Daily Energy Report

World oil demand all-time high, OPEC over/under production, EU gas via Ukraine, Wyoming rare earth find, US shale growth, Ireland’s data center power drain, Grid batteries, and more.

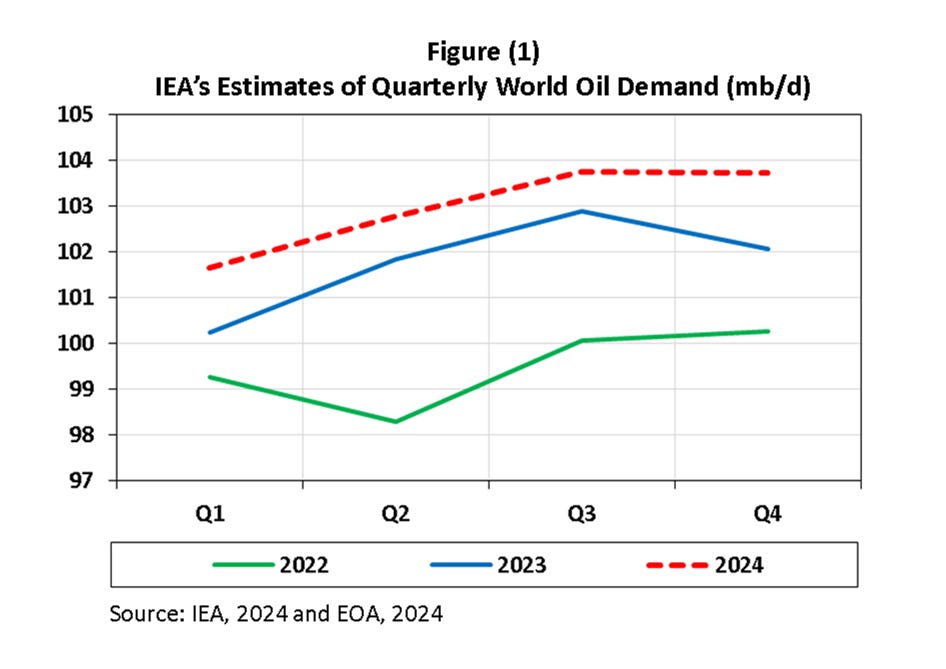

Chart of the Day: World Oil Demand to Hit All-Time High in 2024

Summary

Figure (1) above shows quarterly world demand estimates by the International Energy Agency (IEA) for 2022 and 2023. It also shows the Agency’s forecasts for 2024. The IEA expects oil demand to grow by 1.2 mb/d in 2024 above that of 2023 to reach an all-time yearly high of 102.98 mb/d.

EOA’s Main Takeaways

Global oil demand would grow by 1.22 mb/d in 2024 while non-OPEC production would grow by 1.6 mb/d, according to IEA’s Monthly Oil Report that was released earlier today.

The report emphasized the point that demand declined sharply in the fourth quarter of 2023. Mostly because of a decline in China. Our readers are familiar with this point before others: Our forecast for the fourth quarter failed because of lower expected demand growth in China. This issue is also related to what we covered in recent days: as oil prices rose, China’s oil imports declined and its inventories declined. China is using its inventories to prevent oil prices from rising further.

We must be careful with what the IEA said about global oil inventories. The oil bulls are making a big issue out of it, but it is not really an issue. Global oil inventories declined by 60 mb in January, with on land inventories declining to their lowest level since at least 2016.

Why we have to be careful?

The events in the Red Sea delayed shipments, which forces companies to use their inventories until shipments arrive. These shipments will arrive sooner or later.

China, as mentioned above, resorts to withdrawing oil from inventories every time prices rise to prevent oil prices from rising further.

The winter freeze reduced outputs, especially in the US. That is a reduction in supply that forces companies to withdraw from inventories.

Political events in Libya reduced its output in January by an average of 162 kb/d. Production and exports have now recovered.

In some regions, the decline in inventories reflect a decline in demand.

Therefore, the causes are all temporary and the large draw is not a sign of a fundamentally tight market.

Finally, our estimate world oil demand growth is higher than that of the IEA by about 180 kb/d.