Daily Energy Report

Russia’s oil exports, Mid-East diesel exports, Gazprom’s loss, EU truck emissions fantasy, EU gas dependency, Biden’s China tariffs, EU’s ban on Russia LNG, and more.

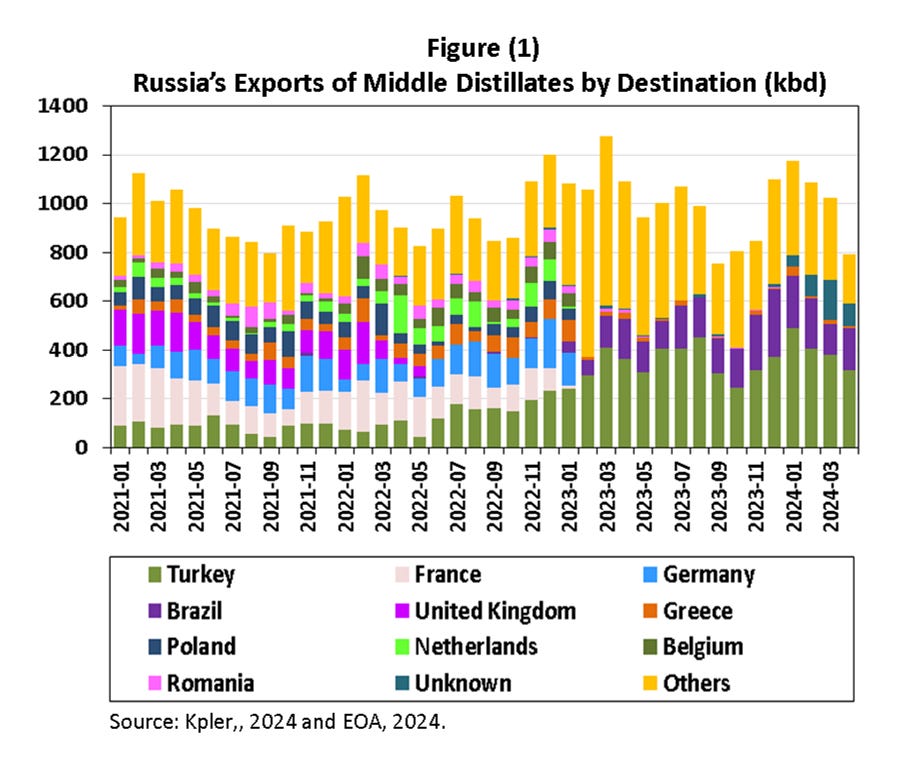

Chart of the day: Russian Oil Trading Partners Changed, But...!

Summary

Figure (1) above shows the Russian exports of middle distillates by destination since the beginning of 2021. It shows how the destinations changed after the G7/EU imposed sanctions on the exports of Russian petroleum products in February 2023. It also shows a decline in exports in recent months because of Ukrainian drone attacks on Russian refineries, maintenance, a ban, then a government-mandated reduction in exports.

EOA’s Main Takeaway

The above chart was inspired by a report from the EIA entitled: Russia’s Seaborne Diesel Trading Partners Shifted After Feb 2023 Sanctions.

We understand that the EIA is trying to be apolitical, but if it wants to tackle these subjects, it should at least mention how those who banned Russian petroleum products are getting them anyway. Yes, the chart above and the EIA chart in the link shows a change in trading partners, but the EU and the US are importing diesel and other products through a third country either directly or indirectly after refining Russian crude. Turkey’s middle distillate exports to Europe increased from less than 20 kb/d before the Russian invasion, to about 140 kb/d in 2023. India’s exports of middle distillates to Europe increased from about 80 kb/d to about 350 kb/d. China did not export any middle distillates to Europe. There was a time in 2022 when its exports exceeded 200 kb/d. South Korea’s exports to Europe in 2023 were double those in 2021!

Story of the Day

S&P Global: Middle East Diesel Exports to Europe Rise to 10-Month High as Russia Mostly Stays Away

Summary

Diesel exports from the Middle East to Europe hit a 10-month high in April. Saudi Arabia was the main supplier, contributing 260,000 b/d. Meanwhile, Russian diesel exports amounted to 788,000 b/d, primarily directed to Turkey, Brazil, and several African nations. The surge in Middle Eastern diesel exports follows the EU's ban on Russian oil products. Forecasts suggest a recovery in the latter half of the year due to improving economic conditions.

EOA’s Main Takeaway

The story misses the main point.