Daily Energy Report

US elections & energy, Alberta oil production, Saudis set Arab Crude OSP, Cheap Iranian oil at risk, South Korea adds storage, US shale drillers risk supply glut, Cobalt miners gloomy, & more.

US Elections

If the Republicans end up controlling all three houses, the likelihood of repealing the Inflation Reduction Act, or parts of it, is very high. Repealing parts of it will cause a sea change in the energy markets, especially in two areas: electric vehicles and offshore wind. The impact is global and not only limited to the US. While the Trump Administration will emphasize US energy supremacy, it will also focus on lowering energy prices. It remains to be seen how companies and the oil producing countries will react to lower oil prices. If Trump delivers on his promise that he will end the wars in Ukraine and the Middle East, oil prices will decline.

We believe that President Trump will not enforce sanctions on Iran unless he gets guarantees from some OPEC members that they will compensate for the decline in Iran’s oil exports. Those countries might give lip service to such a request to avoid lower oil prices.

Finally, if Trump’s election creates a positive sentiment in the market in the coming months, we will see an increase in US demand for oil and gas.

Related News:

Bloomberg: Green Energy Stocks Sink as Trump Wins US Election

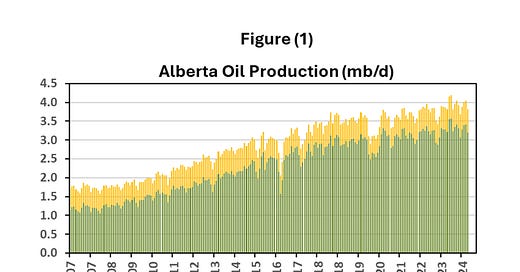

Chart of the Day: Alberta Oil Production Grew 4.4% YoY

Summary

Figure (1) shows trends in Alberta’s crude oil production since 2007. Production increased at a very high rate until 2018, then continued to rise, but at a lower rate. In the first nine months of 2024 production increased by 4.4%, or 166 kb/d, YoY. Production reached 4.043 mb/d in August but declined to 3.819 mb/d in September.