Daily Energy Report

US crude production up, OPEC+ meeting delay, Black Sea storm, OPEC-IEA emissions clash, China growth challenge, Alberta defies Trudeau, NGOs sue Norway, and more.

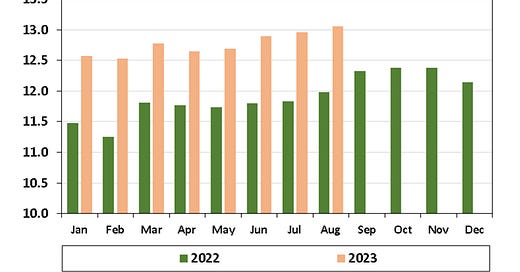

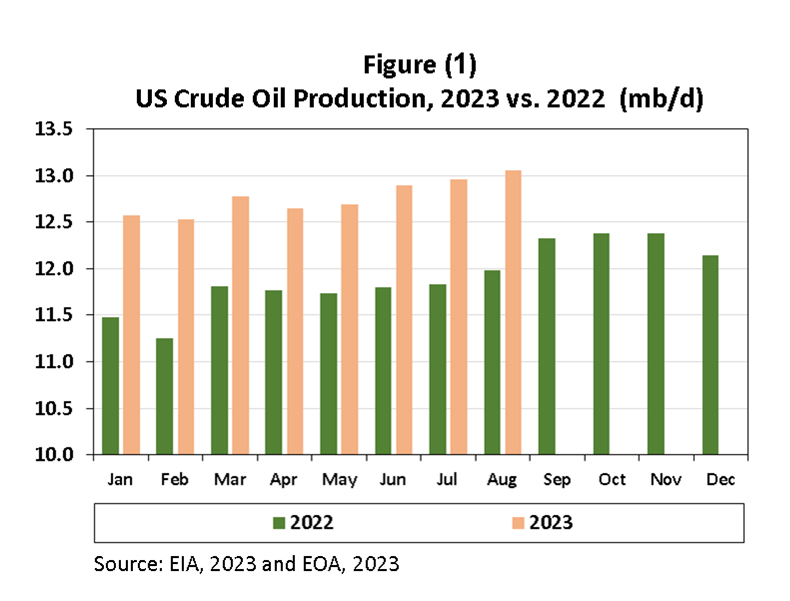

Chart of the Day: US Crude Production Increases by more than 1 mb/d in 2023

Summary

Figure (1) above compares US crude oil production in 2023 to that of 2022. Production in 2023 is not higher but has been increasing in the first eight months. It reached a record high of slightly above 13 mb/d.

EOA’s Main Takeaway

In our EOA 2023 Oil Market Outlook that we published in early January, we predicted that US crude oil production would increase by 1.2 mb/d. Some pundits criticized our prediction and some even made fun of us. They claimed that US crude oil production peaked at the end of 2022 or early 2023.

Now we have the data to show that our forecast was close to actual number. Looking at various monthly forecasts and scenarios for the remaining four months, we will end the year with production growth of 1 mb/d to 1.2 mb/d (December to December or average 2023 relative to average 2022).

Story of the Day

Argus: OPEC+ Meeting Delay Points to Unresolved Issues

Summary

OPEC+ ministers postponed their meeting from November 26 to the end of the month. Central to the talks is Saudi Arabia's view that additional measures are needed to support the market in 2023. The efficacy of any cuts depends on improved adherence to production targets within OPEC+. Overproduction has been an issue, with some members, notably Iraq, exceeding their quotas. Better compliance could effectively result in a near 500,000 b/d cut. There's a collective inclination towards further reductions, which would require equitable distribution of the reduction burden among OPEC+ members.

EOA’s Main Takeaway

The unresolved issues have always been there. We believe that a few other factors are contributing to the delay. We will discuss them in detail tonight at 8 PM US CT in a stream on the X platform, Spaces. Please join us. Here is the link:

OPEC+ and the potential for a price war or a bigger cut?

News of the Day

Reuters: Black Sea storm disrupts Russian and Kazakh oil exports

Summary

A severe storm in the Black Sea has disrupted oil exports from Kazakhstan and Russia, affecting up to 2 million barrels per day. Kazakhstan's output from its largest oilfields is reduced by 56%. Russian companies are rerouting exports to Baltic ports, while Kazakhstan, with fewer export alternatives, faces further output declines. This will contribute to lower November and December oil production forecasts for Kazakhstan, though still above their OPEC+ quota.

EOA’s Main Takeaway