Daily Energy Report

China's dependence on Russian gas, Nigerian gasoline demand falling, Oil price forecast, Saudi-Israel deal, Safer tanker offloaded, Russia oil price cap, India gorges on Russian oil, and more.

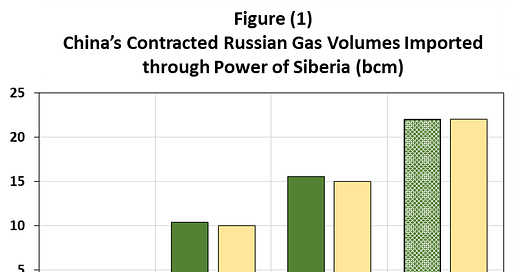

Chart of the Day: China’s increased dependence on Russian gas

Summary

Figure (1) above shows China’s imports of Russian gas via pipeline, the Power of Siberia. In four years China’s imports from Russia via Power of Siberia pipeline more than quadrupled to about 22 bcm per year.

EOA’s Main Takeaway

China’s dependence on Russian gas is increasing. In addition, Russia has already found alternative markets for most of its gas. The Power of Siberia natural gas pipeline is the second most important source of gas to China after its domestic production. It transports gas from Russia. The pipeline became fully operational last December after a new gas-condensate field came into operation, and following the completion of a new pipe section. The system upgrading will enable Russia to increase its gas shipments to 22 bcm per year, from 15.5 bcm in 2021, an increase of 42% year-on-year (Figure 2). The pipeline is expected to reach its design capacity of 38 bcm per year by 2027. That said, China has become a significant market for Russian gas as Moscow is no longer a key gas supplier for the EU market where it has lost its shares due to Western sanctions. Russia’s top gas producer, Gazprom, wants to boost its gas shipments to China, and to this end, it has struck a number of gas deals with the Asian energy giant to compensate for its lost gas share in the European market.

The question now is: What are the market and political implications of this Russian-Chinese interdependence in natural gas?

Story of the Day

S&P Global: Plunging Nigerian fuel demand shuts longstanding European arbitrage

Summary

Gasoline demand in Nigeria has halved since the scrapping of the country's fuel subsidy in May, leading to a drop in imports from 205,200 b/d to 106,000 b/d in July. This has impacted European refiners, although they have found other markets, such as the US Atlantic Coast, to make up for the loss. The removal of the subsidy could save Nigeria $2.6 billion in 2023.