017, maintenance activities in 2018, as well as the impact of the plunge in oil prices in 2020. The chart also shows the impact of production controls by the Government of Alberta from early 2019 until the end of 2021. During that period, the government decided to cap production after price differentials increased markedly, making Canadian oil very cheap. The government’s rationale was that it was a waste of natural resources, so production needed to be curtailed to conserve the oil until prices improved.

Despite the various factors that affected output over the past years, the chart shows the incredible growth story of Alberta’s oil production. Since early 2015, companies have added more than 1.2 million b/d of production.

EOA’s Main Takeaway:

The fires of 2016 reduced production by about 1 mb/d, while the blaze of 2017 reduced output by about 500,000 b/d. These were significant amounts. If the current fire expands to the oil sand area, the evacuation alone would have caused a major decline in production.

Large oil sand projects are necessary to achieve economies of scale. The problem is that when such projects go through maintenance, they significantly reduce production.

Government-mandated curtailment has slowed the growth of oil sand production. However, the impact on prices and companies is subject to debate. The mismatch between production growth and pipeline expansion prompted the government to intervene. The irony here is that if the industry had been integrated, we would not have had this problem. But governments do not like such integration since it creates powerful companies.

STORY OF THE DAY

BLOOMBERG: Europe Forced to Pay Up for Oil Like Russia’s as Options Run Low

Summary:

Bloomberg reported today that refiners in Europe "are having to pay bumper premiums for denser barrels from the Middle East following big price hikes for cargoes being shipped next month."

According to the report, Iraq's OSP of Basrah Medium to Europe for June was set at its highest in over a year, while Saudi Arabia has also hiked prices of heavier oil heading to Europe which is looking for grades similar to the banned Russian crude.

EOA’s Main Takeaway:

Crude quality matters! Europe is feeling the combined impact of crude quality because of sanctions on Russian oil, the OPEC+ cut that was announced in October, and later the voluntary cuts, the halt of crude exports from northern Iraq, and the possible loss of oil from South Sudan and Sudan. Europe’s problem is that there are no other sources to import medium to heavy sour crude from!

As for Saudi Arabia and its allies in the Gulf region, they have played the pricing game right by lowering prices to Asia and increasing them to Europe, knowing that Asian importers have other options, unlike Europe.

Finally, if Europe’s oil demand is increasing, US refineries will start feeling pressure since all US oil imports are medium and heavy sour.

In short, Europe’s current problem will affect price differentials, which might cross the Atlantic and affect US refiners. As a result, we may see a higher trade in petroleum products, especially distillates.

NEWS OF THE DAY

1- BLOOMBERG: OPEC+ Cuts Spark 75% Rout in Oil Supertanker Rates After Boom

Summary:

As of last Friday, ships moving 2 million barrels of Middle Eastern crude to China were making slightly under $24,000/day, a large decline from over $97,000 on March 20, Bloomberg wrote today citing data from Baltic Exchange. The report attributed this drop in earnings to the recent OPEC+ voluntary output cuts which went into effect last week.

"Benchmark rates for oil-carrying supertankers have collapsed by three-quarters as OPEC+ follows through on a surprise vow to slash supply to shore up prices, reducing volumes shipped across the world’s oceans," Bloomberg wrote.

EOA’s Main Takeaway:

There isn’t enough support for the claim that the OPEC+ cuts have caused the rout in tanker rates: