Daily Energy Report

China oil inventories decline, Russia beats sanctions, IEA criticized by US politicians, LNG spot market danger, Hydrogen future, Nuclear power’s moment is here, and more.

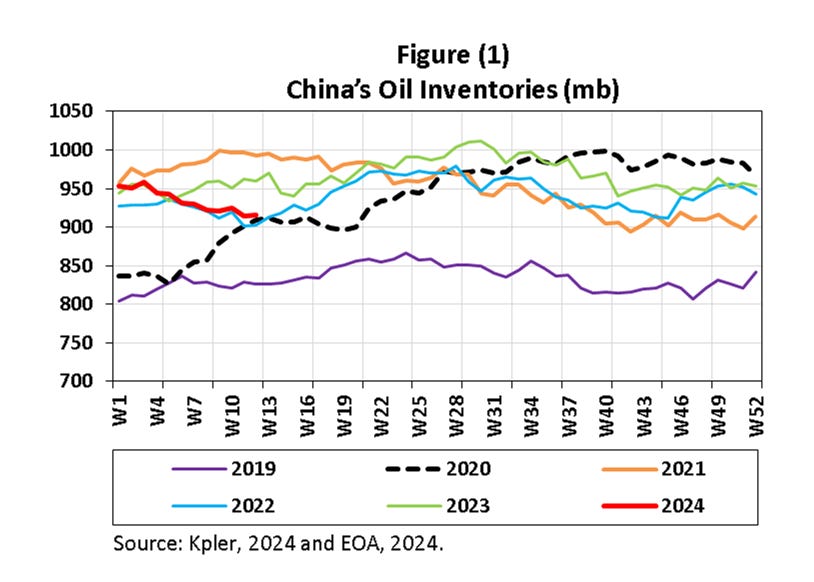

Chart of the Day: China’s Oil Inventories are Declining

Summary

Figure (1) above shows China’s total oil inventories year-over-year since 2019. It shows that oil inventories have declined by about 90 mb since last August.

EOA’s Main Takeaway

One thing is clear from Figure (1): there is a break in the recent pattern for Chinese oil inventories. Several factors are at play, including a rebound from COVID-19 lockdowns, economic growth, government policy, government import/export quotas, and prices. Our readers are familiar with this analysis. China doesn’t want high oil prices. It uses inventories to prevent oil prices from rising. The reaction is NOT leaner, it is level based. When prices cross a certain threshold ($70-$75), they start withdrawing from oil inventories and reduce imports. They refill when prices decline. But now we see the pattern break. The decline since last August is unprecedented. We believe lower economic growth played a role.

Story of the Day

Energy Intel: Russian Oil Firms Boast Strong Results Despite Sanctions

Summary

Russian oil firms report strong financial performances for 2023 despite the Ukraine conflict's impact. Gazprom Neft's revenues hit a record of 3.52 trillion rubles, but its net profits fell by 15% due to economic changes and higher costs, though it significantly boosted cash flow by 72%. The company also increased hydrocarbon production and upgraded its largest refinery.

Tatneft’s revenues were up by 11%.