Daily Energy Report

Saudi petroleum product imports, Shale no brake on $100 oil, Kremlin & Russian oil, OPEC+ cuts drive crude price, Grid batteries, Net Zero roadmap, and more.

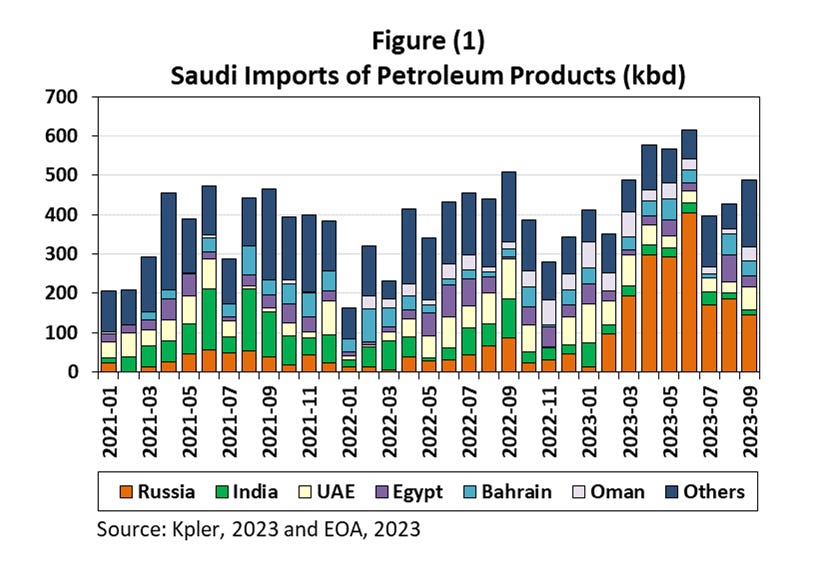

Chart of the Day: Saudi Imports of Petroleum Products

Summary

Figure (1) above shows the trend of Saudi imports of petroleum products (both clean and dirty) from various countries. It shows that these imports increased in 2023, especially from Russia.

However, imports from Russia declined in the last three months.

EOA’s Main Takeaway

This is to emphasize our point that: Production does not matter, NET exports do. The decision of buying from Russia is not political, it is economic. By the cheap oil now and conserve your own resources to sell later at a higher price.

Story of the Day

Bloomberg: China Considers Charging Users to Compensate Utilities for Building Coal-Fired Power

Summary

China is weighing compensation for utilities to cover the costs of their coal-fired power infrastructures. Compensation would come from capacity fees charged to power users on top of their usual electricity consumption rates. These charges are slated to begin in 2023 for industrial and commercial users. A significant portion of the coal generation may remain underutilized, acting merely as a backup for renewable energy sources.

EOA’s Main Takeaway

The percentage of electricity generated from coal in China was 61% as shown in Figure (2) below. China has a serious pollution problem in its cities and wants to reduce it regardless of climate change and regardless of cooperation with other countries.

However, China is teaching Europe and the US a lesson: Renewables need baseload backup, and that backup has a price! Also, the price has to be paid by consumers! Suddenly, renewables are priced higher to reflect market reality. Many Western nations still think they can get around energy reality and not build baseload power, while they continue to provide subsidies that are not reflected in the price of electricity generated from wind and solar. The end results are continuous warnings of power shortages, actual power shortages, and skyrocketing power and natural gas prices.

News of the Day

Bloomberg: Record US Shale Production is No Brake on $100 Oil

Summary

US oil production is projected to reach a record high of over 13 million barrels a day in the fourth quarter, doubling its level from a decade ago. Despite this significant increase, gasoline prices have surged, with a 7% rise since July, averaging $3.85 per gallon. While the US boosts its shale production, OPEC continues to dominate the market, especially with global demand hitting 103 million barrels a day.

EOA’s Main Takeaway

No one will argue that oil is the main input to produce gasoline, but in many circumstances, gasoline prices increase without an increase in crude prices. Crude oil is one thing, gasoline is another. We have discussed several times in the past how US refining capacity declined in the US instead of expanding because of various environmental laws, federal, and state. We also talked about the record mechanical failures at refineries. They are getting old, and maintenance is becoming more expensive than ever.

Wall Street Journal: Kremlin’s Latest Battle is with Russia’s Oil Companies

Summary

Russia is facing domestic fuel shortages, causing tensions with its oil companies. In response to rising fuel prices, the government banned diesel and gasoline exports, decreasing domestic prices but increasing global diesel costs. As a result, executives at Rosneft Oil, connected to President Putin, were ousted. Rosneft recently saw an unusual rate of high-level staff changes, attributed by the company to improving efficiency.

EOA’s Main Takeaway

The government reduced subsidies and prices of diesel and gasoline increased. However, shortages raised prices further. When the export ban was imposed, prices declined by 10%, but they remained higher than before because of a reduction in subsidies.

Gasoline and diesel prices have been politicized in the US for decades. We should not be surprised if they are politicized in Russia. The only difference is that the US does not have a national oil company while the companies in Russia are under the control of the Kremlin. It is only natural to use them for achieving political goals inside and outside the country. The problem for officials of Russian oil companies is that they know very well that the companies can make way more money selling overseas than inside the country. But company officials are one thing, and politicians are something else! One wants to make more profit, the other wants political stability.

EIA: OPEC+ Production Cuts Drive up Sour Crude Oil Price Around World

Summary

OPEC+ production cuts are reducing the global supply of medium and heavy sour crude oils, leading to a price increase for these grades compared to sweet crude oils. This shift upends the usual pricing trend where light, sweet crude oils, being less expensive to refine, command higher prices. Crude oil production in key regions has dropped to some of the lowest levels in recent years.

EOA’s Main Takeaway

This is just a summary of what has been going on for a while. But OPEC+ is NOT the only one to blame: The pipeline from Kurdistan, Iraq, to the Ceyhan port in Turkey remained shut in. Venezuela did not deliver, and production in the Gulf of Mexico declined because of maintenance and then a hurricane. Meanwhile, US exports of light sweet crude remain elevated while others are also increasing exports of the same grades.

Wall Street Journal: Giant Batteries Helped US Power Grid Eke Through Summer

Summary

The U.S. power grid has turned to large batteries to help manage demand during summer heatwaves. These batteries are crucial during sunset hours when solar energy diminishes but power demands, like air conditioning, remain high. Texas has benefited from battery discharge in the evenings when solar and wind generation dip. Tax incentives have boosted the battery market. Texas has projects amounting to nearly 60% of the grid's capacity.

EOA’s Main Takeaway

Notice the use of the “tax incentives” states are using to build these expensive batteries that will need to be replaced much sooner than traditional baseload power sources. Hiding the true cost of wind, solar, and batteries makes it easier to increase the share of these technologies in the electricity market. However, troubles will inevitably cascade as these expensive and unreliable technologies fail in the mid and longer term. Regardless, the role of batteries in the Texas grid was very small. See chart and a table from ERCOT below:

IEA: Net Zero Roadmap

Summary

While climate change effects are escalating, scientific alarms regarding current trajectories are more dire. CO2 emissions from energy hit a peak of 37 Gt in 2022, surpassing pre-pandemic figures. However, with the rapid adoption of clean energy technologies, emissions are predicted to peak this decade, causing demand for coal, oil, and natural gas to decline. Still, these developments aren't sufficient for the 1.5 °C target.

EOA’s Main Takeaway

The issue is how to balance energy security with environmental security. Europe taught us last year a very important lesson: Without energy security, you cannot achieve your climate goals. To be clear, the issue is not climate change, the issues are the policies adopted to fight climate change. The retreat of the UK, Germany, and Sweden, in addition to the European oil majors and companies like Lego, tells us that energy security, which requires oil and gas, is essential to our lives. The chance of dramatically reducing our reliance on fossil fuels by 2050 or even 2100 is small to nonexistent. More than anything else, the executive summary of this report reads like a political document designed to protect policymakers who continue to push policies that are extremely expensive, counterproductive, and misaligned with the needs of the people.