Daily Energy Report

Israel oil imports from Kurdistan, Iraq oil exports from the north, India LNG, Aramco investment in China and more

CHART OF THE DAY

Figure (1)

Commentary:

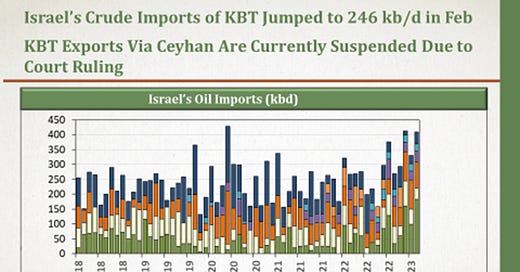

Figure (1) above shows Israel’s crude oil imports since January 2018 and how the majority of supplies have originated from the semi-autonomous Kurdistan Regional Government (KRG) in northern Iraq, followed by Kazakhstan and others.

The KRG exports the Kurdistan Blend (known as the KBT) via the Turkish port of Ceyhan. So far this month, Israel has imported around 167,000 barrels per day (b/d) of KBT, according to data intelligence firm Kpler. However, Iraqi crude oil exports (those exported by the federal government and the KRG) via Turkey came to a halt in the past few days after an international court of arbitration sided with the federal government of Iraq against Ankara for allowing crude oil to be exported by the KRG without Baghdad’s permission. This means that Israel won’t be able to import KBT crude until Baghdad and the KRG come to an agreement. Once a resolution is reached, it will be important to see which authority will market Kurdish oil. The two sides are currently holding talks, but it remains to be seen when exports will resume.

EOA’s Main Takeaway:

Although we believe that Iraqi crude oil exports via Ceyhan, which according to reports have been between 400,000 b/d-450,000 b/d, will resume soon, the situation remains fluid. Bloomberg reported today that Erbil and Baghdad have “failed” so far to agree on the resumption of oil exports from Ceyhan (more details in the Story of the Day below).

“Israel has been importing 40% of its crude from Iraqi Kurdistan ytd (year to date), up from 23% in 2022,” Homayoun Falakshahi, a senior commodity analyst at Kpler, told the EOA. Finding a replacement for Kurdish crude is unlikely to be an easy task mainly due to technical and political reasons.

“If exports resume under SOMO’s approval, we expect this trade to have effectively stopped. If they resume without SOMO’s approval, we could see more cargoes go dark and reappear near Ashkelon [in Israel],” Falakshahi said. When vessels go dark, they turn off their Automatic Identification System (AIS).

SOMO is the State Organization for Marketing of Oil in charge of federal Iraq’s crude oil sales. Officials in Baghdad have voiced their opposition to Kurdish crude oil exports to Israel. Last year, Iraq’s parliament passed a law that “criminalizes” the normalization and establishment of relations with Israel.

Although the chart above shows that Israel also imports crude oil from Azerbaijan, Kazakhstan, Nigeria, Brazil, and others, it is unlikely that KBT supplies will immediately be replaced by other grades. Falakshahi told the EOA that with respect to crude oil from Azerbaijan and Kazakhstan he “did not expect a significant uptick in their exports given a limited unused capacity from the first [Azerbaijan] and a discrepancy in oil quality vs KBT for the second [Kazakhstan].”

Israel can also turn to countries like Brazil and even the US, but again there are issues with prices, freight costs, and crude quality.

“Whatever the replacement for KBT, it is going to be costlier for Israel due to higher freight costs and a pricier crude compared to the KRG’s greatly discounted oil,” Falakshahi told the EOA.

STORY OF THE DAY

BLOOMBERG: Iraq Officials Fail to Agree on Restart of Turkey Oil Flows

Summary:

Officials from Iraq’s federal government and the KRG have “failed to agree on the resumption of around 400,000 barrels a day of oil exports” from Turkey’s Ceyhan port, Bloomberg reported citing sources familiar with the matter.

EOA’s Main Takeaway:

Although the situation remains fluid, it is in the interest of both Baghdad and Erbil to resume their crude oil exports via Turkey. According to Kpler, the last cargo of Iraqi oil departed the Turkish port of Ceyhan on Friday, March 24, and since that day there have been no loadings.

Falakshahi noted that this Iraqi development follows the 4-day disruption we saw in early February following the deadly and destructive earthquakes in Turkey and Syria, “although the level of exports strongly rebounded to average 558,000 b/d in the month (including Kirkuk), the highest level since December 2020.”

Our view is that the impact of Iraq’s latest developments on global oil markets is limited, and as Kpler notes “the loss of 480,000 b/d (average northern Iraqi crude exports over the past three months) represents some 0.5% of global oil supply and 1% of total seaborne oil exports.”

NEWS OF THE DAY

1- BLOOMBERG: India Considers Strategic LNG Reserve to Avoid Future Shortages

Summary:

“India is considering building a strategic reserve of liquefied natural gas to guard against future price spikes or supply shortages after last year’s energy crisis,” Bloomberg reported.

EOA’s Main Takeaway: