Daily Energy Report

Permian oil output, new US LNG projects, Iraq-Turkey talks over crude exports, Nigeria’s financial troubles, Norway's oil and gas supplies, Rosneft and Dubai benchmark, and more

Dear Readers: We are resending this report because of a mistake in its title. Our apologies.

EOA Team

CHART OF THE DAY: Permian Oil Output between Location and Technology Improvement

Summary:

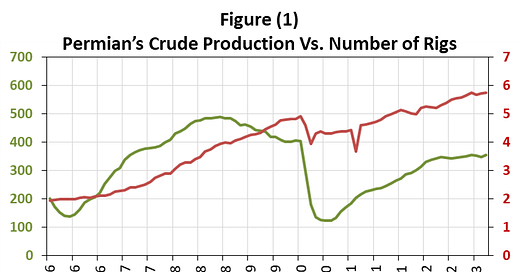

There has been a lot of talk about “peak shale” and the perpetual decline in US production. When it comes to shale and production, it is all about the Permian. Figure (1) above shows crude oil production in the Permian versus the rig count. It reveals how output plummeted as a result of the shut-ins in 2020 when oil prices collapsed. It also shows that the rig count and production shared the same upward trend until early 2022 when they diverged.

EOA’s Main Takeaway:

Production used to be tied to the rig count until 2014 when technology improved productivity. Then the shale industry was overturned in 2015 due to the collapse of the market. In order to cut costs, companies at that time moved to more productive areas, just as technology, production, and management efficacies were undergoing improvement. This was repeated after the market crisis in 2020.

It is important to note that the chart above and the correlation between the rig count and production after 2020 would be misleading simply because of the large decline in the drilled uncompleted wells (DUCs). However, the divergence in 2022 between the two was not only related to DUCs, knowing that the industry that year was operating amid a low number of DUCs. It was also linked to new wells that were more productive. But was this driven by technology or location again as we saw happening post-2015?

One fact is clear: we have tens of thousands of wells that are several years old and produce large amounts of oil. Many shale oil wells in the Permian that are 4-5 years old are producing tens of barrels a day of crude. These tails are long and they come with small decline rates.

We talked to our friend Tom Loughrey, (Twitter: @TomLoughrey_LFE ) President of energy intelligence firm FLOW Partners, LLC, who told us that on average, these wells are producing about 27 b/d.

Some pundits are ignoring the impact of such wells. They are NOT considered “stripper wells” since the threshold is 15 b/d.

Our view is that the industry is still learning. We are not writing off shale growth, at least for now. But as our readers know, crude quality matters!

Subscribed