Daily Energy Report

China oil inventories, US crude production, Why oil is below $100, Oil price for 2024, China export quota, Red Sea protections, Russia diesel exports, Refining boosts gasoline, and more.

Chart of the Day: China’s Oil Inventories have been Rising

Summary

Figure (1) above shows China’s total inventories (Commercial and SPR) in 2023. After rising to near record levels in the summer, they declined by more than 60 mb, then started rising again to the current level of 958 mb.

EOA’s Main Takeaway

China surprised us twice this year and forced us to change our outlook for the second half of 2023. The first surprise was the build in inventories by more than 70 mb in the late spring and summer of 2023. We were expecting a decline. The decline after that was expected and we highlighted that in our reports. The build toward the end of the year was NOT expected.

While the build in inventories was caused by lower-than-expected economic growth, other factors were in play, too. The first build was caused by cheap Iranian crude and the liquidation of Iranian floating storage, in addition to some cheap Russian crude. Some political analysts attribute the build to tension with the US over Taiwan (We do not believe it). The recent build is caused mostly by the limited export quota and the refusal of the government to increase them.

The problem is that such a build will cast its shadow in 2024 balances, especially in the first quarter.

Story of the Day

EIA: US Crude Production is Virtually Flat in October

Summary

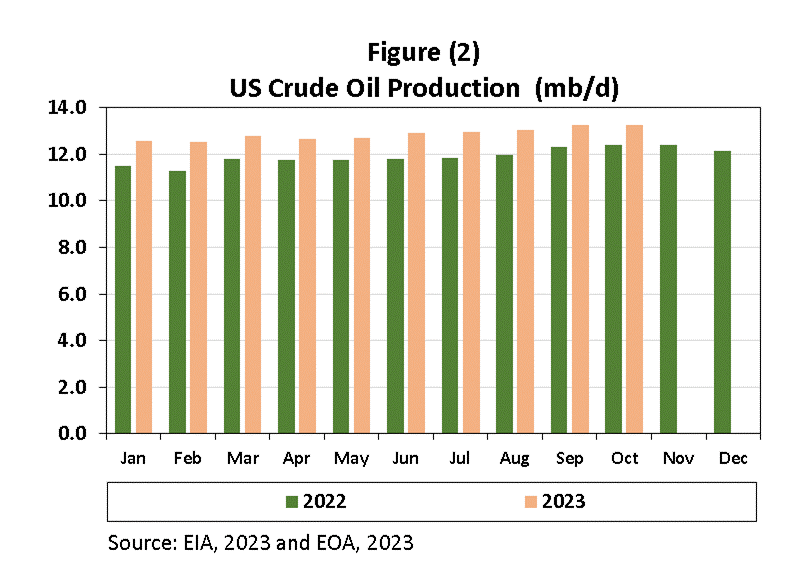

The EIA reported today that USA October crude oil production stood at 13.248 mb/d as shown in Figure (2) below. This is lower than that of September by only 4 kb/d. Most of the decline came from the Gulf of Mexico (-40 kb/d) and North Dakota (-30 kb/d). But production increased everywhere else.

EOA’s Main Takeaway

Those who have been preaching for months that US shale production has peaked are in for another surprise: Crude production increased in all tight plays except in North Dakota where it declined by about 30 kb/d from the previous month’s level. Production in Texas reached a record high. Production in New Mexico recovered to a near record high. Production increased in Colorado and Wyoming while it was virtually flat in Oklahoma. Tight oil production increased by about 20 kb/d!

News of the Day

Bloomberg: Russia Plans to Boost Key Diesel Exports by 1/5th in Jan

Summary

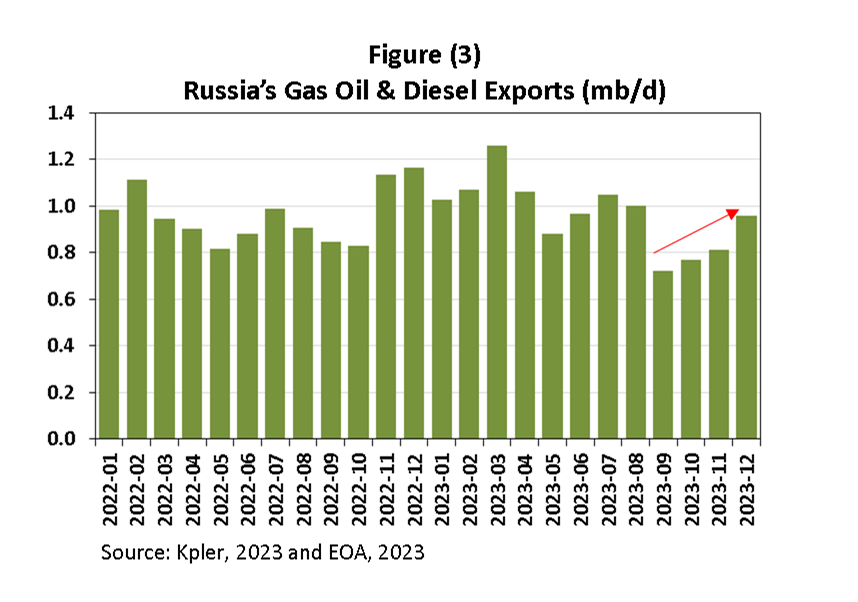

Russia is set to increase diesel exports from its western ports by 18% in January compared to December. The export plan includes diesel delivered to three ports via pipeline, and additional smaller volumes may be transported by rail. Notably, while the export of summer-grade diesel is permitted, winter-grade diesel can only be exported if transported to ports by pipeline, and refiners are required to retain at least half of their output domestically.

EOA’s Main Takeaway

This increase is a continuation of the upward trend since the government lifted the export ban as shown in Figure (3) below. The increase in exports will bring back an export level similar to that of January 2023. This should ease any concerns about diesel shortages this winter. Some of these shipments might end up in Brazil.

Baker Hughes: US Oil-Directed Rig Count Increased by 2

Summary

US oil-directed rig count increased by 2 to 500 while the gas-directed rig count remained flat at 120. Companies added two rigs in teh Permian and one in teh Gulf of Mexico. The number of oil rigs declined by 1 in the Eagle Ford. The oil-directed rig count in tight oil plays increased by 1 to 422 as shown in Figure (4) below.

EOA’s Main Takeaway

We expect the rig count to increase in teh first quarter of 2024. While most of the action will be in the Permian, the one play to watch is the Williston.

WSJ: Why Oil Prices Never Surged to $100 this Year

Summary

The stabilization of oil and gasoline prices this year has been influenced by US strategic actions and oil production. Despite predictions of surging oil prices due to the Russia-Ukraine conflict, the US implemented a price-cap on Russian oil, mitigating revenue losses while maintaining supply flow. Additionally, leniency on sanctions allowed Iran to boost exports. The U.S. prioritized preventing market shortages, contributing to lower gasoline prices and reduced inflation. With record-breaking oil production at an average of 12.9 million barrels per day, the US undercut OPEC's production cuts.

EOA’s Main Takeaway

The WSJ story contains several mistakes and ignored the main reasons for the failure of the forecasts.