Daily Energy Report

UK crude production continues to decline, UK wind/solar jobs, China oil demand slows, China coal demand flat, EU climate policy is in danger, Nickel rout, US LNG export license impact, and more.

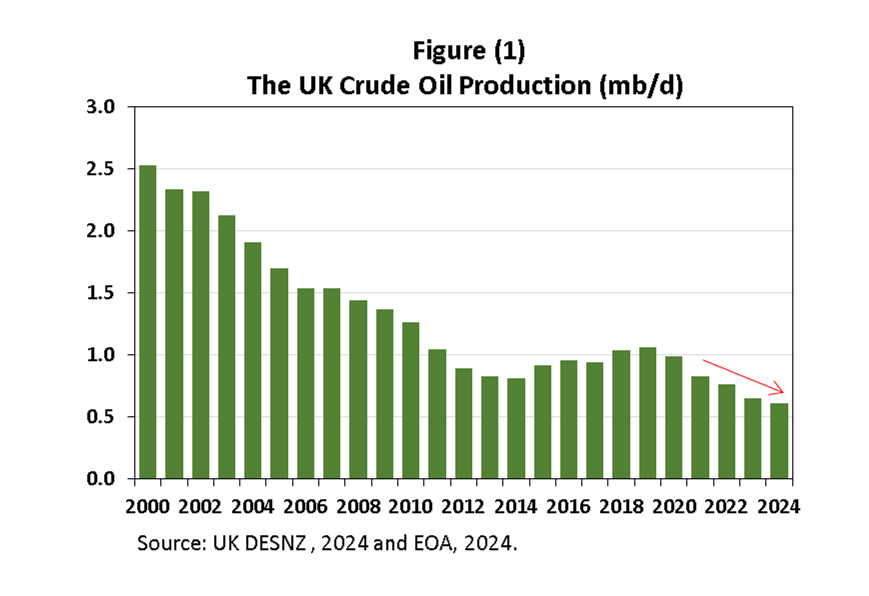

Chart of the Day: UK Crude Oil Production Continues to Decline

Summary

Figure (1) above shows the UK’s average yearly production of crude oil since 2000. The data for 2024 are our own estimate. The decline since 2000 amounted to about 2 mb/d!

EOA’s Main Takeaway

While production declined by a whopping 75% since 2000, mostly because of geological depletion issues, the decline in recent years was caused by COVID-19 and government policies. Production should have increased last year and this year, but the Windfall profits tax changed it to a decline.

Story of the Day

Global Witness: UK Renewables Jobs Up, Oil Jobs Down Since 2015

Summary

The UK's renewable energy sector has seen a 29% increase in jobs since 2015, now employing around 26,600 people. In contrast, the oil and gas industry lost 28% of its jobs during the same period, despite extensive spending by companies and government efforts to issue more licenses. Massive investments and tax cuts in the oil sector have not translated into job stability, unlike the renewable sector, which has grown despite reduced government support.

EOA’s Main Takeaway

While this is one side of the coin, let us look at the other side:

Contrary to the propaganda in this article, the oil and gas industry is being taxed heavily while the renewable energy industry is being subsidized. UK oil production declined by 75% since 2000 and by more than half since 2010 as shown in Figure (1) above. Imports tripled since 2010. Exports declined by 29% since the beginning of 2019! Energy bills have increased significantly since 2010: “Electricity prices increased for much of the last decade. Average bills were £769 in 2021 compared to £450 in 2010, a 36% real increase.” As energy prices increased, the government instated an energy price cap and provided subsidies to citizens. (These subsides are deceptive because the UK government hands out money with one hand while taking it from citizens in the future as debt—with interest.) The irony is that while the government imposed restrictions on oil and gas drilling as well as a windfall profits tax, most of the green jobs were subsidized!

So, when you see someone bragging about green jobs in the UK share the above paragraph with them!

News of the Day

Bloomberg: Chinese Oil Demand Entering Low Growth

Summary

China's oil demand growth is slowing due to the rise of EVs and LNG-powered trucks, which are expected to replace 10-12% of its gasoline and diesel consumption this year. However, the overall demand for crude will still grow, particularly from the petrochemical sector. This slowdown could influence global crude prices, even as China targets about 5% economic growth for the year. (See Figure 2)