Daily Energy Report

China oil inventories drop, Saudis raise Asian OSP, Bullish oil, Asia spot LNG, Inflationary energy transition, BASF gas deal with China, Argentina’s China reality, China in East Africa, and more.

New Podcast/Video

What’s REALLY Going on in the Oil Wars with Anas Alhajji

A discussion of most major issues in today’s oil and gas markets

https://www.tftc.io/oil-gas-geopolitics-anas-alhajji/

On X: https://x.com/TFTC21/status/1776218231897751928

Chart of the Day: China’s Inventories Continued to Decline

Summary

Figure (1) above shows China’s oil inventories since their peak in the summer of last year. Inventories have been declining after oil prices crossed a certain threshold and they continued to decline as Brent prices moved to the high $80s.

EOA’s Main Takeaway

As our readers know by now the continuous decline in China’s oil inventories is intentional to prevent oil prices from rising further. While this was expected, and the amount of the withdrawal was relatively large (about 97 mb), China’s total reserves are huge. We added Figure (2) just to put the withdrawal in perspective and to avoid any visual bias in Figure (1), accentuating the decline in inventories.

In fact, China crude oil reserves are larger than that of the US, as shown in Figure (3) below.

Story of the Day

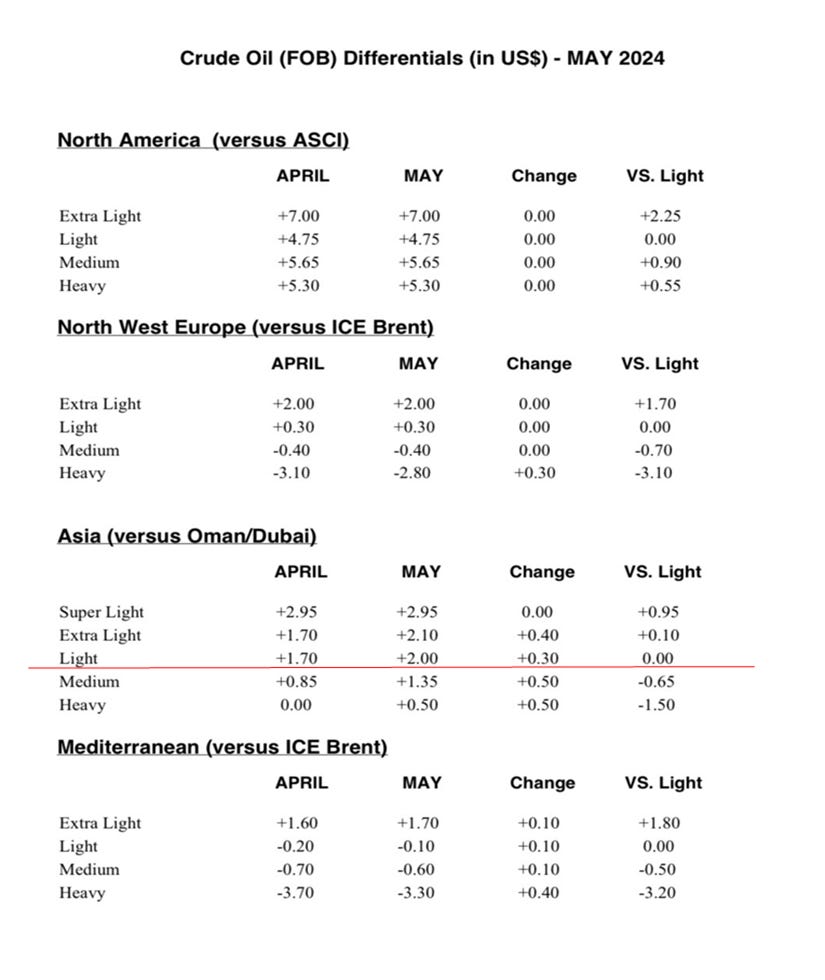

Reuters: Saudi Arabia Raises May Crude Oil OSPs to Asian, Med Buyers

Summary

Saudi Arabia has increased the May official selling prices (OSP) for its Arab Light crude to Asia and the Mediterranean, setting the Asian OSP at a $2.00 premium. The rise was expected, matching industry predictions. OSPs for Northwest Europe and the US remain unchanged, while heavier grades saw the most significant price increase, driven by limited supply due to maintenance, OPEC+ cuts, and increased regional demand.