Daily Energy Report

EIA and the issue of crude quality, impact of banking crisis and France’s strikes on energy markets, Russia’s oil exports, and more

CHART OF THE DAY:

Figure (1)

EIA Forecast of US Crude Oil Imports through 2050: EIA Ignored Crude Quality, Again!

Source: AEO 2023, EIA

Commentary:

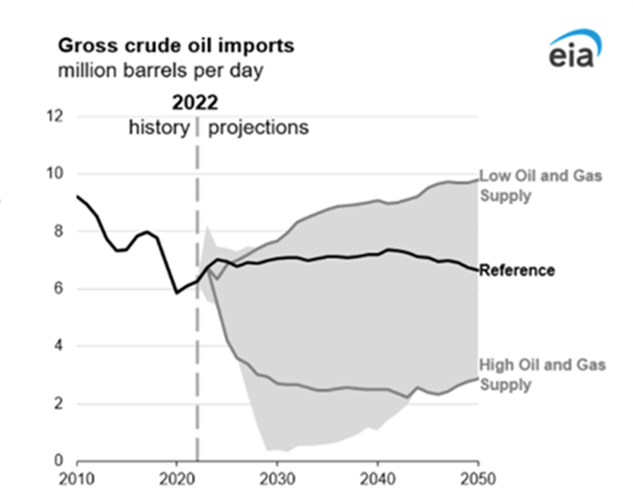

Figure (1) above shows the Energy Information Administration’s (EIA) view of US crude oil imports under three different scenarios taken from the EIA’s recently released Annual Energy Outlook (AEO) 2023. The base case shows virtually flat imports with a minor decline through 2050. In the low US supply case, indicating low oil prices for a long period of time that will reduce US production, the EIA predicts an increase in crude oil imports by almost 3.5 million barrels per day (mb/d) rising close to 10 mb/d.

In the high supply case, where oil prices are high and US production increases markedly— especially in the tight oil plays— US oil imports decline substantially to about 2.4 mb/d by 2050.

Given the severe political implications of US crude imports and exports, it is important to make predictions close to reality. For this reason, we chose the chart above as the Chart of the Day.

EOA’s Main Takeaway:

The most important takeaway from the AEO 2023 is that US oil demand will decline by only 2.1% in the base case by 2050, which contradicts all those who have predicted the demise of the oil industry. Remember that the AEO was published by President Joe Biden’s Department of Energy. This view is supported by the chart above: crude oil imports are virtually the same till the late 2040s!

The EIA, however, ignored the issue of crude quality, and for this reason, the “high oil and gas supply” scenario is inaccurate. If US production increases markedly in the coming years, most of the increase will originate from the tight oil plays where almost all the growth is in light and super light crudes and condensates. Nearly all US crude oil imports are medium and heavy sour. This mismatch means that there are only two scenarios for imports, the base case and the low supply case. The high production case becomes the base case. Crude quality matters!

STORY OF THE DAY

REUTERS: Strike extended to March 27 at three French LNG terminals - union

BLOOMBERG: UK Oil and Gas Output Under Threat as Workers Vote to Strike

REUTERS: European diesel tightens, crude weakens as French refinery outages linger

ARGUS: ‘Tsunami' of strikes to hit North Sea output: Union

Summary:

Strikes at Elengy’s three LNG terminals in France, which have disrupted operations at the facilities, have been extended to March 27, Reuters cited a union representative as saying. Labor strikes have been ongoing in France since January against the government’s proposed pension reforms, and they have recently reached the energy sector, disrupting fuel deliveries from refineries, and other operations.

In the meantime, there are calls for labor action in the UK to demand better pay and working conditions, which according to Bloomberg could affect the UK’s production of oil and natural gas if it took place. Argus reported that about 1,400 UK North Sea oil and gas workers have supported the vote to strike.