Daily Energy Report

OPEC+ production cut, Russian oil supplies, Urals prices and the price cap, electric vehicles in India, Africa’s renewable energy, biofuels, LNG, rig count, and more

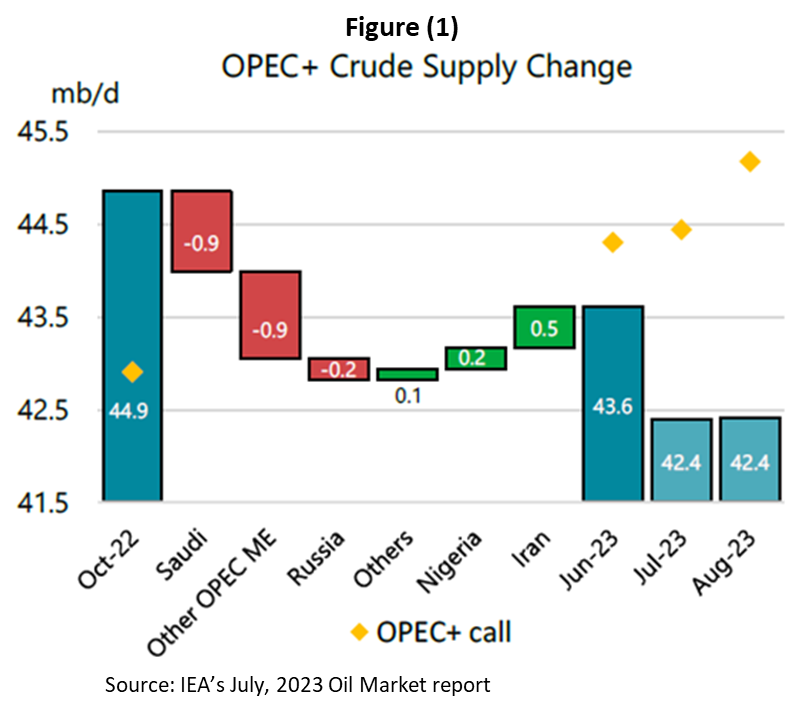

Chart of the Day: How bullish is OPEC+ cut?

Summary

Figure (1) above is extracted from the IEA’s July Oil Market Report, which was released yesterday. It shows OPEC+ crude oil production in October 2022 before the announced production cuts. Then it shows the cuts that have been made since then and the additions until June 2023. Saudi Arabia cut 900,000 b/d, the rest of OPEC in the Middle East cut another 900,000 b/d, and Russia cut only 200,000 b/d. Iran added 500,000 b/d, Nigeria 200,000 b/d, and the rest added about 100,000 b/d. The net cut between October 2022 and June 2023 is only 1.3 mb/d, according to the IEA, which includes the cuts agreed on in October and the voluntary cuts announced in March 2023.

After the additional voluntary cuts announced by Saudi Arabia, Russia, and Algeria last month for July and August, the IEA estimates OPEC+ production to be 42.4 mb/d in both July and August.

EOA’s Main Takeaway

We highlighted the call on OPEC vs announced cuts in previous reports: The call on OPEC, even by OPEC estimates, does not match the policy of the cuts. In other words, something has to give. Figure (1) is unique because it shows the call on OPEC+ (yellow diamond) but yields the same results that we reached: The call on OPEC or OPEC+ is way higher than production. The difference between the call on OPEC+ and actual production implies a large decline in inventories.

While we agree that the call on OPEC or OPEC + is higher than their respective production and we should see a draw in inventories, we think demand estimates by both the IEA and OPEC are exaggerated. We also think that some of what is counted as “demand,” especially in China, is going to inventories. That means the difference between the call on OPEC and actual production is lower than what is shown in the chart, and that inventory build will now be used to cover the difference later. This explains why we are bullish on oil in the second half of 2023, but we believe China will cap oil prices as it releases oil from its inventories.

Story of the Day: Russian Tax Reduction on Urals Exports

TELETRADER: Russian gov't proposes Urals tax discount reduction

Russian Deputy Finance Minister Alexei Sazanov announced that the government plans to reduce the tax discount on Urals oil from $25 to $20 starting September 1, 2023. This decision comes after the price of Russia's benchmark oil exceeded the G7 ceiling. Argus Media will stop providing CIF Urals oil quotes, which are used for calculating several taxes and duties beginning in 2024. Russia says it will switch to its own national price index to calculate these charges.

For background from February:

REUTERS: Putin signs law setting discount on Urals crude oil for tax

S&P GLOBAL: Russia to use Dated Brent in tax calculations to protect state budget from Urals discount

Summary

Russian President Vladimir Putin has signed a law adjusting the tax calculations on Urals crude oil to increase state revenue and mitigate the impact of lower oil prices on the national budget. The law adjusts the price assumptions Moscow uses for its multi-billion rouble tax levy on oil exports, in response to a widening budget deficit brought on by Western sanctions. The government expects this change to boost the budget by 600 billion roubles ($8.2 billion) this year. The new law sets the maximum tax discount for Russia's Urals blend compared to Brent crude at $34 a barrel in April, which will decrease monthly until it reaches $25 in July. In addition, the law includes a 1.1 billion rouble deduction in mineral extraction tax for hydrocarbons produced in the far-north Yamal region. This deduction aims to finance the development of infrastructure necessary for transporting liquid hydrocarbons produced in Yamal. The law is a part of Russia's broader plan to boost oil and gas production exports, particularly through the Northern Sea Route, to increase exports to Asia and offset dwindling supplies to Europe.

EOA’s Main Takeaway