Daily Energy Report

China oil inventories, EU dependent on Russian LNG, Wall Street bets against $100 oil, Biden won’t hit Iran oil, Russia crude shipments, India burns coal, Iran oil exports, and more.

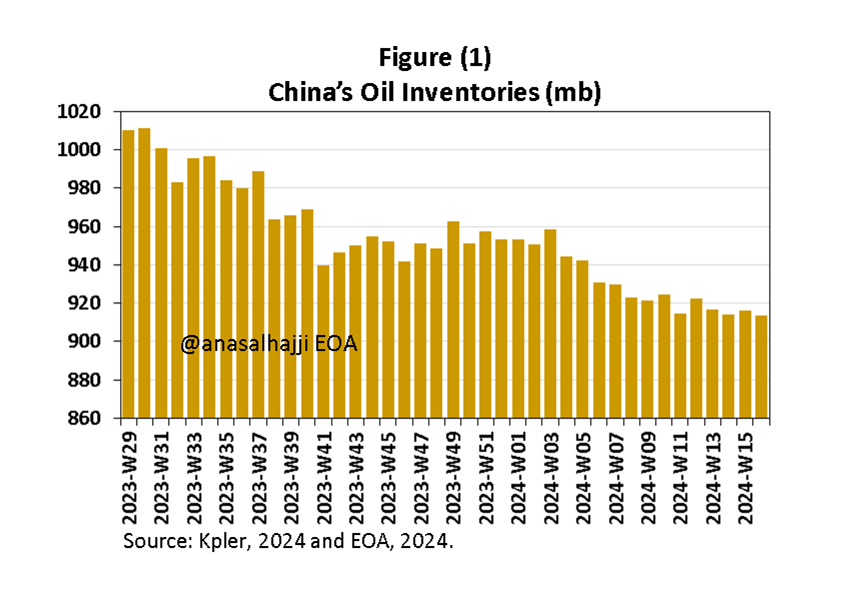

Chart of the Day: China’s Oil Inventories Continue to Decline

Summary

Figure (1) above shows the continuous decline in China’s total oil inventories. The current level is the lowest since early April 2022.

EOA’s Main Takeaway

We informed our subscribers long ago that China will use its inventories when oil prices rise to prevent them from increasing further. China’s move was so predictable: the increase in imports is way lower than the increase in exports! The difference came from inventories.

China started withdrawing from its inventories last August when oil prices rose above a certain threshold. As prices marched toward $90, China withdrew additional amounts from its oil inventories, oil that companies bought in the range of $50s to $60s.

If prices continue around current levels, we expect an additional withdrawal of 20-25 mb. However, recently Chinese companies imported Sokol crude at a discount, which is the same oil that Indian companies refused to receive. We mentioned in a previous report that the increase in China’s imports of Sokol doesn’t constitute a new trend. It is a one-time opportunity. Also, it has been reported that Crude throughput rose 1.3% year on year in Q1. Media reports tied that to the increase in GDP growth. We disagree. Exports of petroleum products have been increasing. The increase in refining utilization was meant to meet growing international demand, not domestic demand.

Story of the Day: Europe is Dependent on Russia’s LNG

Summary

Figure (2) above shows trends in Russia’s LNG exports by destination. Most of Russia’s LNG still goes to Europe.