Daily Energy Report

OPEC oil production, EV roadblock, Ukraine sea drones and Russian oil, Russian exports above G7 cap, oil and US-Iran relations, Europe gas slumps, Cuban oil tankers in Mexico, and more

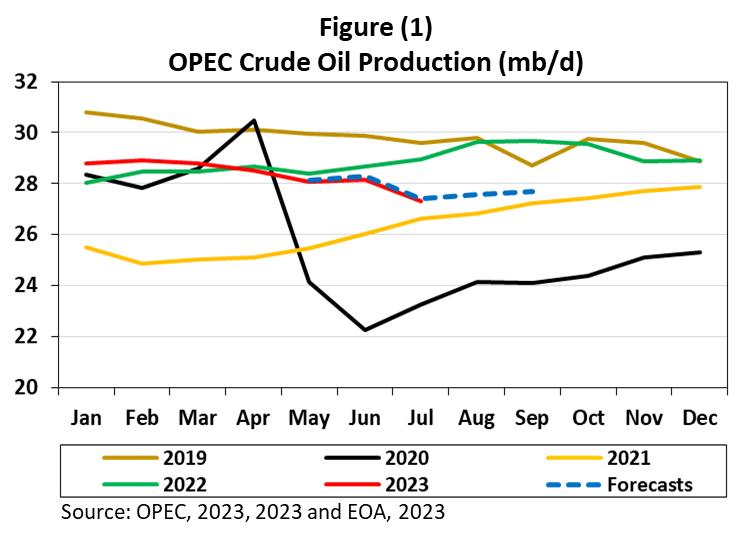

Chart of the Day: OPEC cut production in July, but a slight increase is expected in August and September.

Summary

OPEC published its Monthly Oil Report this morning. Figure (1) above shows trends in OPEC production since the beginning of 2019 and includes the July production number. OPEC’s July production declined by 0.836 mb/d, making total OPEC production significantly lower than that of 2019 and 2022.

The dotted blue line shows our forecast since last April for May, June, and July. The forecast virtually matches the actual numbers. Today we added the forecast for August and September where we see a slight increase relative to July’s production from countries that suffered from political or technical problems and a slight increase from others to take advantage of high oil prices.

EOA’s Main Takeaway

Saudi Arabia promised to make an additional voluntary cut of 1mb/d in July and it DELIVERED, making doubts about Saudi credibility and will to cut baseless.

No other countries cut voluntarily but production declined in Libya (-52,000 b/d), Nigeria (-40,000 b/d), and Equatorial Guinea (- 4,000 b/d) because of political or technical problems in those countries.

Angola has been having problems meeting its quota for a long time. Its production increased by 58,000 b/d to 1.170 mb/d. Iran is not subject to the OPEC quota. It increased production by 68,000 b/d to 2.828 mb/d. Iraq increased its production by 40,000 b/d to 4.203 b/d trying to compensate for some of the production losses from the north after the shutdown of the pipeline that goes through Turkey to the Turkish port of Ceyhan.

For the rest of OPEC, especially the UAE and Kuwait, production was virtually flat.

On another front, OPEC maintained its forecast of growth of global oil demand at 2.4 mb/d in 2023 and 2.2 mb/d in 2023.

OPEC estimates that Non-OPEC production will grow by 1.5 mb/d in 2023 and 1.4 in 2024. Most of the growth will come from North America, Guyana, Brazil, Norway, and Kazakhstan.

We believe that OPEC’s view of the oil market is optimistic. As we discussed in the past, its call on OPEC is way higher than actual, especially in light of the Saudi cut and Brent prices around $87/b.

As we mentioned before, market fundamentals support higher prices in the second half of 2023, but China will cap prices as it lowers imports and releases oil from its inventories.

Story of the Day

Axios: Next roadblock for electric cars: Early adopter era is over

Summary

The transition to EVs is facing delays as mainstream consumers prove to be price-sensitive and hesitant about moving from gas-powered cars. Concerns about charging and the anticipation of better EVs are hindering the switch. Ford's CEO, James Farley, has responded by delaying the company's EV production goals and emphasizing the need for flexibility in offering internal combustion engines, hybrids, and full electrics.

EOA’s Main Takeaway

This is a very interesting write-up given that it is published in a left-leaning media outlet. The article captures a very important idea related to adoption trends of various technologies: early adoption driven by tech enthusiasts and ideologues whose political beliefs align with the promise of the technology. They do not care about prices, costs, or other issues. All other consumers will be driven by a combination of economics, convenience, and performance. Hence, the rate of adoption slows and demand will hit a peak and then fall until such time as economics, convenience, and performance are on par or better than previous technologies (ICEs). Government officials have put a heavy hand on the scale to create an appearance of market success, but that tactic can only work for so long.

The rate of growth, in the beginning, is significant. This creates a problem as promotors and those who fall for their story extrapolate the trend for years to come. Then it creates another problem when growth slows down. Forecasts are not met. If companies over-produce believing the initial trend, they will end up with excess inventories and have to lower prices. As prices decline, the price-conscious group starts entering the market, but companies suffer.

Below are three news items from a month ago that support the above conclusions:

WSJ: EV Sales Growth in First Half Slowed From Torrid Pace

Reuters: US EV market struggles with price cuts and rising inventories

USA Today: EV sales growth's about to slow. If building is getting easier, why is selling them harder?

News of the Day

Bloomberg: Ukraine’s Sea Drones May Not Spare Oil Exports for Long

Summary

Ukraine's targeted attacks on Russian interests in the Black Sea have avoided Moscow's oil exports so far, but that could change if Russia continues to attack Kyiv's grain terminals. Despite initial concerns about the safety of Russia's Black Sea ports after recent incidents, oil loading continues, and the ports are considered relatively safe. However, Ukraine has warned that these ports could be subject to "military threat," hinting at the possibility of escalating the conflict to affect Moscow's oil exports, which could have significant international implications.

EOA’s Main Takeaway

We believe that Ukraine will not hit any oil-laden tanker. The reputational damage because of the environmental impact would be huge. Public support for the Ukraine war, which is rapidly waning in the West, would be destroyed. Given this idea, our readers can see who has an interest in blowing up oil-laden tankers.

Meanwhile, we believe that European and US leaders do not want to see oil prices going any higher. That is why they will put pressure on Ukraine not to attack oil supplies and they will turn a blind eye to the Russian oil prices that exceeded the price cap.

Reuters: Most Russian Fuel Exports Now Pricing Above G7-Imposed Price Cap

Summary

Most Russian fuel exports from the Baltic and Black Sea are now priced above the caps set by a G7-led coalition in February. The caps were set at $100 per barrel for products like diesel and $45 for products such as fuel oil. Recent data shows these caps have been exceeded for several products, except gasoline. Despite this, the US Treasury claims it is confident that the caps are still effective in constraining Russia's revenues.

EOA’s Main Takeaway

As we mentioned in the previous story, The Biden Administration and EU leaders have no choice but to turn a blind eye to the rising Russian oil prices above the price cap. With Brent around $87/b, the last thing they want is higher prices, leading to higher inflation rates and angry populations. Given the US presidential elections next year, it is not in the interest of the Biden Administration to make inflation and high gasoline prices a campaign issue.

However, we will see a lot of rhetoric from politicians regarding sanctions and price caps intended for domestic audiences.

New York Times: US Reaches Deal with Iran to Free Americans for Jailed Iranians and $$

Summary

Iran and the U.S. have reached an agreement for the release of five American citizens who were considered to be unjustly detained in Iran. Four of the detainees were released from Iran's Evin prison on Thursday and are currently under house arrest, along with a fifth U.S. national who was already under house arrest. The White House's National Security Council confirmed the release, describing it as an "encouraging step."

EOA’s Main Takeaway

The issue that people overlook is that to maintain the negotiations, the Biden Administration had to turn a blind eye to sanctions and Iran oil exports. This encouraged Iran to increase its production and exports. Since the start of this year, its production increased by 300,000 b/d, despite the sanctions. The Iranian government claims that the increase is even more.

Bloomberg: Europe Gas Slumps as Rising Stockpiles Blunt LNG Strike Fears

Summary

European natural gas prices dropped by 8.1% amid rising stockpiles and the threat of worker strikes in Australia that could disrupt 10% of global exports. Despite inventories being well above normal, the market remains volatile, with the possibility of supply disruptions leading to price spikes. The potential strikes could also increase competition between Asian and European buyers, adding to uncertainty in the market.

EOA’s Main Takeaway

While we agree with the conclusions and the possibilities mentioned in the story, we would like to point out that:

Gas inventory capacity in Europe is relatively small. Even if storage is near full, it is beneficial only under the assumption that supplies will continue as expected in the winter. Any interruption will show that the positive impact of full storage is temporary. It’s also worth noting that EU nations benefited greatly from an abnormally warm winter in 2022/2023. It seems unlikely the EU will be so fortunate two years in a row.

Europe is importing more piped gas from Russia as we discussed in our report that we posted on Monday: EU’s Gas Imports Mix: Russian Gas Supplies Jump 33% in July

Houston Chronicle: Tellurian’s Massive Driftwood LNG Project Hits Another Speedbump

Summary

Tellurian's Driftwood LNG project in Louisiana faced another setback as its remaining customer, Gunvor, terminated a long-term sales agreement. This forces Tellurian to find new contracts for financing and construction. The situation is further complicated by bankruptcy filings related to the company's chairman, Charif Souki, clouding the future of the $13.6 billion project.

EOA’s Main Takeaway

The world needs additional LNG supplies. The problem here may not be the project itself, but its leadership. The whole company might end up in the hands of others in a fire sale if no new companies sign long-term sales agreements with Tellurian.

DeviDiscourse: Cuban Oil Tankers Becoming Regular Visitors to Mexican Ports

Source: Marine Trafic

Summary

Cuba is using its own tankers to increase crude imports from Mexico, which has become a key oil supplier to the country, surpassing Russia in the second quarter. The communist-run nation is seeking to diversify its oil imports to alleviate fuel shortages, replenish stocks, and reduce its dependence on Venezuela, its traditional main supplier. Mexico has delivered about 2 million barrels to Cuba in the last four months.

EOA’s Main Takeaway

Cuba went through this several times in the last 50 years. Now that the Cubans have support from the top leadership of Mexico, it is cheaper to ship than to import from Russia or Venezuela. Cuba has some oil production, but it is heavy and in small amounts. It is worth noting that about 50 years ago, Cuba was a world leader in renewable energy development within Cuba but for some reason, these industries faltered.

Those who are interested in the topic may read Chapter 8 at this link: The Future of Cuba’s Energy Sector

Argus: Spain Crude Imports Off Lows in June, US Volumes Surge

Summary

Spain's crude oil imports increased by 5% to 1.18 mb/d in June, partially recovering from a decline in May, but still 12% lower year-on-year and 14% below pre-Covid levels. The subdued imports were influenced by maintenance at Repsol's and Cepsa's refineries. The U.S. became Spain's top crude supplier in June, with a 28% increase in imports, while Brazil's imports jumped by 85%. A recent fire at Repsol's Bilbao refinery might further impact imports in August.

EOA’s Main Takeaway

While refinery maintenance played a role in lower crude imports, demand for petroleum products in Spain in June jumped to a 4-year high. Therefore, the decline in imports doesn’t mean declining consumption.

While imports from Brazil are natural given certain historic ties of Repsol, US crude exports

to Spain have increased markedly, especially in the last two years as shown in Figure (3) below.

Reuters: Palm Oil Demand Boosted as Rival Oil Prices Jump on Supply Woes

Summary

Demand for palm oil is surging, driven by its price advantage over soy oil and sun oil, which have seen price increases due to U.S. production issues and Black Sea supply disruptions. This growing demand is helping Indonesia and Malaysia reduce their palm oil stocks and is supporting Malaysian palm oil futures. India, the largest global buyer of edible oils, imported 60% more palm oil in July compared to June, and other Asian countries are also increasing their purchases.

EOA’s Main Takeaway

While biofuel has become part of the green transition, it benefits greatly form higher prices of “mineral’ oil, but the incremental increase resulting from higher oil prices is limited because it is tied to the planting and harvesting seasons. This explains why inventories are declining.

On a different note, we are still puzzled by the classification of biofuel as “green” and we will not be surprised if the narrative changes in the future as more people become aware of the realities undermining this claim.

FOX News: Biden Touts Pro-Native American Efforts Despite Axing Oil Drilling that Sustains Tribes

Summary

President Biden designated a million acres as a national monument to protect Native American culture. However, a June ban on fossil fuel leasing near Chaco Culture National Historical Park has been criticized by Navajo leaders. They argue the ban harms tribal income and that they were not properly consulted, potentially neglecting legal obligations to protect Navajo rights.

EOA’s Main Takeaway

This shows that decisions related to climate change policies that might appear to be local are in fact nothing of the kind. These decisions are made by people who have no connection to the local environment. At one time there were efforts to close a nuclear power plant near Toledo, Ohio by a non-profit group that is headed by French nationals!

The lesson here is that “climate change” is a convenient term that can be employed by almost any government, corporation, non-profit, and any other group to attempt to exert power over others. ESG serves this same purpose. “Environmental” discussions these days are almost never truly about the environment. The “environment” and “climate” are just convenient rhetorical tools. People always hijack language and perceptions for their own ends. It was always thus.

AP: Utah’s Oil Train Proposal Chugs Along Amid Eco-Derailment Concerns

Summary

Utah officials and oil and gas companies are progressing with a plan to invest billions in building an 88-mile rail line, known as the Uinta Basin Railway, through national forest and tribal land to quadruple oil production. The railway would enable an additional 350,000 barrels of crude to be shipped daily. While the project has support from the local Ute Indian Tribe and Utah lawmakers and has received key federal approvals, it could conflict with President Joe Biden's stance on environmental issues and his efforts to address climate change.

EOA’s Main Takeaway

This is also related to the previous story. It is true that transporting oil via trains is much more dangerous than pipelines, but the administration is known for opposing building pipelines. At issue here is the close relationship between increased oil supplies, foreign policy, and national security. If it was not for the shale revolution, President Trump would not have been able to impose sanctions on Iran and hit Venezuela with new sanctions. If it was not for the shale revolution, the US and the EU would not have hit Russia with sanctions and reduced Europe’s dependence on Russian gas. The challenge for the Biden Administration is to find a balance between a commitment to climate change (whatever that means—it could mean almost anything or nothing) and the reality of foreign policy and national security.

Hart Energy: SoCalGas Submits App for Large RNG Pilot Project

Summary

Southern California Gas has proposed a renewable natural gas (RNG) pilot project to turn agricultural waste into 4.5 billion cubic feet of RNG annually. If approved, the project would become California's largest RNG initiative and could start in late 2026. California set a goal to reduce methane emissions and SoCalGas' target to replace 12.2% of traditional gas with RNG by 2030.

EOA’s Main Takeaway

Using gas from trash dumps and animal waste is common in the US and many countries around the world. However, the amount is very small and will not make the slightest dent in providing energy for the people.

Reuters: India raises concerns over oil market volatility with producer countries

India's oil minister has raised concerns over global oil price volatility with major oil producers and organizations, including OPEC. As the world's third-largest oil importer, India imports over 80% of its oil needs and is calling for responsible and reasonable pricing for consumer countries. OPEC+ nations have limited supplies to bolster the market, and tighter supply has led to a rally in oil prices.

EOA’s Main Takeaway

Same old story repeated again and again in recent years, regardless of who is the minister. It always backfires. In fact, it became annoying to OPEC ministers who have been in their position for a long time.

Other News

Bloomberg: In Rare Controversial Trade, Russian Oil Tanker Heads to Ghana

Reuters: New Canadian clean electricity rules would allow some use of fossil fuels

Bloomberg: America’s Drivers Are Racking Up Record Miles But Using Less Gasoline