Daily Energy Report

Saudi oil exports from ports on Red Sea, Reaction to OPEC & US Fed decisions, Russia gasoline/diesel exports, LNG deals boom, US coal exports, China energy/economy, Wind output exaggerated, & more.

Chart of the Day: Saudi oil exports from ports on the Red Sea are increasing

Summary

As the Houthis attack ships and tankers in the Gulf of Aden near Bab El-Mandeb, ships and tankers were diverted, some stopped, others paid the high insurance premiums and higher wages. One development was taking place quietly, but expected as we discussed in Spaces and Podcasts: Saudi Arabia increased its exports from the west, avoiding Bab El-Mandeb completely. Figure (1) above shows the increase oil exports in recent weeks as reported by Kpler.

EOA’s Main Takeaway

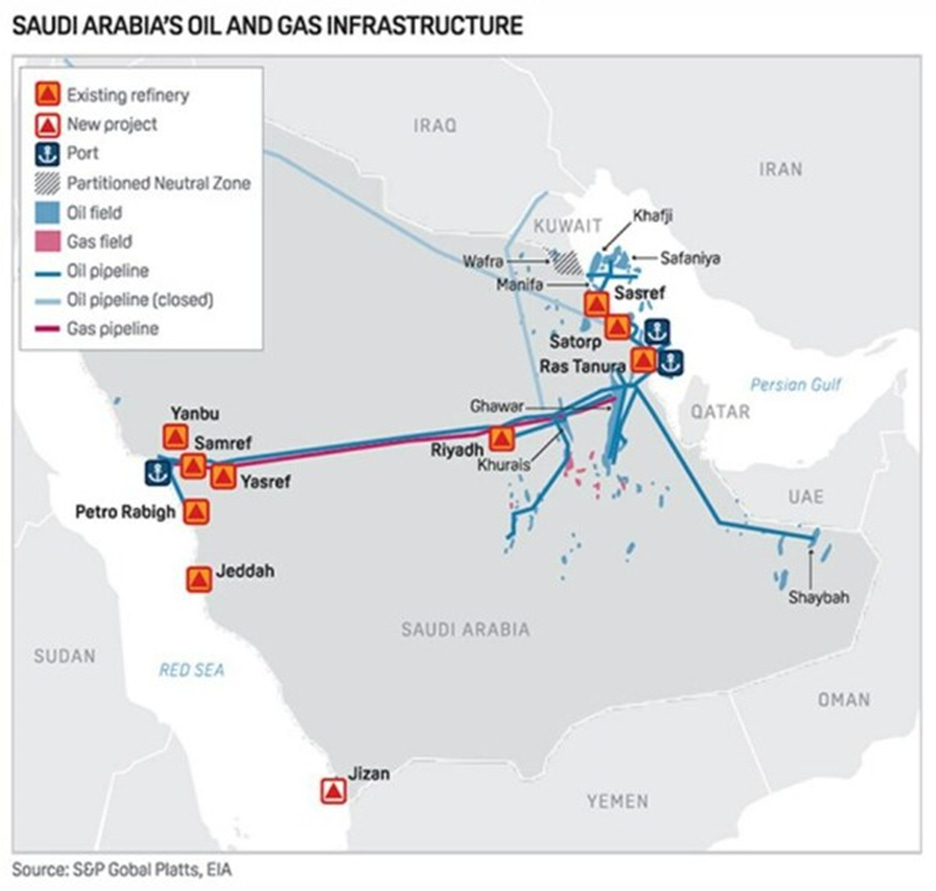

East-West pipelines were built to avoid the Hormuz Strait and the problems that were created by the 8-year Iraq-Iran war (See map below). It is an ironic twist of history to see their advantage to avoid Bab El-Mandeb Strait!

The exports from the western ports are both crude and products. While most products are going to Europe, some are going to other destinations, including the US. We will not be surprised if total exports of crude and products increase to 4 mb/d.

Another historic twist: Despite the severity of the situation, only the Saudis can do things in the oil market that others cannot! While other countries and companies divert ships, the Saudis just pump more oil into their own pipelines. Ships leaving Yanbu on the western coast pay lower insurance premiums than others because they do not go through dangerous areas!

Story of the Day

CNBC: Oil Falls as Market Digests OPEC, Fed Decisions

Bloomberg: OPEC+ Sticks with Oil Production Cutbacks for First Quarter

Reuters: OPEC Oil Output Falls in January on New Cuts, Libya – Survey

Summary

U.S. crude oil prices dropped suddenly with the West Texas Intermediate (WTI) for March down 2.02% and Brent for April down 1.97%. This fall occurred despite an earlier increase due to reactions from an OPEC committee meeting and the Federal Reserve’s interest rate decision. The OPEC committee confirmed adherence to production cuts, maintaining a reduction of 2.2 mb/d this quarter. January saw OPEC's oil output significantly decline, the largest monthly drop since July. OPEC pledged an additional 900,000 barrels per day cut for Q1 amid slowing demand growth. Meanwhile, the Federal Reserve held interest rates steady, suggesting they’ve peaked, and hinted that March rate cuts are unlikely, which typically boosts oil demand.