Daily Energy Report

The decline in Nigeria’s LNG exports, China’s slowdown, US oil production in Permian and the Gulf of Mexico, Iran’s fuel smuggling and more

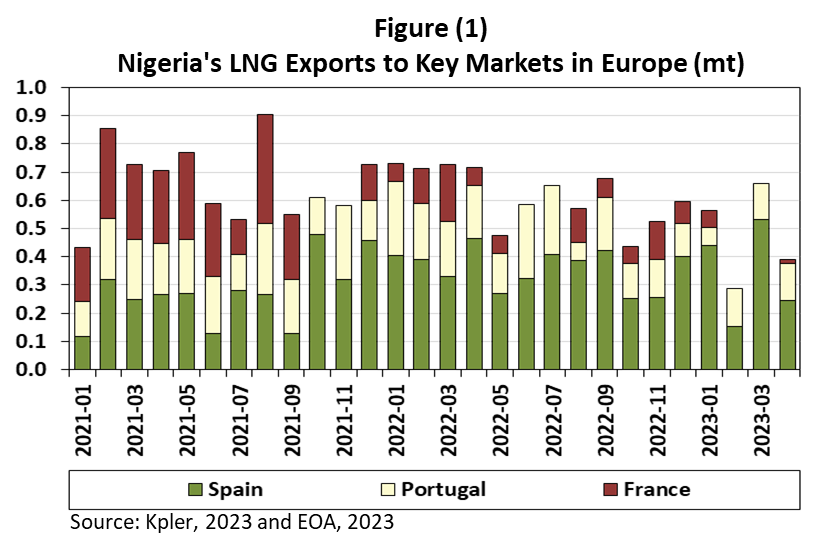

CHART OF THE DAY: The Decline in Nigeria’s LNG Exports

Commentary:

Figures from data intelligence firm Kpler show that during the first four months of this year, Nigeria exported an average of 1.15 million tons (mt) from the Nigeria LNG (NLNG) facility on Bonny Island compared to around 1.35 mt during the same period last year, and 1.5 mt in 2021 (Jan-April). The three top markets for Nigerian LNG between 2021 and 2023 so far have been Portugal, Spain, and France as shown in Figure (1) above.

EOA’s Main Takeaway:

The drop in Nigerian LNG so far this year compared to 2022 and 2021 is most likely due to the force majeure which NLNG declared on supplies from facilities in Bonny Island in October 2022 partly due to water flooding. Despite the force majeure, exports continued but not at normal levels. In March, the Natural Gas Intelligence said that LNG supplies from Africa’s key LNG exporter remained weak despite Europe’s growing demand for gas. “Nigeria once had a 10% share of the global LNG export market, but by 2021, the country’s market share had fallen to just 6%,” Natural Gas Intelligence wrote.

Nigeria is one of the Sub-Saharan African countries that are seeking to take advantage of Europe’s growing gas demand by attracting more foreign investments to tap their LNG potential. However, security and technical challenges need to be overcome so that Nigeria and the region in general can play a major role in the gas and LNG global markets. For more on this subject, we encourage readers to check today’s EOA Weekly Newsletter in which we discussed this topic in detail.

STORY OF THE DAY

REUTERS: China factory activity unexpectedly shrinks in April

Summary:

Citing official data, Reuters reported today that manufacturing activity in China "unexpectedly shrank" last month, noting that this change comes as the world has been expecting China's economy to rebound and boost global demand.

"The official manufacturing purchasing managers' index (PMI) declined to 49.2 from 51.9 in March," Reuters wrote based on data from the National Bureau of Statistics, saying this is less than the 50-point mark that separates monthly activity expansion and contraction.

EOA’s Main Takeaway:

We told readers on January 9 that most of the rebound in China’s oil demand in the first half of 2023 will be triggered by the transportation sector, and that it will take until the fourth quarter to see the rest of China’s economy recovering. We encourage readers to review the EOA 2023 Oil Market Outlook here.

NEWS OF THE DAY

1- REUTERS: As oil output peaks, US Gulf of Mexico makes room for carbon capture

Summary:

Oil production in the US Gulf of Mexico (GoM) is "heading towards its peak", Reuters reported, as the region turns into "a hot spot for burying greenhouse gases."

According to the report, companies, including Exxon Mobil Corp, have been leaving assets in the GoM, and going after "capturing and storing carbon dioxide and other greenhouse gases underground” instead.

Reuters cited some analysts as saying that the region could soon turn into a "contested ground for oil, carbon sequestration, and renewable energy."

EOA’s Main Takeaway: