Daily Energy Report

Gabon oil exports, EU power mix, Russia & oil cuts, Saudis to hold cut, Qatar’s slow LNG start, US offshore wind bid, Asia (China) solar panels, PetroChina refining surge, China diesel exports & more

No paywall today. Check out today’s report free of charge. We hope that we will see you on the paid subscribers list!

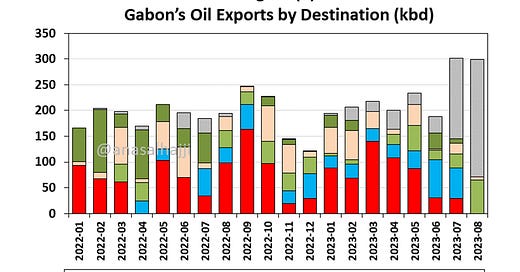

Chart of the Day: Who is affected if Gabon halts its oil exports?

Summary

Immediately after announcing that President Ali Bongo had won a third term, a military coup took place this morning.

Gabon is an oil producer and an OPEC member. Its oil production was receovering nicely despite OPEC cuts. Its production exceeded 210,000 b/d in July.

Figure (1) above shows Gabon’s oil exports by destination. In case of a halt of exports, it is easy to know who is affected. As illustrated in the chart, Gabon has no steady customers except China. However, China did not import any oil from Gabon in July!

After losing oil imports from Kurdistan, Israel replaced some shipments from Gabon. If Gabon’s oil exports stop, it will be the second source of oil that Israel loses within 5 months.

EOA’s Main Takeaway

The impact on world oil balances and prices is limited, if any.

Israel is the most affected country if exports are halted.

Looking at crude quality at the tightness in medium crudes, a halt in exports might affect price differentials as additional quantities of medium crude are lost.

For additional details, click here.

Story of the day

Reuters: Fossil Fuels’ Share in EU Power Mix Hits New Low

Summary

In the first half of the year, fossil fuels accounted for only 33% of the EU's power, marking the lowest percentage since 1990. The decline is attributed to reduced electricity demand, allowing renewables to cover a greater portion of the demand. Factors such as milder weather, policies reducing consumption, and high gas and power prices due to decreased Russian gas deliveries to Europe have led to a decrease in energy usage.

EOA’s Main Takeaway

This is one of the most biased stories we have seen in more than a week. The countries in question are suffering from a recession. All research and data from around the world show that electricity consumption declines with a recession. The story talks about a major decline in electricity consumption but never mentions the word recession. By avoiding the word “recession,’ they give two impressions: 1. renewables are doing the job and, 2. demand for fossil fuel is declining.

The fact is, renewables are maxed out. With a decline in electricity consumption, it is only logical for their share to increase. It is only logical that once Europe is out of a recession, the recovery in electricity consumption will come mostly from fossil fuels!

News of the Day

Bloomberg: Russia is the Big Winner From OPEC+ Output Cuts

Summary

Russia benefits significantly from the OPEC+ production cutbacks. Major OPEC+ members, led by Saudi Arabia, have been decreasing their oil output since May to elevate prices. Russia, initially delaying its promise to reduce oil output due to Western sanctions and export price caps, joined the Saudis in cutting shipments in July. Saudi Arabia has borne most of the reduction responsibility, cutting 1.22 million barrels daily since February, which is over twice the reduction Russia has made.

EOA’s Main Takeaway

This is a clickbait story. They all benefit by producing less and getting more for each barrel exported. Saudi Arabia has always carried the burden of other members in the last 40 years. Here is one fact that is not mentioned in the article: Between March and August, Russian crude exports declined by 1.5 mb/d as shown in Figure (2) below.

Bloomberg: Saudi Arabia Expected to Prolong Oil Cut Again, Survey Shows

Summary

Saudi Arabia is likely to extend its 1 million-barrel oil supply cut into October to support prices amidst economic concerns in China. Despite rising oil prices earlier this month, economic challenges in China, including youth unemployment and property sector issues, have affected the rally. A recent Bloomberg survey indicates most analysts expect the Saudis to continue the cut.

EOA’s Main Takeaway

This is the general sentiment in the market. If they do not extend the cut, oil prices will decline by several dollars. It is clear that the Saudis were ahead of the curve when they decided to cut and extend the cut on a month-by-month basis. However, remains to be seen if the cut will be the same 1 mb/d or a different number. We will not be surprised if the cut is higher or lower than 1 mb/d.

S&P Global: Qatar Sees Slow Start to Sale of LNG Supply

Summary

Qatar faces challenges in selling its newly-built 48 million mt/year LNG production capacity, as buyers seek more flexible contract terms. So far, only 11.8 million mt/year have been signed, as per S&P Global Commodity Insights. Despite European nations showing interest in Qatari LNG post-Russia's invasion of Ukraine, only Germany has finalized a supply deal.

EOA’s Main Takeaway (UPDATE)

We have discussed this issue several times before and before others. We also discussed the difficulties and opportunities. Below are links to reports on the topic and a chart extracted from a previous report:

The Implications of Qatar’s New LNG Deal with Bangladesh

Germany-Qatar LNG Deal: Implications for Qatar and Europe (The third section of the report)

Reuters: US Offshore Wind Sector Faces Key Test After Weak Gulf Auction

Summary

The first-ever auction for offshore industrial wind development rights in the Gulf of Mexico saw low interest, posing a challenge to President Biden's green energy goals. Despite the administration's emphasis on offshore wind as a key to combating climate change, only one $5.6 million bid was received for a vast tract off Louisiana. Two other leases got no bids.

EOA’s Main Takeaway (UPDATE)

We covered this topic on Monday. We talked about the challenges and we said this explains why some people are talking about green hydrogen instead of electricity. Now we know the results. The challenges are confirmed. The talk about green hydrogen is probably hot air.

Bloomberg: Rosneft CEO Decries Russia Oil-Output Cuts

Summary

Rosneft CEO Igor Sechin stated that intermittent oil-output cuts in Russia since 2017 have hindered Rosneft's growth potential. Despite this, the company remains dedicated to the current output reductions, in line with Russia's collaboration with OPEC. Rosneft's liquid production decreased by 2.2% in the second quarter. Sechin has consistently opposed Russia's cooperation with OPEC since 2017.

EOA’s Main Takeaway

Nothing new. He always did -since 2017.

EIA: Solar Panel Shipments Set Record High in 2022

Summary

In 2022, U.S. solar photovoltaic panel shipments rose 10% from 2021, reaching a new record of 31.7 million kWp. These shipments reflect the ongoing growth of solar capacity in the U.S. While there's a gap between when panels are shipped and installed, the majority of the shipped panels (88%) in 2022 were imported, mainly from Asia.

EOA’s Main Takeaway

Notice they said Asia and did not say China. This avoids the multiyear investigation showing Chinese companies sending their solar panels through third countries to avoid tariffs. So the question is: Who should be bragging, the US or China?

Reuters: PetroChina Reports Record Interim Net Profit on Refining Surge

Summary

PetroChina reported a record net profit of 85.3 billion yuan ($11.70 billion) for the first half of the year, a 4.5% increase from the previous year. The gain was fueled by higher oil and gas output and a rebound in refined fuel sales. Despite a 21.7% drop in realized crude oil prices to $74.15 per barrel and an 8.3% decline in total revenue to 1.48 trillion yuan, the company's total crude oil and natural gas output grew by 5.8% to 893.8 million barrels.

EOA’s Main Takeaway

Notice that while the European and US oil majors reported a decline in profit, Petro China reported a record net profit. Context matters. Last year China was in lockdown and everything was down. At the same time, Chinese companies were buying cheap discounted oil from Russia and Iran. In addition, Chinese companies benefited from buying the cheap discounted oil, refining it, and then resending the products to Europe at world prices.

Reuters: China Diesel Exports seen Rising to over 1 MLN Tons in September

Summary

Chinese refiners are set to increase diesel exports in September to over 1 million metric tons due to attractive overseas selling margins and anticipated additional export quotas from Beijing. September's estimated diesel exports from China range from 1.1 million to 1.2 million metric tons, a significant rise from the 650,000 to 887,000 tons recorded in August.

EOA’s Main Takeaway

When diesel cracks are this high, any refiner with spare refining capacity would increase utilization, let alone Chinese refiners. However, the level of diesel exports remains way lower than the levels in the fourth quarter of last year as shown in Figure (4) below. As we discussed in a previous report, we will not see similar levels of exports. These high exports took place because of the lockdowns.

On another front, unlike the conclusion of the story that this increase will ease the tight diesel market, the increase will compensate for the decline in Russian exports:

Russia’s Diesel, Fuel Exports Poised for August Slump as Refineries Undergo Work

EIA: Crude Oil Inventories Declined by 10.6 mb

Summary

The EIA reported today that commercial crude inventories declined by 10.6 mb, to 422.9 mb.

Gasoline inventories decreased by 0.2 mb/d to 217.4. Distillate inventories increased by 1.2 mb to 117.9 mb.

Crude oil imports declined by 0.316 mb/d last week to 6.617 mb/d. Crude oil exports increased by 0.270 mb/d to 4.528 mb/d.

US demand for overall petroleum products increased last week by 0.265 mb/d to 21.429 mb/d (Figure 5). US oil demand remains robust relative to recent years.

EOA’s Main Takeaway

We are only 24 mb away from a critical point with inventories going below 400 mb. If demand continues to be as strong as it has been in teh last months, imports must increase and inventories will decrease.

The adjustment remains low. Either the problem is fixed or the number is fixed.

Other News

Reuters: Japan Plans Subsidies to Curb Record Gasoline Prices

Above the Law: Vietnamese Electric Automaker Vinfast Soars In Value, Then Stock Price Plunges In Wild Trading