DAILY ENERGY REPORT

Lithium production, US crude output, oil-directed rig count, China’s hydrogen projects, drastic changes in energy transition plans, nuclear energy in Europe, US SPR, and more

CHART OF THE DAY: Lithium Production is Highly Concentrated

Summary:

Figure (1) above shows lithium production by country in 2022. Australia was the largest producer of lithium in the world (47%), followed by Chile (30), China (14%), Argentina (5%), Brazil (2.2%), and the US (0.7%). The rest was small production in Zimbabwe, Portugal, and other countries.

EOA’s Main Takeaway:

About 90% of global lithium in 2022 was produced in three countries: Australia, Chile, and China. What is not highlighted, however, is the fact that most of the processing has been taking place in China.

All the minerals needed for energy transition are highly concentrated in certain countries and in terms of reserves, production, and processing, but these don’t include Europe or the US which have been trying to take action on climate change.

Energy transition carries with it some national security concerns. In the US, the Biden administration is aware of these, particularly when it comes to imports of metals from China, which are needed for manufacturing EV batteries for instance. Although it has been trying to address this problem by developing lithium mines in the US, the Biden administration has been facing opposition from environmental groups campaigning against mining.

We believe that once governments realize the full-scale implications of their dependence on other countries for some vital metals, the energy transition will slow to a trickle. This in its turn will lead to higher demand for oil and gas than earlier forecasts.

For more on the national security implications, we encourage readers to read this article by our own Dr. Anas Alhajji.

STORY OF THE DAY:

EIA Reports Decline in US Crude Oil Production in April

Summary:

The US Energy Information Administration (EIA) reported today a decline in US crude oil production by 102,000 b/d to 12.613 mb/d. However, total US petroleum production (crude and NGLs) reached a record high near 19 mb/d!

EOA’s Main Takeaway:

Almost all the decline came from the Gulf of Mexico and not from the tight oil plays. Production in the Gulf of Mexico declined by 138,000 b/d, from 1.872 mb/d in March to 1.734 mb/d in April. Tight oil production, meanwhile, increased in New Mexico and North Dakota while it was virtually flat in Texas. The net increase was by about 35,000 b/d.

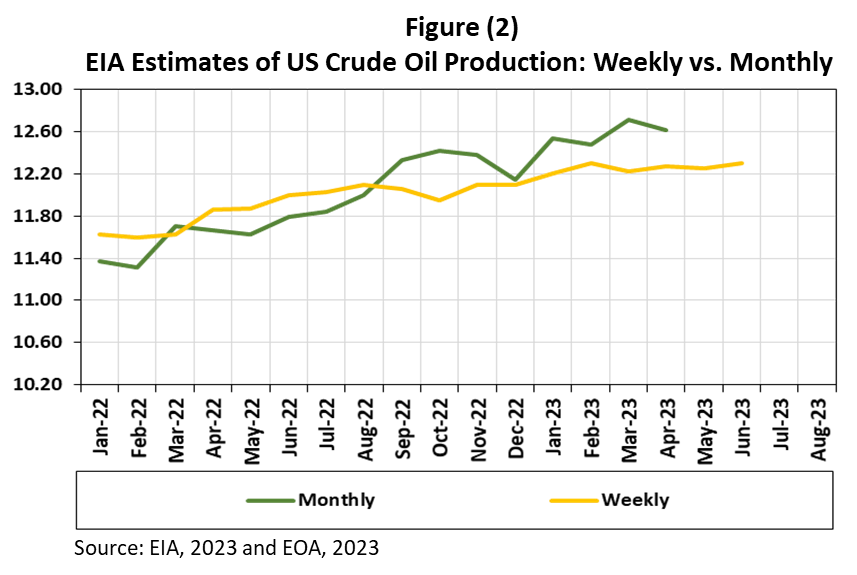

It is clear that the EIA has a problem with its model. It is not only that the weekly adjustment numbers are large, but production estimates are way off as shown in Figure (2). Actual production is way higher than what is estimated by the EIA model.

On another front, companies have continued to revert to lower API production. That means the net increase in actual crude below 45 API increased by more than 35,000 b/d.

The fact that US liquid production increased to the highest level on record while crude is still struggling supports our view that we have discussed a few times in the past: production was gasier. The large number of DUCs before COVID-19 existed because the areas or the zones contained a high percentage of gas and NGLs.

NEWS OF THE DAY

1- DEPARTMENT OF ENERGY: Contracts finalized for the purchase of 3.2 mb for SPR Refill

Summary:

The US Department of Energy (DOE) today finalized contracts for the purchase of 3.2 mb from four companies to be delivered in September, according to a statement. The DOE announced earlier this month that 3.1 mb will be delivered in August, bringing the total to 6.3 mb.

EOA’s Main Takeaway: