DAILY ENERGY REPORT

EU’s LNG imports, sour crude demand, China’s 2023 oil demand, Norway’s deep-sea mining projects, Qatar’s new LNG deal with China, Pakistan’s energy challenges, and more

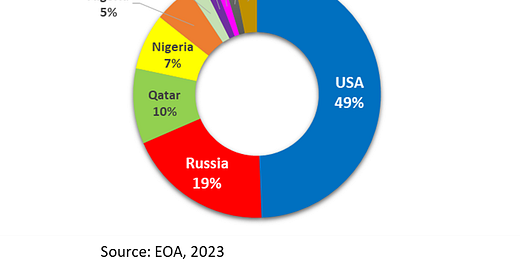

CHART OF THE DAY: Despite the Increase in US LNG Imports, EU Cannot Replace Russian Gas Flows

Summary:

Figure (1) above shows that the EU’s dependence on US LNG increased to about 50% in May from 44% in February. It also shows that 19% of total LNG imports have been sourced from Russia.

EOA’s Main Takeaway:

In May, the EU’s gas imports were equally split between piped gas and LNG, with around 50% of LNG imports originating from the US. While the EU’s energy dependence on the US has been increasing since Moscow’s invasion of Ukraine, it hasn’t been able to wean itself off Russian gas: about 20% of EU imports come from Russia— 7% of these volumes are piped gas while the remaining is LNG.

Even in normal circumstances, the EU won’t be able to replace the share of Russian gas in its market. In the event of a scorching summer or a severe winter, the share of Russian gas is expected to increase due to higher demand. Meanwhile, and in the case of hurricanes in the Gulf of Mexico, the US share in the EU gas market is expected to decline.

STORY OF THE DAY

REUTERS: U.S. sweet, sour oil price spread narrows on strong sour demand

Summary:

Reuters reported today that pricing data has shown that US sweet and sour oil differentials "narrowed significantly this month, as demand for higher sulfur crudes climbed from refineries and exporters while supplies tightened."

The spread between Light Louisiana Sweet and Mars sour crude narrowed to $1.70 a barrel last week from around $6.75 per barrel at the start of 2023, and $9.20 per barrel a year ago, Reuters wrote.

EOA’s Main Takeaway:

Tightness in the sour crude market has been caused by the following developments around the world:

OPEC is already reducing oil production, and Saudi Arabia is scheduled to cut an additional 1 mb/d starting July 1st.

Ten VLCCs carrying over 20 mb of Saudi sour crude are currently anchored near the Suez Canal in Ain Sukhna, Egypt. Check our recent note on this issue here.

Iraq’s northern crude oil exports, around 400,000 b/d to 450,000 b/d, via Turkey remain suspended.

Although the fires in Canada’s Alberta have marginally reduced crude oil production, the threat of disruption is still there.

Venezuela’s oil production has declined.

Mexico has plans to halt crude production this year.

There is currently no spare capacity in other countries to compensate for any potential loss of crude barrels in the market.

NEWS OF THE DAY

1- S&P GLOBAL: China's Shandong customs resume long-suspended bitumen blend clearance

2- REUTERS: China's May fuel oil imports ease after hitting decade-high

Summary:

S&P Global reported today that around 1.27 million barrels of bitumen blend have passed customs clearance from bonded warehouse in China's Shandong since June 16. This would raise the possibility of reopening access for importing the bitumen blend.

"It brings hope to independent refineries, lifting the likelihood for them to take back their bitumen blend cargoes home after being detained since April," S&P Global quoted a market analyst as saying.

EOA’s Main Takeaway: