DAILY ENERGY REPORT

Saudi economic growth, offshore oil spending, Germany’s imports of Kazakh oil, Texas power grid amid heat wave, US diesel prices, China’s imports of Iranian oil, and more

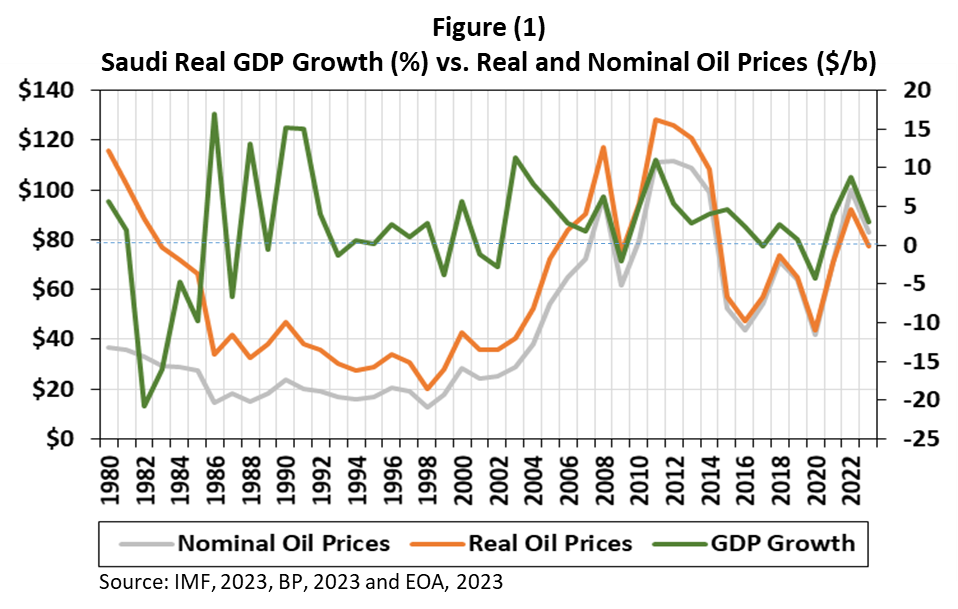

CHART OF THE DAY: Saudi Economic Growth Remains Sensitive to Oil Prices

Summary:

Figure (1) above shows Saudi real GDP growth versus nominal and real oil prices.

Saudi Arabia’s economy remains sensitive to oil prices despite diversification efforts.

EOA’s Main Takeaway:

Although economic growth in Saudi Arabia remains sensitive to oil prices, the impact of lower oil prices on the economy is way lower than what the kingdom experienced in the mid-1980s. Looking at periods of collapse in oil prices— 1981-1982, 1985-1986, 1998-1999, 2015, and 2020— shows us that the current impact is way lower than the impact in the 1980s. Economic diversification and stronger fiscal policies have played a significant role in mitigating the impact of low oil prices.

STORY OF THE DAY

REUTERS: Offshore oil spending to rise more than 20% this year - SLB

Summary:

Oilfield services firm SLB said today that offshore oil and gas exploration spending will rise more than 20% globally in 2023, Reuters reported.

"Offshore is experiencing a renaissance, with significant breadth and anticipated durability," Reuters quoted SLB Chief Executive, Olivier Le Peuch, as saying at a conference.

EOA’s Main Takeaway:

This is music to our ears. Since December 2022, we have been telling our readers that we are bullish on offshore drilling and activities. And we remain so.

NEWS OF THE DAY

1- REUTERS: Fire halts oil output at Equinor's Gina Krog oil platform

Summary:

Output was halted today at Equinor's Gina Krog oil platform in the North Sea due to a fire incident, Reuters reported. The fire has been extinguished, but the impact remains unclear.

EOA’s Main Takeaway: