Daily Energy Report

Russian oil in the US, Toyota and electric vehicles, Russian gas exports, Turkey's energy ambitions, roadmaps for reducing carbon emissions, Russia-Iran energy ties, and more

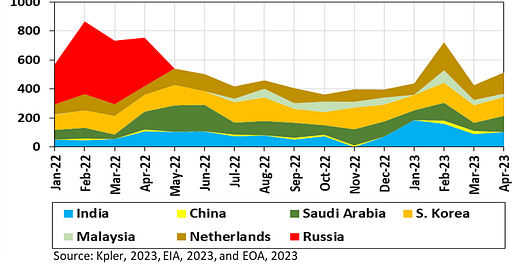

CHART OF THE DAY: The US is importing Russian oil… indirectly!

Commentary

Figure (1) above shows US imports of petroleum products from countries that are importing Russian crude and products. These countries are involved in either refining Russian crude then exporting the products derived from it, or directly re-exporting Russian oil products. It also shows how imports of Russian petroleum products came to an abrupt halt when President Biden banned such imports last year. The main exporters of petroleum products to the US, however, are not included in the chart, and these are Canada and Mexico.

We recommend that new readers read about “oil laundering” before reading the section below: Russia Sanctions and the Rise of “Oil Laundering”

EOA’s Main Takeaway:

The US is receiving Russian oil! This is taking place through importing petroleum products made from Russian crude oil and via exporters that are involved in “laundering” Russian oil. Probably the term “laundering” is not accurate because such shipments are legal under current sanctions; as long as the crude goes through a major transformation, the EU and the US can import it.

There are cases where the US is not importing products made from Russian oil, but is instead importing oil cargoes swapped with shipments of Russian oil products. For example, an oil-producing country can import 100,000 barrels per day (b/d) of Russian diesel to be used in its domestic market and export 100,000 b/d to the US (or to the EU for that matter).

US imports of petroleum products from India were at a record high in the first quarter of 2023. Imports from Saudi Arabia are double of what they were before the Russian invasion of Ukraine. Imports from the Netherlands in April are three times the imports in the fourth quarter of 2022.

The impact of this development is significant. Russia has been able to market its steeply discounted crude and oil products, changing global trades and the oil market in general. For example, the increase in US imports of petroleum products from countries that “launder” Russian oil came at the expense of many countries in Europe and Latin America.

Other countries, meanwhile, have benefitted from discounted Russian oil. For example, some OPEC oil producers have been importing Russian crude and products at cheap prices while cutting their own production—which they can sell at higher prices in the future. And for this reason, we would like to point out that the expected tightness of the market in the summer months— due to the increased power burn— may not happen if OPEC members end up importing Russian fuel oil and other products for electricity generation.

STORY OF THE DAY

AUSTRALIAN ASSOCIATED PRESS: Toyota Australia executive says it’s too early for electric vehicles to replace nation’s cars

Summary:

In what was deemed controversial comments, Toyota Australia sales and marketing chief Sean Hanley has said that it is “too early” to replace all cars with electric vehicles. Hanley’s remarks came less than two weeks after the federal government launched its national electric vehicle strategy, the Australian Associated Press reported.

“If we just move to only zero-emission vehicles, what are you going to tell the hundreds of thousands, if not millions of Australians who tow caravans, who use their cars for work, who need their cars on the land, who need their cars in the mine, who need more than a 200 or 300km range?….. What battery electric vehicle do we have right now on sale in Australia that can tow 2.5 tonnes for 600km? We don’t. It doesn’t exist,” Hanley was quoted as saying.

Environment and EV groups criticized the Toyota executive, saying his statements were made because of Toyota’s delay in launching its electric models, according to the report.

EOA’s Main Takeaway:

There is no surprise here since Toyota has held this view for years now, and it is among the latecomers to the market of electric vehicles.

Our view is that the argument of the Toyota executive is outdated. Toyota announced recently that it is committed to electric vehicles, and that it is going to produce several models.

Nonetheless, Toyota needs to up its game since it hasn’t been able to market the hydrogen vehicle until now, and the new renewable fuel—which was introduced at a show at the Toyota North American Headquarters last month, and which we covered in our Weekly Newsletter— is still in its infancy.

NEWS OF THE DAY

1- REUTERS: Russia's April gas exports to Europe up 7.5% from March, calculations show

Summary:

Reuters reported today that based on its own calculations, daily Russian piped gas by Gazprom to Europe increased by around 7.5% from March, mostly due to a rise in transit through Turkey. Average daily pipeline exports rose to 75.6 million cubic meters (mcm) from 70.3 mcm in March.

Reuters relied on data from the European gas transmission group Entsog and Gazprom's daily reports on its transit via Ukraine.

EOA’s Main Takeaway:

We predicted this in our Weekly Newsletter on April 17. We told readers that according to the EOA’s calculations for March 2023, and based on data from the European gas transmission platform (Entsog), the Kremlin-controlled Gazprom shipped 2.11 bcm of gas to Europe (including Ukraine) via Ukrainian territories and the TurkStream pipeline through Turkey, an uptick of 22% month-on-month (m-o-m). However, this figure was sharply down from 10.1 bcm in March of last year.

To assess the success of European efforts to shift away from Russian gas, the EOA issues a monthly tracker for the EU external gas supplies through pipelines from Russia, Azerbaijan, Norway, and North Africa (Algeria and Libya), as well as LNG cargoes from the global market. This tracker aims to highlight EU gas supply changes and the extent to which the bloc has managed to reduce its reliance on Moscow. We encourage readers to subscribe to our Weekly Newsletter here.

2- DAILY SABAH: Turkey Discovers Oil and launch the Largest Solar Farm in Europe

Summary

Turkish President Recep Tayyip Erdogan announced that his country has discovered "high-quality petroleum with a daily production capacity of 100,000 barrels", the Daily Sabah reported, as he officially inaugurated what has been dubbed "Europe’s biggest solar power plant built on a single site and one of the five largest in the world."

The Kalyon Karapınar Solar Power Plant is in the central province of Konya and reportedly has an installed capacity of 1,350 megawatts, according to the Daily Sabah,

"More than 3.2 million solar panels at the facility are to generate 3 million kilowatt-hours of electricity annually, enough to provide power to 2 million people and prevent the use of $450 million of fossil fuel equivalent resources," the newspaper said.

EOA’s Main Takeaway: