Daily Energy Report

Japan power mix, Iran oil sanctions, Biden LNG moratorium, Japan coal, Red Sea diversion update, New Ukraine nuclear reactors, AI power drain, TMX to begin filling, US renewable stall, and more.

Chart of the Day: Is Japan Able to Diversify its Power Generation’s Energy Sources?

The News

EV Wind: Japan launches major offshore wind auctions

Japan Times: As Japan makes major investments in wind power, some residents are pushing back

Reuters: Japan's 2023 preliminary LNG imports down 8% to lowest in 14 years

Summary

Figure (1) above shows Japan’s sources of power generation for the month of September 2023, the latest data available. Almost 77% comes from thermal power, mostly coal and natural gas. The share of nuclear power is low because of the shutdown of reactors, but they are coming back online. The role of renewable energy is too small.

EOA’s Main Takeaway

Following the Fukushima disaster Japan decided to get rid of nuclear altogether, but now the Japanese understand they cannot survive without nuclear. The return of nuclear power plants should reduce the amount of coal used, reducing CO2 emissions, but it reduced LNG imports instead. Coal remains the cheaper choice. Now Japan is shifting to wind power, but it is facing two problems: stiff opposition from the local population and need for back up. The question is: what will happen to energy demand as Japan’s population continues to decline? A major decline in energy demand will enable Japan to reduce its coal use substantially.

Story of the Day

Bloomberg TV: Iran Oil Sanctions Are Working, Says Biden Adviser

Summary

Biden administration advisor, Amos Hochstein, touts the president’s policies on energy spending. He says the US needs more government subsidies to accelerate the energy transition. Hochstein claims the Biden administration is responsible for lowering gasoline prices. He also defends Biden sanctions policy, claiming they were successful in lower revenues for Russia and that Sanctions on Iran are working!

EOA’s Main Takeaway

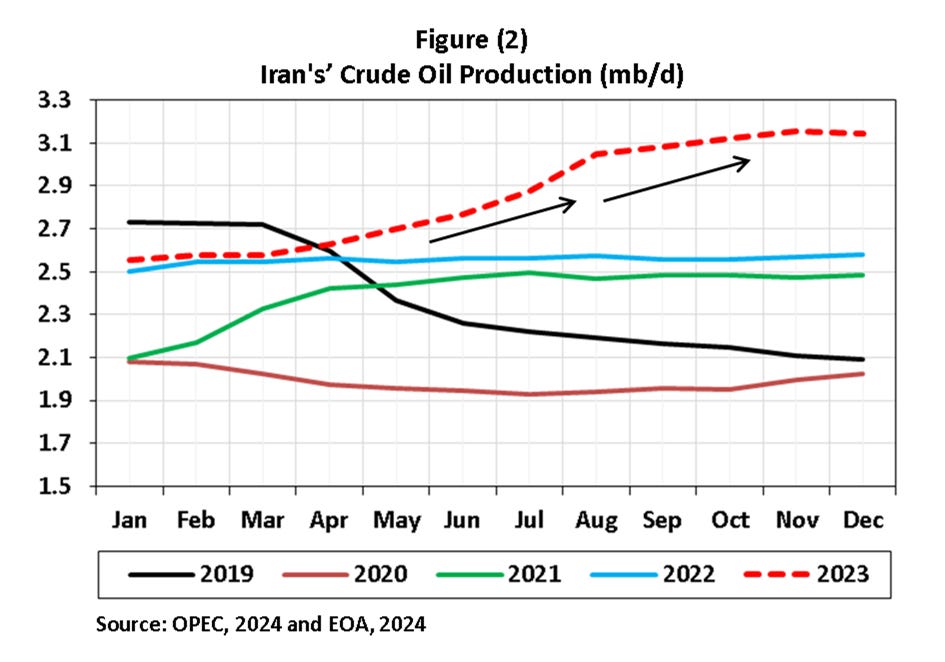

We reply to these comments with two charts and a link to an old report showing that Iran did pretty well during President Biden’s tenure:

More details: Iran’s Vanishing Floating Storage

News of the Day

Bloomberg: Biden Admin Ponders Moratorium on New LNG

Summary

The Biden administration is poised to announce measures that could impose tighter environmental scrutiny on natural gas export projects. The changes would likely delay significant LNG terminal developments in the Gulf Coast and elsewhere. The government is considering a deeper review process to evaluate the public interest and environmental impact of these projects, delaying approvals. Critics argue such a moratorium would disrupt the global energy market and undermine U.S. reliability as an LNG supplier.

EOA’s Main Takeaway

As we mentioned yesterday, LNG has become an integral part of US foreign policy and national security. However presidential election priorities might force President Biden to take actions that could delay a decision until after the elections or take a decision before the elections with a mild impact to satisfy his political base. Even a moratorium is expected to be short-lived.

Venture Global LNG posted the following:

"It appears that individuals within the White House are trying to force policymaking through leaks to the media. This continues to create uncertainty about whether our allies can rely on US LNG for their energy security. If this leaked report from anonymous White House sources is true, it appears the Administration may be putting a moratorium on the entire US LNG industry. Such an action would shock the global energy market, having the impact of an economic sanction, and send a devastating signal to our allies that they can no longer rely on the United States. The true irony is this policy would hurt the climate and lead to increased emissions as it would force the world to pivot to coal.”

Japan Today: King Coal Set to Lose Crown for Electricity Production: IEA

Summary

According to the IEA, by 2025, renewables, led by solar energy, are expected to overtake coal as the primary energy source for global electricity production. Renewables projected to account for more than a third of total production. Combined with nuclear energy, low-emission sources are set to generate nearly half the world's electricity by 2026. Despite a reliance on coal, particularly in China, the IEA anticipates a gradual decline in coal usage, with developing countries driving most future electricity demand increases.

EOA’s Main Takeaway