Daily Energy Report

Record for US oil production, Libya protests & oil field closures, Chesapeake/SW merger, LNG’s bright future, Iran captures tanker, Solar rival to China, Russia 2023 oil/gas, and more.

We would like to share with you two tweets:

The US imports about 10 kbd of Russian crude in november

US miles traveled are at record high

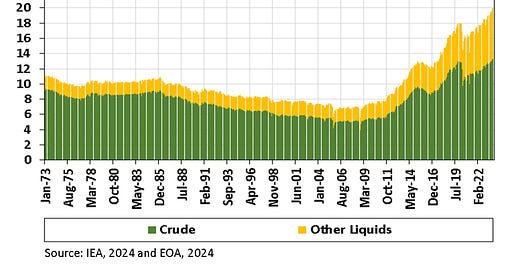

Chart of the Day: US Crude and Liquids Production at Record High

Summary

Figure (1) above shows US field production of total liquids. The green is crude. The orange is other liquids. The chart also shows how other liquids, mostly NGLs, increased after the shale revolution started and how they continue to increase as oil plays produced more gas and NGLs. The easiest way to remember the numbers is this: 13 and 7. The US produces about 13 mb/d of crude and condensates and about 7 mb/d of other liquids.

Since the above chart is about field production, it does not include biofuel liquids.

EOA’s Main Takeaways

US crude production increased by an average of 1 mb/d in 2023. However, December to December, production might have increased by 1.16 mb/d.

Liquids production was higher as shown in Figure (1) above. Looking at field production of liquids, the increase is about 1.4 mb/d. If all liquids are included, the increase is about 1.7 mb/d.

While total liquids production was higher than all forecasts made in December 2022, our estimates were the closest.

Story of the day

Reuters: Protestors in Libya Threaten to Shut Down Oil/Gas Facilities

Summary

Protesters in Libya are threatening to shut down the Mellitah complex and disrupt the Greenstream pipeline to Italy. They are demanding the removal of NOC's Chairman over alleged violations and calling for job creation and environmental protection. The capacity of protesters to close facilities remains uncertain, but they aim to halt operations at the Zawiya refinery, linked to the Sharara field.

EOA’s Main Takeaway

Unfortunately, Libya’s domestic politics and alliances have wreaked havoc on its oil sector. Any side can pressure the other by blocking the flow of oil because it is the only source of income. They use what hurts the most.

Attaqa published an article written by Ahmad Shawky, who is the director of the energy research unit and an expert in the oil market that focuses on recent events in Libya. The article is in Arabic. He stated that the three results from closing the EL Sharara field and any other fields:

1- Loss of Libyan oil production: about a third of its daily production. It led to a decline in exports. This, of course, inflicts great financial losses on the Libyan economy, especially since oil represents approximately 90% of the country’s total revenues.

2- The closure of this field leads to a local fuel crisis. The Zawiya refinery, which processes about 120,000 b/d, depends on crude from the field. This exacerbates the fuel shortage, which was originally one of the reasons for the outbreak of protests at the Sharara field. The negative impact extends to the cessation of the operation of the Ubari power station.

3- Closing the fields and then reopening them again might lead to technical problems. They also need maintenance. In the case of the Sharara field, the cost of this will be borne by the already exhausted state treasury.

4- The plan to increase production capacity to 2 mb/d may not materialize as international companies shy away. Financing would become difficult and more expensive.

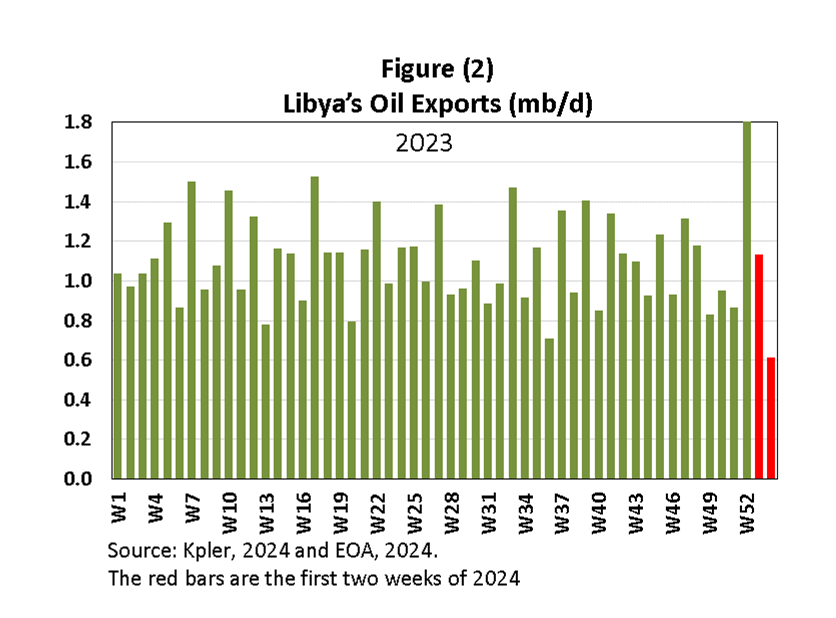

Figure (2) below shows Libyan oil exports in 2023 and the first two weeks of 2024. It shows how exports declined recently because of the closure of the Sharara field. Exports will decline further if other fields and export facilities are closed. Most Libyan oil is exported to Italy, Spain, and France. The US imports from Libya occasionally. The loss of some of the Libyan oil is supporting oil prices. However, there is enough evidence that once the oil production of a country becomes volatile and is under constant threat, traders will discount the role of that oil in the market. In a sense, they assume a minimum amount will come to the market. If production goes below that amount, prices will react, otherwise, any production losses above that minimum will have a limited impact.

News of the Day

WSJ: Chesapeake, Southwestern Merge as New Gas Behemoth

Summary

Chesapeake Energy and Southwestern Energy have agreed to a $7.4 billion all-stock merger, creating one of the US’s largest natural gas producers. The merged entity, with a market cap over $17 billion, positions the US as a major LNG exporter. This merger is part of a trend encouraging energy companies to scale up, following other large deals in the sector.

Bloomberg: Big Spending Cements LNG in Energy Mix for Decades

Summary

The global LNG industry is set to grow significantly, with over $235 billion invested in projects since 2019 and an additional $55 billion expected by 2025. This expansion is projected to increase LNG export capacity by 70% by decade's end. The investment reflects a belief that LNG will continue to be in demand, particularly as Europe seeks alternatives to Russian gas and Asia transitions from coal.

EOA’s Main Takeaway

Let us not forget that all the Permian deals were promoted as oil deals, but they are gas deals, too. The Permian is a major gas producer, and it feeds some of the LNG plants in Texas. This deal is more gas focused, something that should have happened 8-9 years ago. The implications are straight forward: