Daily Energy Report

US gasoline prices, Venezuela’s stuck tankers, $100 oil call, Refinery closure risk, Oil Giants CCS in SE Asia, Russia Navy enters Red Sea, Japan LNG growth, and more.

Note: There will not be a Daily Energy Report tomorrow, as the US markets will be closed in observance of Good Friday.

News of the Day: No, Gasoline Prices have Not Risen Faster than Usual this Year

Summary

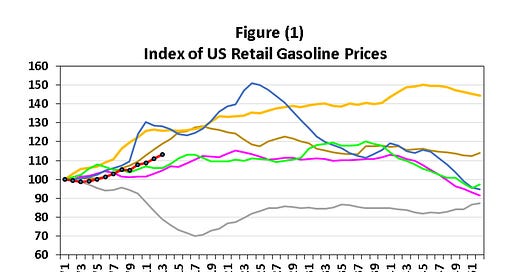

Figure (1) above is an index of US retail gasoline prices where prices are compared year over year since 2018. It shows that gasoline prices have been steadily increasing in 2024, something we have seen in 2019, 2021, and in 2022. The importance of the chart is that it shows you where gasoline prices stand today relative to previous years. However, the index is based on nominal values and not adjusted for inflation.

EOA’s Main Takeaway

This chart is in response to a story by the WSJ entitled: WSJ: Why Gasoline Prices are Rising Faster than Usual this Year

This story states that gasoline prices in the US have increased early in 2024, exceeding typical seasonal rises due to extreme weather and geopolitical events. The national average gas is $3.54 per gallon, a 14% jump from the beginning of 2024. Fuel prices are expected to continue rising, influenced by OPEC+ production cuts and refinery disruptions due to winter storms in the U.S. and Ukrainian drone strikes on Russian refineries, benefiting shares of operational refiners.

But the data, as shown in Figure (1), shows otherwise. Gasoline prices increased at higher rates in 2019, 2021, and 2022.

Story of the Day

Bloomberg: Tankers Booked for Venezuelan Oil Have Now Been Stuck for Months

Summary

A group of oil tankers slated to load oil from Venezuela have been stationary off its coast, causing complications for traders involved in the country's oil market since the easing of sanctions. Four supertankers have been delayed since December. As a result, these ships are accumulating high demurrage costs, potentially amounting to millions of dollars, as waiting fees can exceed $100,000 per day.

EOA’s Main Takeaway

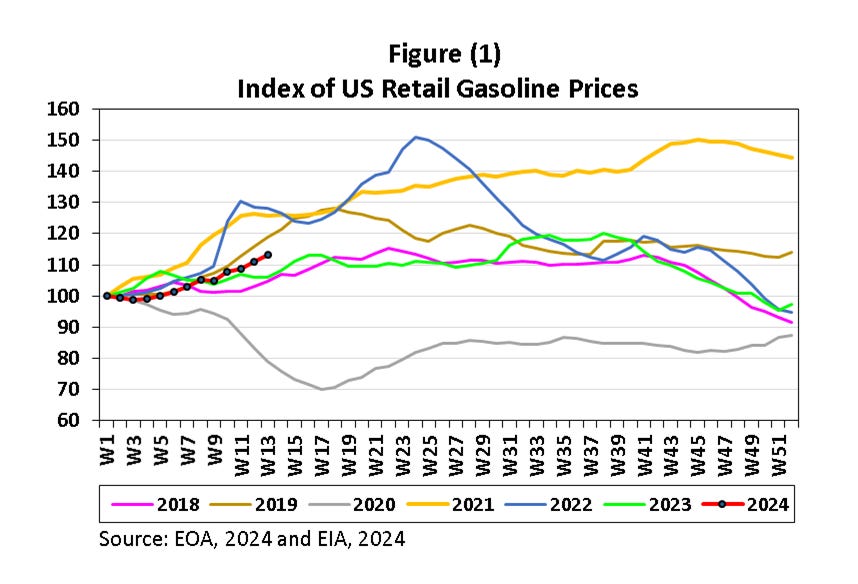

We were working on US crude imports from Venezuela when the story above came out. For starters, alluding to 8 mb in the story should only be to reference the capacity of the tankers, not to convey a message regarding supplies or the impact of sanctions. Back to the main issue, Figure (2) below shows US crude oil imports from Venezuela. Direct imports were halted after former President Trump imposed sanctions on Venezuela. Imports in recent months were the result of President Biden’s relaxation of sanctions.