DAILY ENERGY REPORT

Saudi budget and oil prices, Texas vs. OPEC, US long-term oil and gas exports, US SPR, Russia’s oil exports, Chinese oil demand, and more

CHART OF THE DAY

Figure (1)

Texas Crude Oil Production Vs. OPEC Members (February 2023)

Source: OPEC, 2023, EIA, 2023 and EOA, 2023

Commentary

Figure (1) above shows crude oil production in Texas compared to the output in OPEC member states. If Texas were an oil-producing country and a member of OPEC, it would have been OPEC’s second-largest producer after Saudi Arabia, surpassing Iraq, the UAE, and Kuwait.

Texas is currently the third largest crude oil producer in the world after Saudi Arabia and Russia, and ahead of Canada and China. Texas produces more natural gas, exports more LNG, and has a higher refining capacity than any OPEC member state. It also has some of the world’s finest oil and LNG ports.

EOA’s Main Takeaway

Texas is a global powerhouse when it comes to energy. Yet, it is not receiving enough attention from Washington. Texas is what enabled the Federal Government to achieve its foreign policy goals: re-imposing sanctions on Iran, slapping sanctions on Venezuela, and helping Europe stand up to Russia’s Vladimir Putin. We are highlighting these facts in today’s Daily Energy Report because they are ignored by the mainstream media.

STORY OF THE DAY:

Summary:

EIA Annual Energy Outlook 2023: EIA projects that the US “will remain a net exporter of petroleum products and natural gas through 2050 in all cases”

In its Annual Energy Outlook (AEO) 2023, which addresses long-term energy trends in the US, the Energy Information Administration (EIA) expected US production to remain “historically high” due to growing finished product exports amid rising global demand. This will also keep US refinery runs strong as the local refinery sector stays competitive in the global market “through 2050 in all cases,” the EIA said. See Figures (1) and (2) below as published in the AEO report.

Figure (2)

Source: EIA, 2023

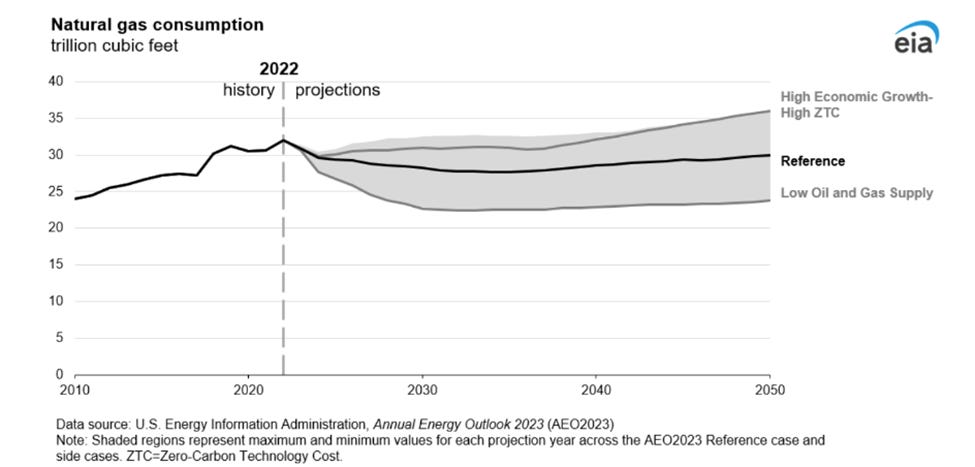

Moving to the gas sector, the EIA said in its AEO2023 report that domestic natural gas consumption will remain “relatively stable – ending recent growth in most cases,” this is despite the growing share of renewable sources and batteries in power generation. But the EIA notes that natural gas production will keep growing in some cases due to global LNG demand, “supported by associated natural gas produced along with crude oil.”

“Given the combination of relatively little growth in domestic consumption and continued growth in production, we project that the United States will remain a net exporter of petroleum products and natural gas through 2050 in all AEO2023 cases,” the EIA said.

Figure (3)

EOA’s Main Takeaway:

There is strong evidence to support the natural gas projection, but we doubt the EIA’s forecast regarding petroleum products. We believe that US production will be lower in the long run, while demand for petroleum products will likely be higher, leading to lower exports.

NEWS OF THE DAY

1- BLOOMBERG: Top Biden Adviser Says US Won’t Rush to Fill Petroleum Reserve

President Joe Biden “is still committed to replenishing the SPR after extraordinary draws last year,” US Special Presidential Coordinator for Global Infrastructure and Energy Security Amos Hochstein said in an interview on Bloomberg Television’s “Balance of Power”. “Nothing happens overnight. You have to decide that this is the right environment, so therefore you wait to see where the prices are going to be landing,” he added.

EOA’s Main Takeaway:

This is what our own Dr. Anas Alhajji predicted four months ago in a discussion about the role of the Strategic Petroleum Reserve (SPR) in the oil market and how the US and China will use it as a tool to manipulate oil prices as a reaction to OPEC+ production cuts. Readers can view the discussion here.

In short, the SPR still has about 370 million barrels (mb), which is more than enough to meet any emergency. Buying oil at high prices carries with it serious political risks.

Our view has been that the Biden Administration will not fill the SPR as long as WTI is above $40/b.

2- REUTERS: Russia's Urals crude supply to EU via southern Druzhba up q/q, sources say